Personal finances are like a dazzling diamond, shining brightly in the fintech world.

Personal finance management has historically been a challenging endeavor. For a long time, most people’s income came in the form of actual cash, thus it was up to the breadwinner to do the math and figure out how much money the household needed for various needs.

The procedure was tedious and time-consuming. With the advent of the digital age and the widespread adoption of online banking, however, such personal financial calculations have become much simpler and more efficient.

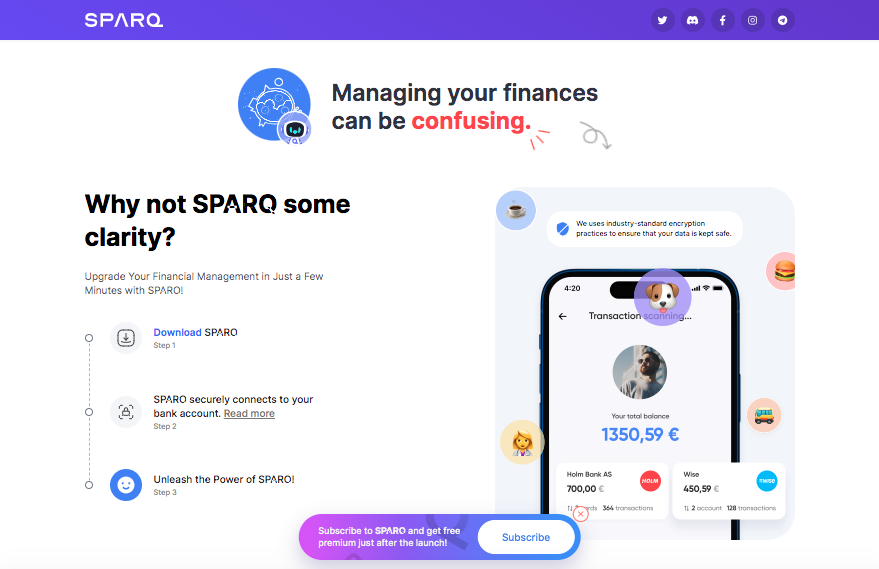

SPARQ

SPARQ, with its headquarters in Estonia and its operations spanning the European Union, is a flexible platform for managing one’s finances.

It integrates seamlessly with the user’s existing bank account(s) and caters to their every monetary requirement. SPARQ facilitates quick, fee-free, cross-EU transfers, as well as the establishment of savings targets for big-ticket items like vacations and new phones.

The purpose of this software is to help people learn how to better manage their money and reduce their debt. It states that due to financial difficulties, fourteen percent of EU residents have missed payments on essentials like rent, mortgages, consumer credit, and personal loans.

It also wagers that citizens who are more informed about their personal affairs and who have ready access to such data will exercise better fiscal restraint. With this goal in mind, SPARQ was created to aid in the management of payments, loans, and other forms of personal finance to reduce debt and improve consumer control and consistency.

Read: Unveiling The Indispensability: 5 Crucial Financial Reports For Your Company’s Success

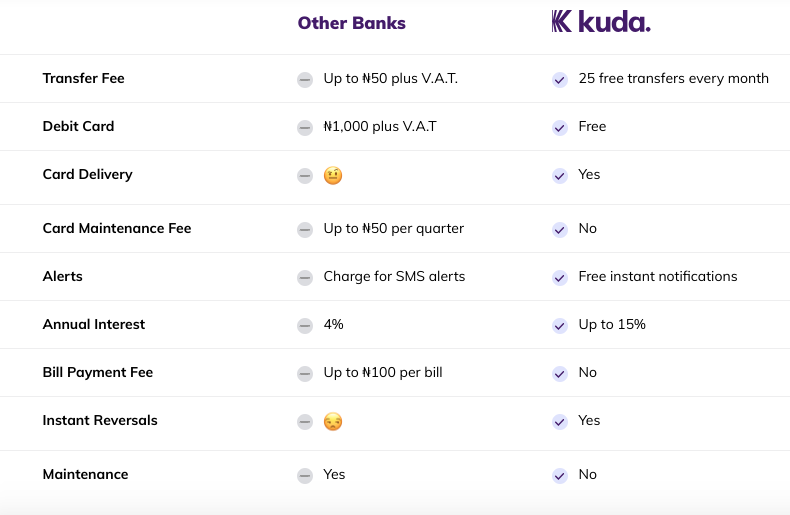

Kuda

Increase in volume of searches during five years: 4,900% With Kuda, you may make cashless payments, make free transfers, and earn interest on your savings. In 2019, it began operations in Lagos, Nigeria. Kuda is a smartphone app that allows users to conduct banking transactions in Nigeria.

Increase in volume of searches during five years: 4,900% With Kuda, you may make cashless payments, make free transfers, and earn interest on your savings. In 2019, it began operations in Lagos, Nigeria. Kuda is a smartphone app that allows users to conduct banking transactions in Nigeria.

With free debit cards, no monthly fees, and no ATM fees, the business hopes to make banking services more accessible to clients. Accounts can be opened and customers can begin using the bank’s services in a matter of minutes, all without ever setting foot inside a branch.

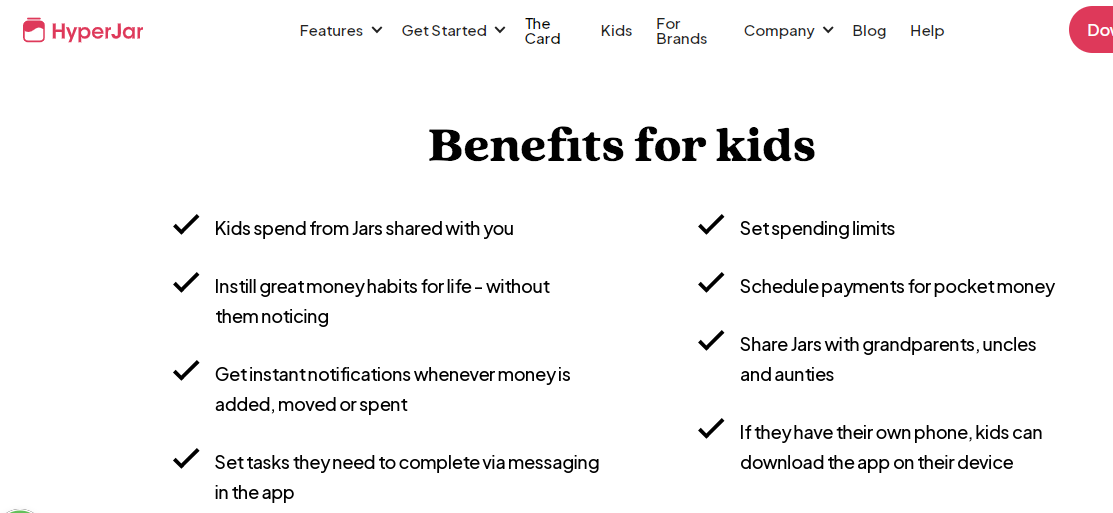

HyperJar

An increase of 470% in queries during the past five years. You can use your HyperJar Mastercard debit card to make purchases directly from your Expense Jars. It’s the best option for international travel because there are no foreign transaction fees. The HyperJar prepaid card and companion software are designed to maximize your financial well-being at any age.

Read: Unveiling The Indispensability: 5 Crucial Financial Reports For Your Company’s Success

The HyperJar prepaid card is a trusted companion in times of financial need. From learning how to budget your parents’ money when you’re young to adulthood, there are many ways to stretch a dollar. From the grandkids’ birthday presents to the vacations planned for the teens.

London, England in 2016 was the founding year. HyperJar is a budgeting and financial planning app that helps users save money and stay on top of their finances. With its innovative ‘jars’ function, customers may set up individual savings accounts for various needs, such as food, bills, and vacations. Sharing a user’s jar with others simplifies the process of dividing up spending and keeping track of group funds.

Zoro Card

Increase in volume of searches during five years: 3,300%. Austin, Texas was the birthplace in 2019. Zoro Card is a debit-style card designed to assist customers in increasing their credit score.

The organization provides its services for a reasonable monthly charge and has a speedy application process. Early access is now all that is offered for this company based in Indiana, which was formed by Roger Morris and Zak Grove, both of whom attended the Indiana University Kelley School of Business.

Copper Banking

There was a 733% increase in queries over five years. Date of Inception: In 2019 Copper Banking’s main goal is to improve teens’ knowledge of personal finance and money management. Customers can use their debit cards for online purchases and at ATMs with the help of mobile banking. The startup raised $29M in a Series A round in 2022, having been created by individuals with expertise at PayPal, Stripe, Intuit, and other companies.

Tasks are useful for helping kids complete their tasks, whether it’s chores, homework, a project, or a practice. With Tasks, kids may earn money for developing positive routines while also gaining valuable life skills. Parents should delegate jobs and set up recurring responsibilities for their children.

Read: How Can Banks Stay Competitive With A Secured IT Security Infrastructure?

Revolut

You can either give them an estimate of how much money you’ll be spending in the future, or you can tell them the maximum amount of money you’re willing to spend.

5-year growth in search volume is 455%. Founded in 2015, Revolut is a digital wallet that facilitates transfers, payments, budgeting, and international purchases in more than 30 different currencies. Revolut, which was founded in the United Kingdom but is now utilized all around the world, has reportedly raised $1.7 billion to date, with its most recent Series E round in 2021 bringing in $800 million.

Kraken

It was started in 2011 in the United States by Jesse Powell with funding of $118,500,000. Kraken employs hundreds of full-time Client Engagement crypto and finance experts who are well-versed in all aspects of the company’s offerings. Our global staff is multilingual, quick to respond with tailored answers, available 24/7 (even on holidays), and made up of dedicated individuals from all corners of the globe. We back up our crypto products with unparalleled customer service.

CowryWise

Cowrywise aspires to be a one-stop shop for all of one’s financial management needs, much as the aforementioned apps. Cowrywise was the first of its kind in Nigeria and is now one of the most widely adopted personal finance businesses throughout all of Africa.

CowryWise includes features including savings programs, rainy day funds, mutual funds, and investment in US stocks (although the latter is not currently available) with the primary goal of assisting users in achieving financial independence. It also offers higher interest rates than banks do right now, a rare commodity given the ongoing inflation issue.

NerdWallet

It was started in 2009 in San Francisco by Jacob Gibson, and Tim Chen. Looking for a credit card that offers incentives like cash back or free flights? You may make an informed choice with the help of their in-depth comparisons and unbiased assessments.

One convenient location to view your assets, credit cards, and savings. If you have all your data in one place, you can make informed financial decisions with the help of timely technical insights. Investigate and evaluate your business funding choices, such as SBA loans, invoice financing, and more. You can make the best choice with the help of intelligent matching and unbiased critiques.

Read: Top 15 Business AI Tools For You

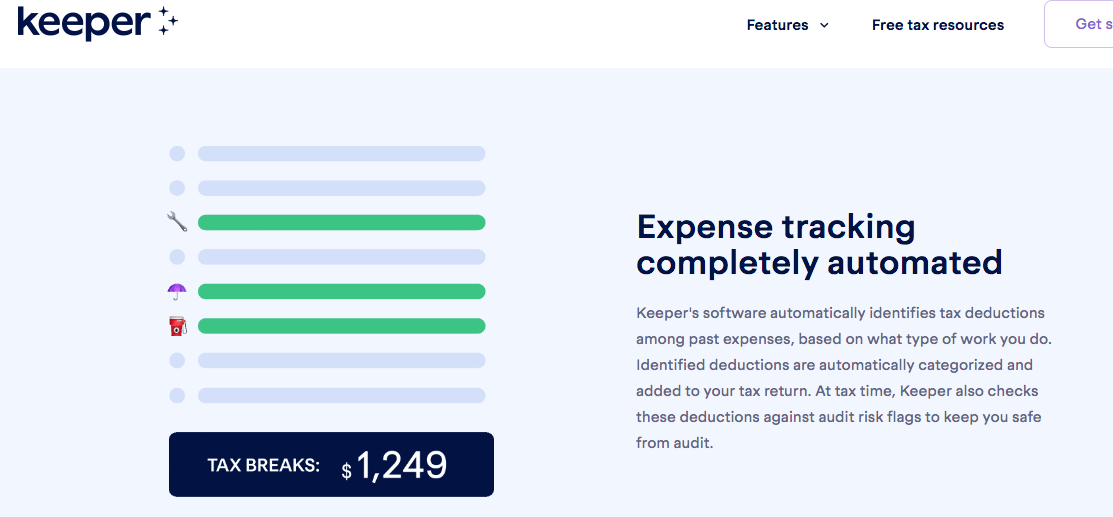

KeeperTax

Worldwide, tax systems can be complex and challenging. The complicated paperwork and confusing deduction options are a hassle to deal with. The American fintech firm KeeperTax focuses on consumer tax and financial management. KeeperTax’s USP is that it notifies you of deductions you may have forgotten about when filing your taxes. The paid subscription is partially paid for by providing access to additional features and a tax expert who can help you depending on any issues you may have.

Keeper tracks your purchases in real-time to automatically categorize and label tax-deductible expenditures. Your response of “yes” or “no” will suffice as confirmation.

Keeper tracks your purchases in real-time to automatically categorize and label tax-deductible expenditures. Your response of “yes” or “no” will suffice as confirmation.

This belief that paper receipts are necessary is widely held yet mistaken. Bank statements detail all purchases made with a credit card, including amounts, dates, and descriptions that can be used to file taxes. I was astounded by how helpful and simple this tool is for entrepreneurs. It eliminates the need to estimate tax amounts and keep track of paperwork. Not to worry!!

Read: Unleashing The Power: How Tech Giants Harness Generative AI Chatbots

Nothing about filing taxes has ever made me happy. But this software offers so much more in terms of understanding, ease, and convenience. It turns filing taxes into an enjoyable experience. I’m so relieved to have located it!

This service just connects to your financial accounts and uses AI to analyze your spending habits. The IRS has recognized this software as a valid “e-filer” in all fifty states, therefore in addition to aiding with deductions, it can be used to file taxes automatically. The traditional method of filing taxes has been around for a long time, but with the advent of open finance, it was time for a change.

Conclusion

Personal finance management has become increasingly efficient with the advent of the digital age and online banking. Platforms like SPARQ, Kuda, HyperJar, Zoro Card, Copper Banking, and Copper Banking have all made financial management more accessible and efficient.

Fixing taxes has never been easier with the help of AI chatbots. This software connects to financial accounts and uses AI to analyze spending habits, making it a valid “e-filer” in all fifty states. The traditional method of filing taxes has been around for a long time, but with the advent of open finance, it’s time for a change.

[To share your insights with us, please write to pghosh@itechseries.com ]