In this blog, we shall highlight the CBP for the Middle-East Asia.

Today’s businesses may benefit tremendously from the ease and effectiveness of cross-border payments. It’s available in a wide variety of forms, making it flexible enough to meet any enterprise’s needs while streamlining processes like commerce, money transfers, and remittances.

The United Arab Emirates and Saudi Arabia host two of the world’s three busiest remittance corridors, highlighting the region’s reliance on cross-border remittances. Together, they processed more than $100 billion in 2022, or around 7% of GDP in both countries.

Connected Cross-Border Ecosystems: A New Frontier

A cross-border transaction, in layman’s terms, is one in which a customer from Country A makes a purchase from Customer B, and a modest fee is charged to account for the extra effort involved in translating currencies (for instance, Visa charges 1.2% and Mastercard costs 1%). You can pay using a number of options, such as a credit card, a bank transfer, or an electronic wallet.

On average 67% of the population believe that in the next five years, cross-border transactions will be driven mostly by bilateral arrangements between countries for real-time settlement and the scaling up of digital money-transfer operators.

Latest Read: Can Fintech Survive Without IT Support? Let’s Know With Experts!

Project Aber, a shared digital currency between Saudi Arabia and the UAE, the Buna payment platform, which enables multicurrency payments among members of the Arab Monetary Fund, and the AFAQ system, which links the real-time gross settlement (RTGS) systems of the six countries in the Gulf Cooperation Council (GCC), are the three initiatives already in motion.

The development of regional hubs or trade agreements (57%), the provision of cross-border solutions by regional ecosystem participants (43%), and the acceptance of cryptocurrencies (10%) were also cited as major drivers of cross-border transactions.

A Comprehensive Guide to Cross-Border Transactions

The Middle East and Gulf regions have developed robust ties to both developing and advanced economies due to their location at the crossroads of East and West.

As a result of absorbing a diverse range of international best practices, the region has emerged as fertile ground for the development of novel approaches to domestic and regional monetary exchange.

Read more: Top 10 Fintech CEO Watchlist

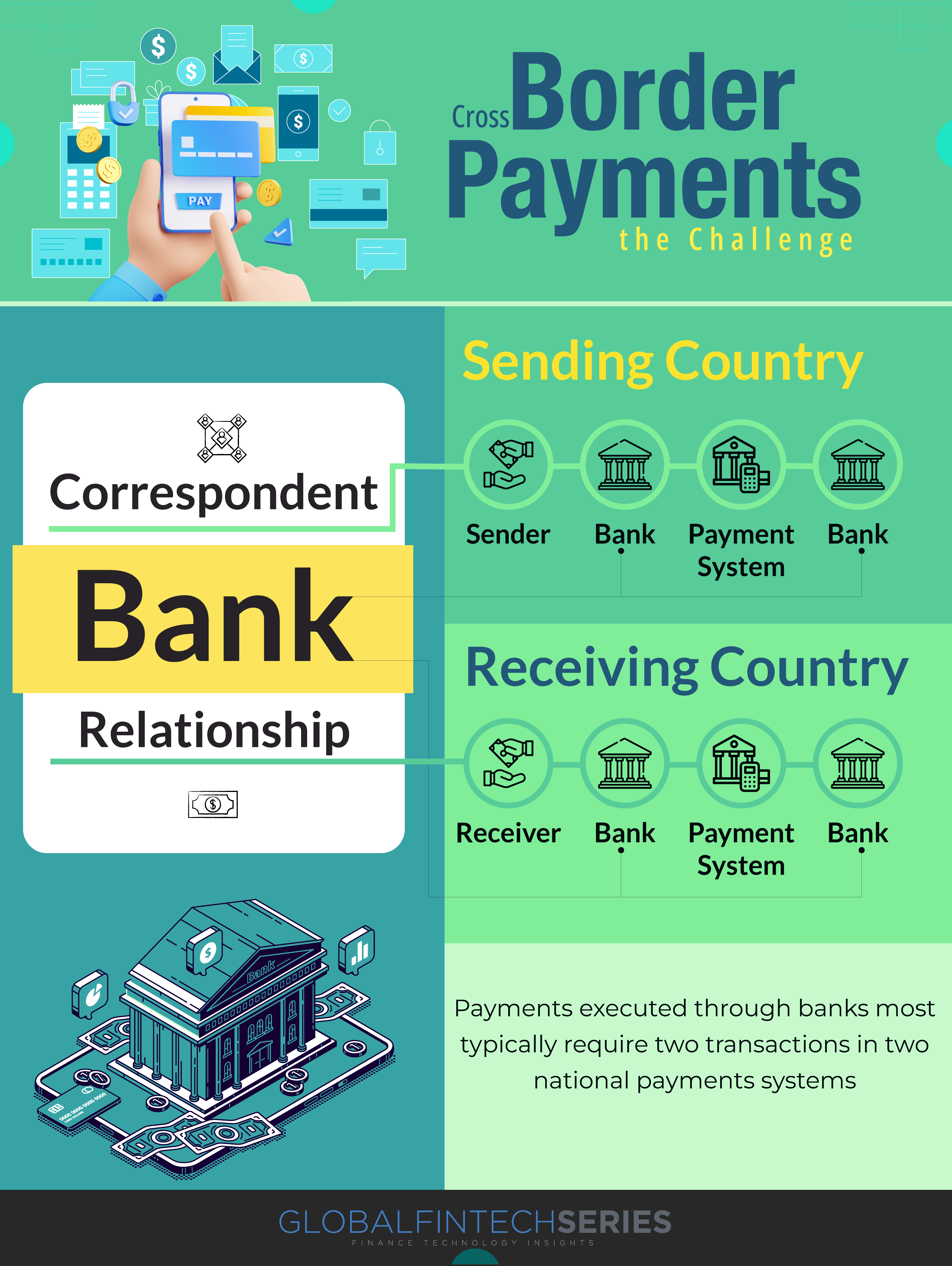

An e-commerce message SWIFT sends a message to deduct funds from Bank A and deposit them into Bank B. Since they aren’t necessarily connected, they have to go through a third party, like a bank, where they hold joint accounts. However, the entire transaction is finished in less than 3 seconds despite many sophisticated procedures taking place in the background.

This means that if a customer from any country of Middle-East Asia wants to send money to another country for which the bank does not currently carry the currency, the consumer will have to rely on the bank’s overseas banking partners to facilitate the transfer. Because of their limited resources, smaller banks must rely on the larger bull banks for their foreign currency reserves.

Read : Global Fintech Fest 2023 – Outcomes

However, other countries can learn from India’s vigorous attempts to spread UPI abroad and form coalitions. The elimination of SWIFT, a global centralized system over which the United States has de facto leadership, will result in a decentralized global web of links to faster payment systems across the globe.

What Are the Potential Implications of Faster and Cheaper Cross-Border?

There is a lack of uniformity and cohesion in the payment methods used throughout the Gulf Cooperation Council and the Middle East.

For example, in the Gulf Cooperation Council countries alone, annual payment flows exceed USD 2 trillion, made via approximately 2.3 million transactions, and these rely on the legacy rails provided by bilaterally agreed correspondent banking frameworks.

Still, efforts are being made to better domestic payment ecosystems even as boosting international payments is a top goal. The Central Bank of the United Arab Emirates, for example, has outlined the National Payments Systems Strategy as part of its Financial Infrastructure Transformation (FIT) program, with the twin goals of introducing novel payment features and improving the existing payments architecture to prepare for the continued development of the payments industry.

The Impact of Faster and Smarter Cross-Border Payments

More people and businesses in underserved areas can benefit from financial inclusion if they have easier and more affordable access to global financial transactions made possible by faster and cheaper cross-border payments. This has the potential to lower obstacles to international trade and commerce, both of which can contribute to economic growth.

Faster and cheaper cross-border payments can improve economic efficiency by decreasing the time and money spent on processing and approving foreign payments. This can make for easier business operations, better cash flow management, and more international investment opportunities.

In order to streamline the payment processes between buyers and sellers across different nations, global trade facilitation relies on faster and cheaper cross-border payments. This has the potential to promote business alliances, lessen transactional risks, and increase opportunities for economic growth.

Many people send money home from their jobs overseas to help out their family and their communities. Recipients can both save money and get their hands on their money faster if transfer times and fees for international transfers are reduced and made more efficient.

Financial industry innovation and competition can be boosted by developments in technology and financial infrastructure that facilitate instantaneous, low-cost international money transfers. It is possible that new companies will enter the market and provide useful innovations in the payment processing industry.

It is possible that increased regulatory monitoring and compliance procedures may be needed to handle potential threats such as money laundering, fraud, and terrorist funding as a result of the faster and cheaper flow of funds across borders. Financial organizations and regulatory bodies must find a middle ground between easing the burden of making payments and providing sufficient protection.

Conclusion

In particular, a growing FinTech ecosystem in Dubai and Abu Dhabi (promoted by the Dubai Financial Services Authority and the Abu Dhabi Global Markets) has led to an uptick in the number of locally founded businesses alongside well-known multinationals offering payment processing services.

Increasing digital payment solutions for corporations and individuals have been fostered by the presence of regulatory sandboxes and closeness to the region’s sovereign wealth funds (a source of funding to fuel expansion).

[To share your insights with us, please write to pghosh@itechseries.com ]