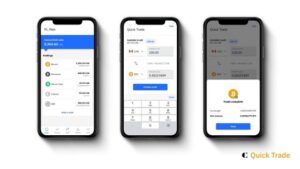

Coinsquare, Canada’s leading digital asset trading platform, has announced the launch of its new Quick Trade mobile app. The simple to use app makes buying and selling digital assets quick and convenient, with customers able to easily manage their portfolio of digital assets.

Read More: OWNR Announces Its Cryptocurrency Wallet Turns Into A Wholesome Ecosystem

The launch of Quick Trade represents a new standard for mobile trading, with commission-free transactions and competitive pricing for the most popular digital assets.

The Quick Trade app — available in English and French — offers the following benefits and features:

1. Simplified KYC process – get verified to trade within seconds

2. Instant account funding via Interac e-Transfer

3. No-fee e-Transfer deposits and withdrawals

4. Commission free trades

5. Easy portfolio management

6. Swap between any two assets, with 15 pairings to start and many more to come

At launch, the Quick Trade app will offer Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP and Bitcoin Cash (BCH), with many more digital assets to be onboarded over the coming months.

Read More: GlobalFintechSeries Interview with Sandra Blair, Chief Product Officer at MerchantE

“We are thrilled to announce the release of Quick Trade. This is just the first of many exciting new announcements to come. Quick Trade’s simple onboarding and easy-to-use interface offers Canadians a simple and secure way of investing in digital assets,” said Stacey Hoisak, CEO of Coinsquare. “Our new Quick Trade app is part of our commitment to offer Canadians the most user-friendly, comprehensive and secure investing experience.”

Coinsquare recently announced new appointments to its board and executive team. The newly appointed directors and executive team have extensive backgrounds in Canadian securities regulation, investment dealer operations and regulated marketplaces.

Coinsquare Capital Markets Ltd. (CCML) also recently submitted a dealer membership application to the Investment Industry Regulatory Organization of Canada (IIROC) and an application to the Ontario Securities Commission (OSC) to operate a regulated marketplace for digital assets. The proposed marketplace will provide automated trading systems bringing together institutional and retail orders from buyers and sellers of digital assets deemed securities under the Ontario Securities Act.

Read More: Covid-19 Spending Habits – Has The Pandemic Caused An Increase In Acquirer Fraud?