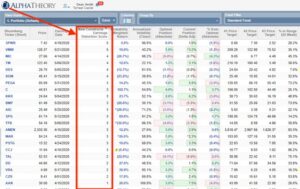

New Constructs (NC), the leading provider of insights into the fundamentals and valuation of private and public businesses, announced that portfolio optimization software provider Alpha Theory integrated NC’s Earnings Distortion Scores directly into its platform for portfolio managers.

“Alpha Theory’s goal is to constantly provide new sources of value for our clients and we believe the Earnings Distortion Score from New Constructs is a great addition,” said Cameron Hight, CEO of Alpha Theory.

Read More: Healthfully and Paya Deliver Expanded Patient Care and Payments Through New Partnership

The Earnings Distortion Scores indicate how likely a company is to beat or miss consensus expectations for EPS, revenue or guidance in the next quarter. These scores are categorized into 5 tiers:

1 – Strong Beat

2 – Beat

3 – Inline

4 – Miss

5 – Strong Miss

“We are excited that Alpha Theory’s clients will now have access to our proprietary consensus earnings prediction tool, which will help them make smarter investment decisions,” said David Trainer, founder, and CEO of New Constructs.

Earnings Distortion Scores measure the level of non-core income/expense contained within reported earnings. It is a proprietary measure featured by professors from Harvard Business School and MIT Sloan in a recent paper: Core Earnings: New Data & Evidence. The paper empirically demonstrates the superiority of NC’s measure of core earnings based on NC’s proprietary adjustments for unusual gains/losses.

Read More: M Financial Group Licenses FAST Software to Enable New Digital Ecosystem for Member Firms