There’s growing buzz about embedded finance—with good reason. It is a burgeoning space with the potential to dramatically reshape the way customers engage with financial services.

But because varied things get labeled as embedded finance, conversations can get confusing.

What is it?

What are the examples?

How can financial institutions (FIs) pursue embedded finance and why?

Let’s take a closer look.

How to Succeed at Investing: 5 Tried-And-True Tips

Modern embedded finance is …

Embedded finance isn’t a specific technology, but an idea signaling a shift in how customers access tailored financial services products. Specifically, in the report “Demystifying Embedded Finance: Peril and Promise for Banks,” we define it as “the discovery and acquisition of tailored financial services products at the point of need within the digital experience curated by a non-bank third party.”

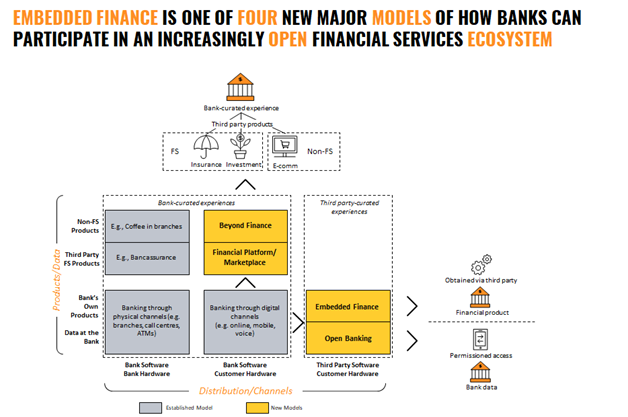

Embedded finance is one of four new major models that banks utilize to participate in an increasingly open financial services ecosystem. (See figure below.) Banks have always sought to create curated experiences for their customers and increasingly look to expand the product range, either with financial products sourced from third parties, or even going beyond finance.

However, customers can also acquire and consume financial services products at the point of need within the digital journey curated by a non-bank third party. Examples include Apple partnering with Goldman Sachs for the Apple Card; Stripe Treasury (which enables software platforms or marketplaces, such as Shopify, to offer bank accounts to the platform’s customers); or fintechs without their own banking license (such as Chime or MoneyLion) that provide financial solutions to their customers by partnering with banks.

Clearly, enabling third parties to offer financial services isn’t new. Yet embedded finance is more than simply making FS products available for seamless use at a third party (as is the case when you keep a card on file with Netflix or Uber for “invisible payments”).

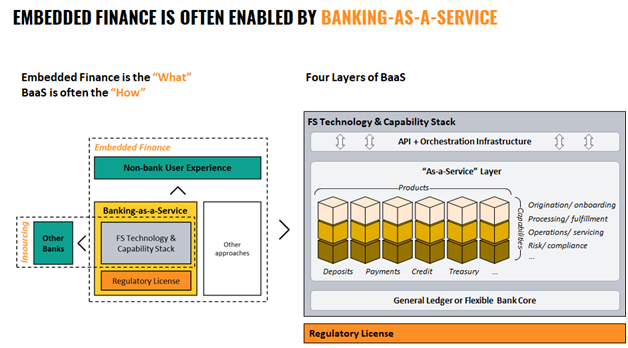

To deliver an embedded finance ecosystem, qualitatively different capabilities with three components are required:

- A non-bank brand that provides the customer experience, which recognizes the need for a financial services product.

- An appropriate technology and capability stack, which typically includes an API and orchestration layer, the “as-a-service” layer, and a flexible bank core.

- The license to provide regulated financial services and to ensure compliance.

Rising Expectation Of ‘Cashless’ Societies Worldwide: A Second Annual Report By The Economist Intelligence Unit (EIU), Shows Growing Acceptance Of Digital Currencies, Accelerated By Covid-19

Additionally, the term “embedded finance” sometimes is used interchangeably with “banking-as-a-service” (BaaS), but they are not the same. BaaS, which includes an FS technology and capability stack and required licenses, is one of the approaches to delivering embedded finance. Think of embedded finance as the “what” and BaaS as the “how.” The players with technology relevant for enabling an embedded finance ecosystem are incredibly diverse, from full-stack BaaS platforms to cards- and payments-as-a-service providers, to software vendors that support banks.

Ways Banks Engage With Embedded Finance

Leading banks are already engaging with embedded finance and are experimenting with different approaches. Through our research, we identified at least five models, which we believe differ in terms of business model impact as well as commitment, resources, and risk appetite required.

Tech-led approaches simplify how partners integrate banks’ standard products into the partners’ digital experiences. One example: enabling to apply for a credit card seamlessly at the point of need, such as during shopping cart check-out. In the license-led model, banks hold the regulatory license and often act as BIN sponsors to support financial services propositions launched by neo-banks and other fintechs that don’t have their own banking licenses. A combined license + tech-led approach combines a banking license with a modern technology platform to offer a full BaaS package. This requires having and managing a tech platform for the benefit of third parties, not just for a bank’s internal use.

Fintech Trends: Chinese Banking Giants Versus US / European Banks During COVID-19

Collaborative partnerships, which require upfront efforts for cocreation of tailored propositions, such as Apple Card or Stripe Treasury, represent the biggest change for banks in the business model and, most importantly, the mindset. Rather than viewing technology giants and marketplaces as competitors poaching the banks’ retail and commercial customers, banks willing to participate via this model must be prepared to view those players as partners and as a channel to grow their own books.

Considerations for FIs Evaluating Embedded Finance Opportunity

It remains to be seen how big embedded finance opportunity turns out to be. We are not yet ready to pronounce the death of the traditional banking model of banks selling proprietary products through own channels. However, without a doubt, the financial services ecosystem is becoming increasingly open. Each institution needs to determine what role it wants to play and whether embedded finance is the appropriate strategy.

Banks that embark on embedded finance initiatives usually do so because they’ve identified an opportunity. They may see a way to rapidly acquire customers and deposits, reduce customer acquisition and unit processing costs, grow fee revenue through partnership agreements, or even change the valuation narrative. Having clarity on why the bank wants to pursue this and whether they’ve got what it takes is critical. The fear of missing out is not a valid strategic driver!

Of course, embedded finance carries risks. Partners can misbehave or attract undesirable customers. Banks may also be understandably concerned about reduced engagement with customers and access to transaction data, and as a result, lower ability to innovate and add value beyond the core proposition.

And yet, the biggest risk to banks may be doing nothing at all. The need for financial services is not disappearing, but customers may increasingly realize they don’t have to go to banks to meet that need. In such a world, the FIs that act early are most likely to harness profitable partnerships and to secure competitive advantage.

Decision Intelligence Is Becoming Fintech’s Most Valuable Asset