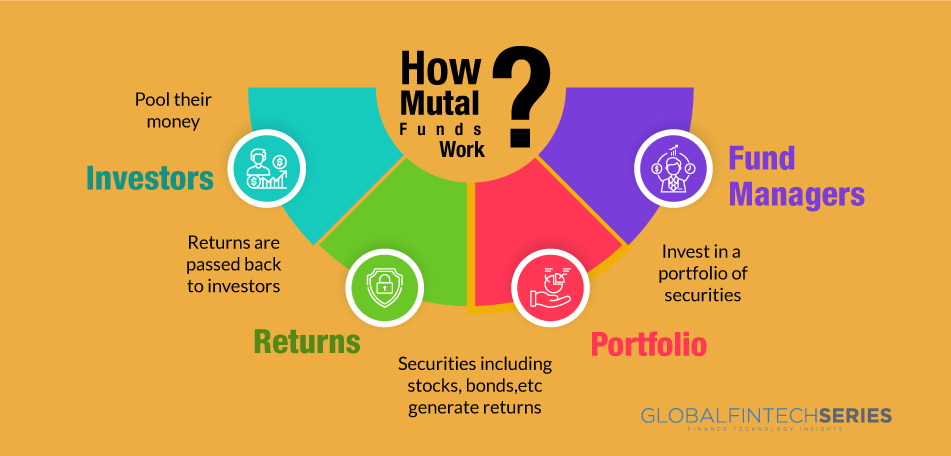

Are you curious about the latest technological developments in the fintech sector? Learn how their solutions affect your business by exploring our analysis of mutual funds startups. Enhancing your competitive edge entails staying ahead of the technology curve. We will be providing you with data-driven innovative insights into the fintech domain. This article will highlight the key points to discover 5 hand-picked mutual funds startups on a global level.

Top 5 Mutual Funds Startups on the Global Startup

This report is based on the StartUs Insights Discovery Platform, which uses big data and artificial intelligence (AI) to cover over 1.3 million startups and scale-ups worldwide. Also, you learn about areas with a high startup activity rate and the geographic distribution of the 420 businesses.

Read latest article: Best Loan CRM Software

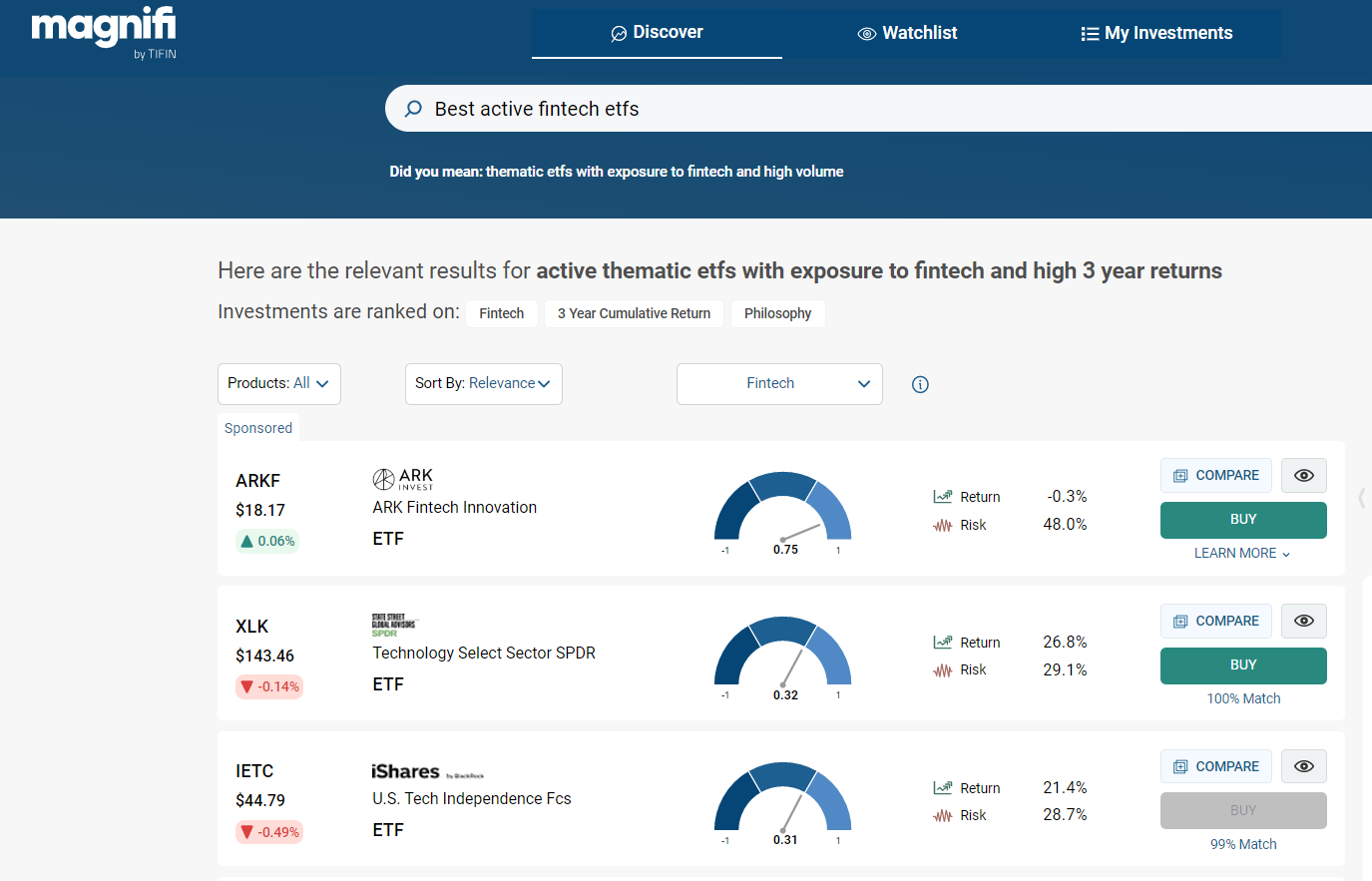

Magnifi makes recourse to a platform for semantic investments.

Investors without a background in finance frequently find the precise jargon used by financial organizations to be perplexing. Startups create semantic recognition tools that provide investment intelligence on mutual funds, exchange-traded funds (ETFs), and model portfolios to overcome the language barrier and streamline the investing process. The technologies make it easier for investors, financial advisors, and portfolio managers to get useful information about investment opportunities.

A US-based firm called Magnifi is creating a discovery and comparison platform for obtaining investment intelligence. The platform uses natural language processing to identify and compare investing opportunities and to let users choose the best mutual funds, ETFs, or equities to buy. The platform from Magnifi has a vast database of funds that investors and investment managers may use to create, improve, and assess portfolios.

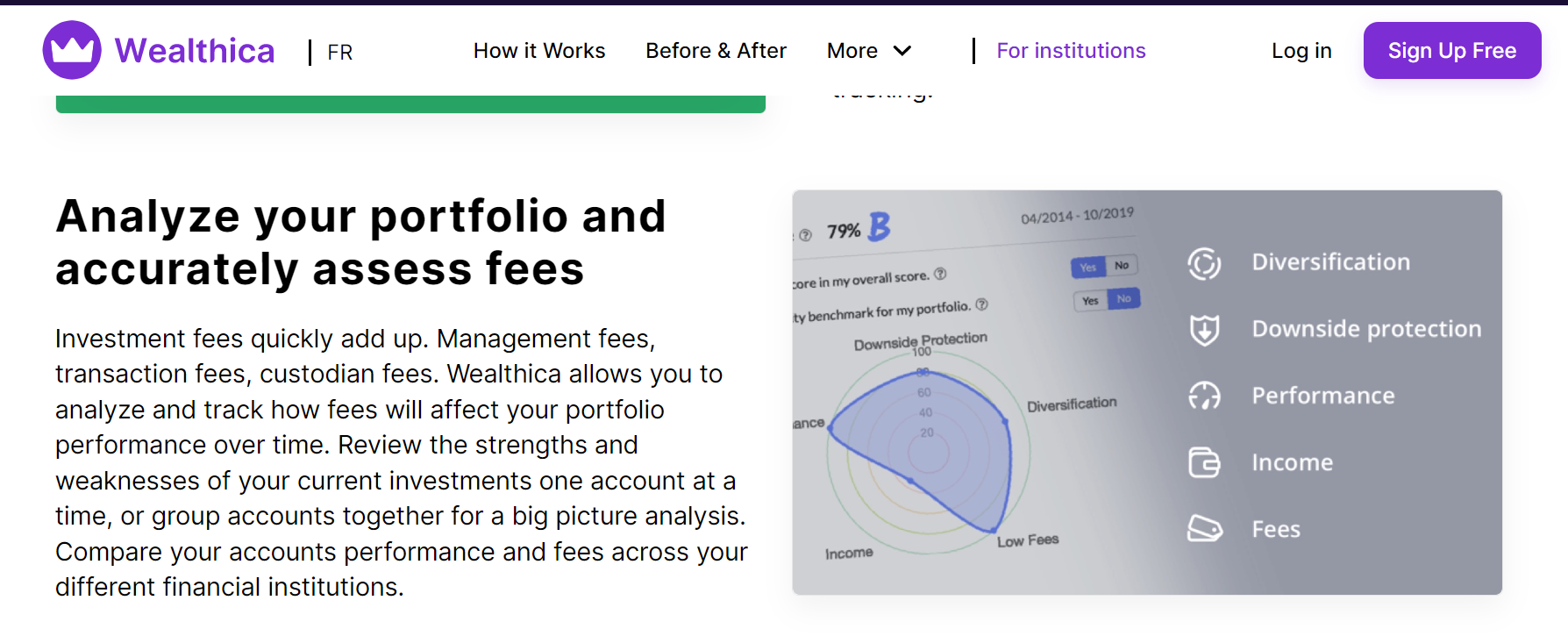

Offering Portfolio Tracking is Wealthica.

Tracking investments and financial assets is made more difficult by the many modes and formats in which financial institutions offer reports and statements. Startups create systems that provide a consolidated picture of all assets to support mutual fund tracking. Such systems present a clear aggregated picture of investment performance and net worth.

A technology created by Canadian firm Wealthica links banking and investing accounts, giving customers access to a consolidated view of all their finances from a single screen. The startup’s platform offers data analytics tools that let users evaluate other institutions’ ways of keeping track of all transactions. Moreover, automated recommendations on mutual fund investment strategies are provided by Wealthica’s advanced analytics tools. This makes it easier for ordinary investors to manage and invest their funds.

A technology created by Canadian firm Wealthica links banking and investing accounts, giving customers access to a consolidated view of all their finances from a single screen. The startup’s platform offers data analytics tools that let users evaluate other institutions’ ways of keeping track of all transactions. Moreover, automated recommendations on mutual fund investment strategies are provided by Wealthica’s advanced analytics tools. This makes it easier for ordinary investors to manage and invest their funds.

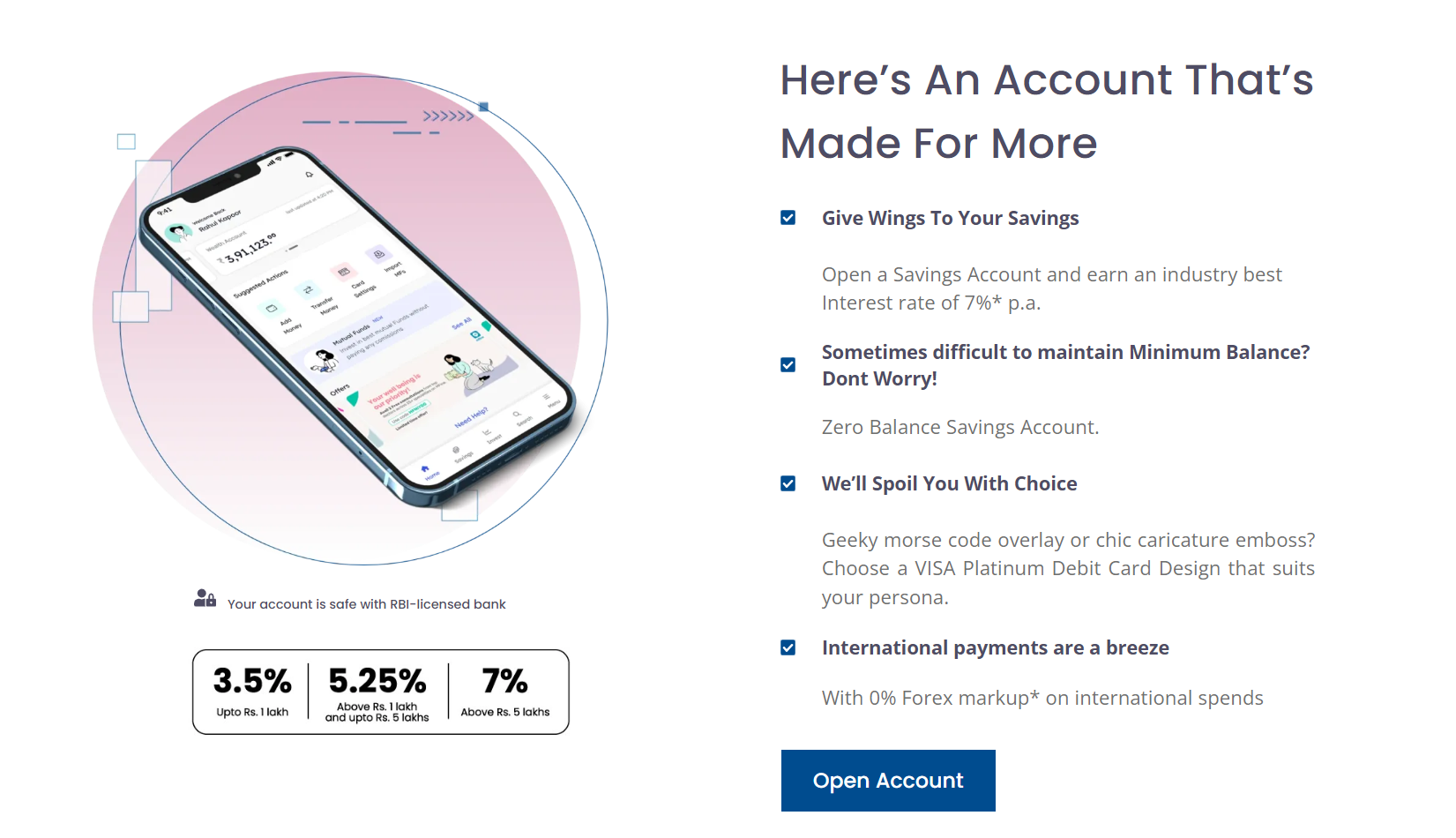

Niyo Money offers investments with goals.

Mutual fund investments are frequently made by people to achieve specific objectives, such as a retirement plan, vacation, or emergency fund. In order to allow investors set goals and offer the best mutual funds for each goal, entrepreneurs create goal-based investment programs. A personalized plan can be created using these options depending on investment goals and preferences. A goal-based mutual fund investment platform is provided by the Indian firm Niyo Money to private investors. GoalSense, a proprietary piece of software developed by the business, recommends mutual funds based on the objectives, time constraints, and ambitions of each investor. To assist users in maximizing income and lowering risks, the startup also provides portfolio rebalancing and allows asset allocation modifications near the goal’s time budget.

Tanamduit makes it possible to consolidate investment operations.

To increase their idle funds, individuals and businesses look for chances to invest in mutual funds. Investors continue to explore for ways to further decrease hazards even while diversification lowers the risk of such an investment. Startups create digital solutions that streamline mutual fund withdrawal and investing processes to assist with this. Tanamduit, an Indonesian startup, creates a financial platform for both enterprises and individuals to invest in mutual funds. Users of the startup’s app can examine various investment options and select an investment manager. Tanamduit also makes investment monitoring easier and allows withdrawals at any time, lowering investment risks.

AI-Based Investment Management is made possible via ArrayStream

Portfolio managers must use sophisticated signal interpretation and organization approaches since there are so many market signals that they must consider when deciding whether to keep holdings in the fund or sell them. Companies create AI-based solutions that increase fund diversification and draw deeper conclusions from the data at hand. Mutual fund managers can surpass their benchmarks with the aid of such technologies. For mutual fund managers, the British startup ArrayStream creates AI market signal processing tools. In order to find profitable opportunities, the firm employs cloud computing to find signals with high predictability and merge individual signals into composite signals. It tracks signal strength to assess their trustworthiness and usefulness. To assist fund managers in raising the value of their active funds, the business also creates polymorphic investment diversification options.

Conclusion

We give you thorough, actionable innovation intelligence so you can stay up to date on the most recent innovations in technology. The five mutual fund businesses you read about above were selected using a data-driven startup scouting methodology, which also took into account things like geography, founding year, and the applicability of technology, among other things.

Read: The New Digital Mobile Banking Sphere