With continued pressure to remain innovative, the financial services sector is heading towards cloud-based platforms and AI solutions to provide the best services for its clients. Computer-based intelligence continuously upgrades the capacity to use huge volumes of data for business exercises. This wave of innovation is based on hyper-personalization and 360-degree client experience.

AI In Finance

With the fast progression of innovation, human lives have gone through remarkable change. By utilizing a huge number of progressive cutting-edge innovations, for example, Artificial intelligence, ML, Web 3.0, Data Science, and i4. The business houses have additionally embraced boundless digitization and cloud-based arrangements while Man-made brainpower i.e. AI has come up as the banner carrier of this contemporary computerized change. According to a report it has been assessed that using man-made intelligence to improve center’s financial capabilities and offer assistance to clients across the globe will broaden a worth of more than $250 million across this industry. As we move to the following outskirts of mechanical revelation, and innovative work, let us dive into the job of computer-based intelligence in disturbing the monetary area, its effect on organizations, and how it disentangles another vista of extraordinary open doors.

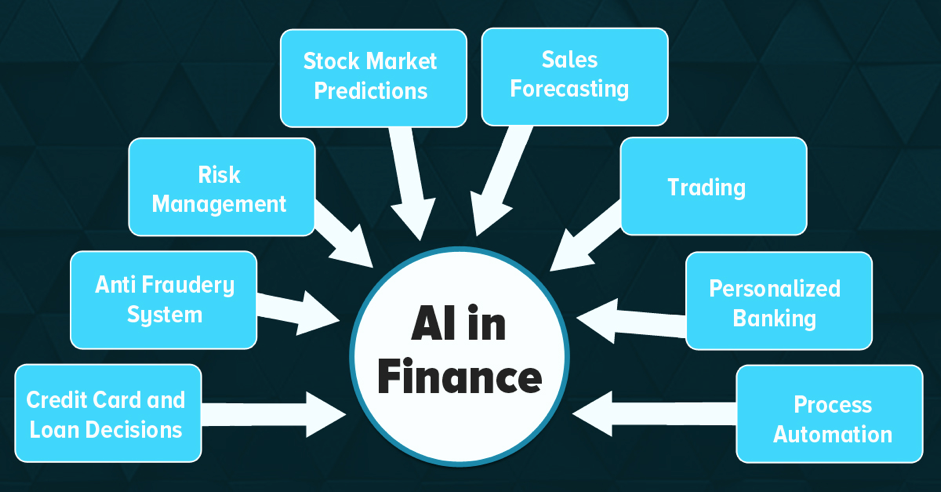

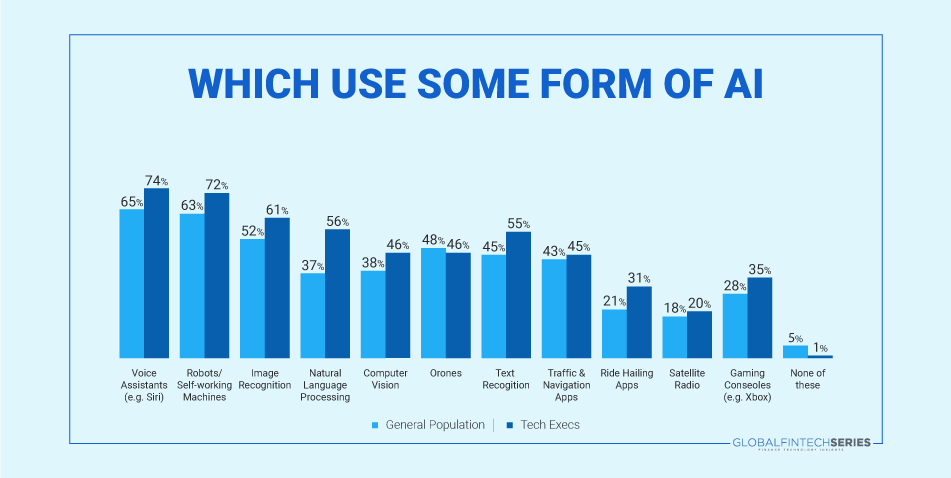

Artificial intelligence can free up personnel, improve security measures and ensure that the business is moving in the right technology-advanced, innovative direction.70% of monetary firms are utilizing AI to foresee cash flow events, change financial assessments and identify misrepresentation. Plenty of trendy instruments like voice assistants, chatbots, process automation, and predictive investigation are rethinking monetary administrations presently. Furthermore, this is just the beginning. The monetary business is awakening to the enormous extraordinary capability of computer-based intelligence. Industry specialists accept that utilizing artificial intelligence will assist the financial business in saving $1 trillion come 2030. One more report by Story Science in 2018 uncovered that north of 32% of banks out of the complete reviewed had previously embraced progressed artificial intelligence-based strategies, for example, prescient examination, proposal motors, voice acknowledgment, and reaction times in their activities.

Read: Understanding the Basics of Stock Market Trading- An Enigma?

This original influx of advancement centers around upgrading client experience. Conversational AI, for example, chatbots, is likewise turning into a well-known must-have for brands at the front end. Process and task automation and algorithmic analytics invigorate and raise finance at the back end. Robots have progressively begun supplanting representatives. Also, Robotic Process Automation (RPA) is profoundly savvy, adding up to 33% of the pay given to a seaward representative and one-fifth of that given to a coastal worker. RPA accomplishes the snort work, a standard-based framework that robotizes tedious errands and has no insight except for being many times sorted under simulated intelligence.

AI in finance is overwhelmed by ML, however, automation likewise assumes a huge role in banks. The monetary area has fundamentally profited from AI; banks can group and dissect immense measures of information in finance. AI is a development of man-made intelligence, which permits machines to learn and advance utilizing information without relying upon human intervention.

Voice recognition is another new-age innovative capacity that utilizes computer-based intelligence to direct financial activities through voice orders. At the core of this development lies Natural Language Processing (NLP). This simulated intelligence-fueled innovation is utilized to foster various remote helpers (increased specialists) and chatbots, for example, Capital One’s Eno. The holy grail for digital payments is to find a system that is both exceptionally advantageous and profoundly secure. ML and profound learning empower complex types of personality verification in view of biometrics like face acknowledgment, speech recognition, fingerprint recognition, and retina acknowledgment. Likewise grin to pay is a framework that permits buyers to approve installments essentially by grinning into a camera.

Leveraging AI

Since market speculation is for the most part overwhelmed by individual asset supervisors enabled by a command of prominence, it very well may be difficult to envision their impact being replaced by artificial intelligence. Be that as it may, artificial intelligence-driven beta assets can altogether lessen the opportunity for human blunder through their continually advancing standards and algorithms.

Read: Global Fintech Interview with Jitin Bhasin, Founder & CEO at SaveIN

The financial services industry of the future will revolve around real-time data and new technologies that help banks better serve their clients by personalizing the customer experience. Data will be plentiful, and AI and the Cloud will take center stage.In the near future, AI will enable companies to get better in stock and cryptocurrency trading. What’s more, it will allow companies to get better at trading as algorithms are more likely to identify many complex trading signals. Most of these signals are rarely noticed by humans.

The Bottom Line

Although AI adoption rates and maturity levels vary widely across industries and even within them there seems to be no question that AI is here to stay. In fact, AI is quickly becoming a competitive necessity for nearly all types of businesses driving unprecedented levels of efficiency and performance and making it possible for businesses of every shape and size to do things that simply weren’t possible before.

Read: Cybersecurity Timeline and Trends You Should Know before Planning for 2023

[To share your insights with us, please write to sghosh@martechseries.com]