“As more consumers understand the benefits and ease of digital-first and mobile technology, they will continue to ask for more from their FIs; Backbase is well-positioned to make the case that its solution is one step ahead of what customers are asking for today,” according to Digital Banking Impact Report

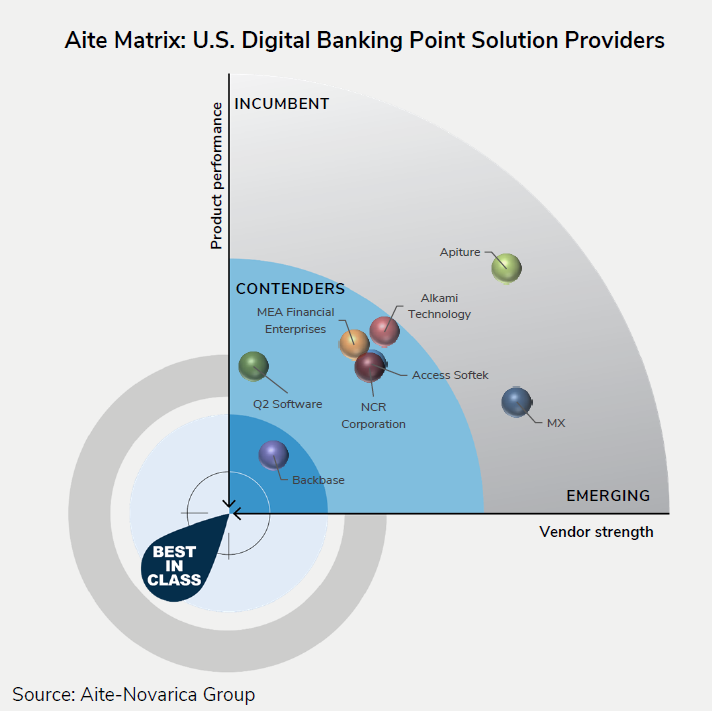

Backbase, the global Engagement Banking platform provider, announced that it has been awarded Best-in-Class in the latest Aite Matrix Report: U.S. Digital Banking Point Solution Providers, published by advisory firm Aite-Novarica Group. The impact report arms financial institutions with the insights needed to make informed decisions when selecting technology partners.

“Backbase’s digital banking capabilities are contemporary and are driven by an extensive catalog of features and functions that are ahead of its competition,” said David Albertazzi, Director, Retail Banking & Payments, Aite-Novarica Group. “The platform is both feature-rich and UX strong, and its ability to deliver a seamless end-to-end digital journey is a forward-looking vision on financial wellness tools that has it standing out from its peers.”

Leveraging the Aite Matrix, a proprietary Aite-Novarica Group vendor assessment framework, Aite-Novarica evaluated the overall position of Backbase against eight of the other most significant digital banking solution providers — focusing on vendor stability, client strength, product features, and client services.

Read More: Bank of Sun Prairie Partners with 360 View to Empower Their Customer Relationship-Focused Culture

“This recognition further cements our position as pioneers of Engagement Banking,” said Vincent Bezemer, Senior Vice President, Americas, at Backbase. “We’ve worked tirelessly to build our Engagement Banking Platform, a solution that empowers financial institutions to go beyond traditional banking to re-architect the entire experience around the customer. We believe that technology like ours is an enabler of progress and innovation in service of the end customer, and this latest acknowledgement validates our approach, testifying to the impact that Backbase and our platform continue to make.”

According to the Aite matrix, Backbase was found to be far ahead of the competition across multiple digital banking benchmarks. Backbase’s strong balance of both vendor strength and product performance are highlighted in the report’s findings.

“Leading financial institutions know that providing exceptional customer experiences is the key to success and longevity. Platforms from big-tech and fin-tech players are taking the world by storm as their technologies simplify the personal finance needs of customers. To stay relevant, banks and credit unions need to act now. This report underscores the need for financial institutions to architect their operations around their customers and members. And the best way to do that is to replace legacy point solutions with a single engagement banking platform, such as Backbase. With our platform, FIs can break down silos, reduce technical debt, and unite seamless customer and employee journeys — empowering them to break free from legacy infrastructure and effectively compete in a digital first world.” concluded Bezemer.

Read More: Piper Sandler Expands Credit Union Coverage with Addition of Jon Searles

Backbase is on a mission to transform the broken banking system, so financial institutions don’t just interact—they engage—with the people they serve.

That’s made possible with the Backbase Engagement Banking Platform—powering all lines of business on a single platform, including Retail, SME & Corporate and Wealth Management. From digital sales to everyday banking, the platform’s entire design focuses on a seamless and captivating experience for both customers and employees.

Industry analysts Ovum and Celent continuously recognize Backbase’s front-runner position, and over 120 large financials around the world are powered by the Backbase Engagement Banking Platform—including AIB, Barclays, Banamex, Bank of the Philippine Islands, BNP Paribas, Bremer Bank, Islands, Citibank, Citizens Bank, CheBanca!, Discovery Bank, Greater Bank, HDFC, IDFC First, KeyBank, Lloyds Banking Group, Metrobank, Navy Federal Credit Union, PostFinance, RBC, Société Générale, TPBank, Vantage Bank Texas, Westpac, WSECU and Wildfire CU.

Read More: Abra Launches Token-Based Rewards Program for Customers Powered by Crypto Perx (CPRX)

[To share your insights with us, please write to sghosh@martechseries.com ]