What is an E-commerce payment gateway?

Between buyers and sellers, a payment gateway authorizes the movement of funds. It enables your e-commerce site to ask a customer’s bank for payment for goods or services they’ve purchased. The payment is subsequently safely sent to your bank, assuming it is approved.

Why is it crucial to comprehend how a payment gateway functions?

You must make a number of choices when setting up a payment gateway on your own eCommerce website. The kind of merchant account you select and make sure that your customers’ payments are secure are two of the most crucial factors. Below, we go into greater detail about these. Let’s first examine the actual steps involved in placing an order and making a payment on a website.

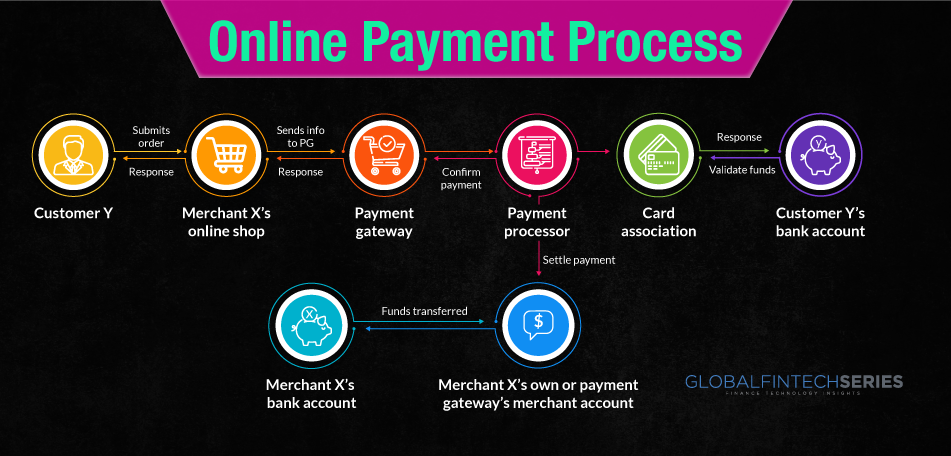

The procedural flow for payment gateways

Although there may occasionally be subtle modifications to the procedure, such as when refunds or charge-backs are involved (and it’s important to familiarise yourself with those as well), most transactions go as follows:

1. At checkout, the merchant’s website transfers payment details encrypted to the payment gateway

- The customer uses their laptop or phone to browse your website, adds their choice to their shopping cart, and then goes through the checkout process.

- They could be prompted to verify their order and provide their billing and shipping information as part of the checkout process.

- They click “order” or “pay now” to submit the order. The payment information is transferred to your web server after being encrypted by the customer’s web browser.

- Secure Socket Layer (SSL) encryption is used throughout the transaction, thus as the merchant, you must own a complete SSL certificate.

- The transaction information is subsequently forwarded to your payment gateway by the gateway application on your website, once more utilizing SSL encryption. The payment gateway now takes control.

Read the Latest Article: All About Fintech Startups

2. Payment gateway sends a request to the customer’s bank for authorization

- Your bank’s payment processor (the “acquiring bank”) receives the encrypted transaction information from the payment gateway.

- The card association for the customer, such as MasterCard or Visa, receives this information from the processor.

- The bank that issued the customer’s credit card receives the transaction through the card association.

- After the request is received, the customer’s bank confirms that the customer has the money necessary to cover the desired amount.

- The payment processor receives a code from the customer’s bank that shows whether the request was accepted or rejected (and if it is declined, the reasons why).

- The payment processor then relays this response to the payment gateway.

- This response is forwarded by the payment gateway to your website, which interprets it and forwarded it to the consumer who is checking out as well as to you as the merchant.

- Surprisingly, this entire procedure takes 2 to 3 seconds.

3. If the transaction was approved, the merchant is paid by the customer’s bank.

- If the customer’s payment is accepted, you submit the authorization to your (“the acquiring”) bank via the payment processor once more in a batch that is processed.

- All money that have been approved are deposited by your bank either into your merchant account or the combined merchant account held by your payment gateway.

- The payment is subsequently sent into your company’s bank account from that merchant account.

Gateway for white-label payments

Certain payment gateways provide white-label services, which let acquiring banks, e-commerce platforms, ISOs, resellers, or payment service providers completely brand the payment gateway’s technology as their own. This means that PSPs or other third parties can control the entire user experience without taking on additional risk management or compliance responsibilities associated with payment operations. However, the party providing the white-labeled solution to its clients may still be liable for certain regulatory requirements like Know Your Customer.

Read latest article: The New Wave: Decentralized Finance

[To share your insights with us, please write to sghosh@martechseries.com]