They say word-of-mouth generates the most genuine opinions, so it’s good to see the conference circuit opening up again to get an ear to the ground on the latest news and future trends for the financial services industry.

My recent trips included the IDC Directions Conference in Boston, the CeFPro Fraud and Financial Crime USA Summit in New York City, and the GDS Meet the Boss roundtable. To sum up the key takeaways from these events, there were four themes to the future of technology in financial services: speed, scalability, trust, and impact. The buzz at each event always returned to these for delivering high-value services to customers and ensuring greater productivity and value.

While we are still coping with the headwinds of COVID, it’s interesting to learn from IDC that despite a huge focus on reducing costs, the percentage increase on IT budgets has grown. In fact, 2021 technology spend grew 11%, with banking leaders admitting it was tech that saved the day and helped them respond so quickly to the pandemic, providing the necessary flexibility in work style.

There were a few other trends that stood out more than others:

There were a few other trends that stood out more than others:

It’s Lift Off for the Cloud

The hesitancy to move to the cloud has finally lifted. Many organizations are realizing that this is their best option for achieving speed and scalability. The Cloud makes it easier for standalone applications to be implemented, and innovation leaders now understand the restrictions around on-premises systems. The accelerated adoption of the cloud is enabling more partnerships and faster access to technical innovation which may have previously been hampered by misconceptions regarding cloud security. By 2025, Gartner predicts more than 95% of new digital workloads will be deployed on cloud-native platforms, up from just 30% in 2021. But without a solid tech eco-system, financial services teams are unable to move quickly and at scale to solve continually evolving issues that impact their business.

But becoming cloud-enabled and mobile first has uncovered a huge technology skills gap, and companies are now pursuing additional skills and new training initiatives. 2023 will be a tipping point for digital spend. As previously mentioned, it’s all about outcomes and impact, and the new currency is trust – trust in the tech ecosystem, AI algorithms, and with your customers.

Environmental, Social and Governance

There is growing momentum that investors and customers are more focused on the importance of environmental, social and governance (ESG) initiatives. It was a very prevalent topic of conversation at each event. Investors are now asking a lot of questions around the subject before deciding where to put their money. Even on the business-to-consumer (B2C) side we are seeing customers selecting products and services that support their beliefs. Financial services institutions are likewise responding with preferential treatment and/or better rates for supporters of a low carbon footprint, such as extra cashback points for renting a bicycle instead of filling up with gas.

Metaverse

The metaverse was the shiny object in the room at each conference. The promise of boosting impact by augmenting experiences holds real promise, but people are still unsure of its exact impact. A connection has already started as more employees become involved in the operation of artificial intelligence in banking. Indeed, the democratization of technology means that business users, and not the IT department, are now being charged with implementing sophisticated technology.

Front line risk and compliance analysts for example, will be using AI and machine learning to fine tune risk scoring and reduce false positives, in order to spend more time on value added work. Also, loan officers will have access to low code/no code AI platforms, such as intelligent document processing, that will help them make faster decisions on approving or denying finance, streamlining the process, and preventing repetitive requests for information from clients.

The Rise of Zombies

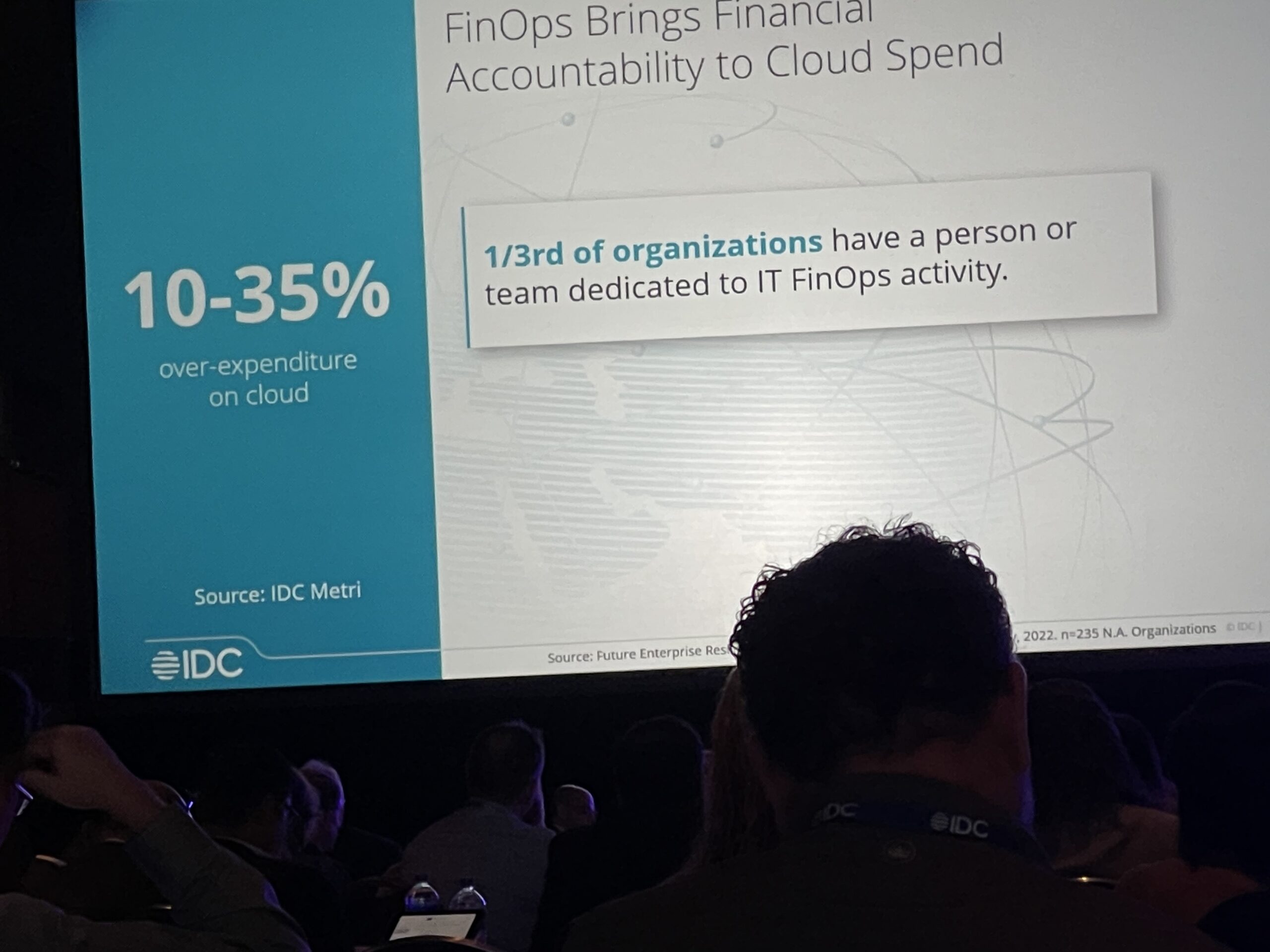

We’re aware that the rush to automate when the pandemic struck led to some non-essential investments. Those bad decisions still live on in the form of what are called ‘zombie’ servers and ‘zombie’ containers – technologies that are lying dormant despite hundreds of thousands of dollars poured into their creation but are now part of the technical debt that many leaders are burdened with. The question is, what do you do about them? One-third of organizations have dedicated FinOps teams to look for ways to maximize the business value of their cloud spend, across functional teams. Some companies are looking at ways experts can resurrect these zombies into service or streamline systems to recoup some of the money. Major analysis of operations and business processes are being undertaken to re-evaluate what is working well and where redundancies are lurking. This in-depth evaluation will root out the zombies and either shut them down or put them to work in a more valuable way. On the subject of technical debt, businesses are realizing the need to spend more on skilled labor as the aforementioned democratization of technology takes a grip. For example, JP Morgan announced a massive $12 billion will be invested in technology to fight the threat from FinTechs.

We’re aware that the rush to automate when the pandemic struck led to some non-essential investments. Those bad decisions still live on in the form of what are called ‘zombie’ servers and ‘zombie’ containers – technologies that are lying dormant despite hundreds of thousands of dollars poured into their creation but are now part of the technical debt that many leaders are burdened with. The question is, what do you do about them? One-third of organizations have dedicated FinOps teams to look for ways to maximize the business value of their cloud spend, across functional teams. Some companies are looking at ways experts can resurrect these zombies into service or streamline systems to recoup some of the money. Major analysis of operations and business processes are being undertaken to re-evaluate what is working well and where redundancies are lurking. This in-depth evaluation will root out the zombies and either shut them down or put them to work in a more valuable way. On the subject of technical debt, businesses are realizing the need to spend more on skilled labor as the aforementioned democratization of technology takes a grip. For example, JP Morgan announced a massive $12 billion will be invested in technology to fight the threat from FinTechs.

Proof of Identity

This was by far one of the most popular conversations on the floor as workers admitted to the difficult scenario of proving if people are who they say they are.

With so much fraud and financial crime taking place, proof of identity has become a major hurdle within know your customer (KYC) regulations, particularly as more transactions occur online or through self-service models on mobile devices. For example, ‘selfie-likeness’ is a new scam for people applying for loans who provide a screen shot portrait instead of a live photo. New liveness detection technology can be put in place to detect fakes, ensure headshots are genuine, taken live from different angles, and compared for authenticity.

Fraud-as-a-Service and Rise in E-skimming

We can never get away from the reality that fraudsters are continually looking at ways to outsmart the smartest cyber security professionals in banking. We’ve seen a massive rise in e-skimming, a scam where a hacker inserts malicious credential-stealing software into a retailer’s website. According to one panel session at CeFPro, 181 million cards were skimmed, accounting for 50 billion attempted fraud attempts with the average cost of each attempt being $300.

Some scams are being packaged up with a nice red bow on top to allow other people without experience to commit financial crime. It’s been labelled fraud-as-a-service. These bad actors are taking advantage of the cloud, which is why working within an ecosystem of trusted vendors that specialize in best-in-breed KYC solutions is all the more important.

Sadly, some of the true-life stories behind the financial crimes disclosed were enough to make you weep – child pornography, sex trafficking, slavery and drugs are among the money laundering schemes we heard about. Compliance teams are up against chilling and wicked people. I was horrified to hear that right now, there are roughly 4.1 million people in the US in forced slavery. It’s not just about protecting your bank or your brand, it’s about saving lives. Many of us certainly left with a heavier heart to hear what is going on behind the scenes of these money laundering rings.

Knowing the impact financial institutions have on customers, stakeholders, and greater communities, it’s important to remember that the four pillars of successful technology influence each other more than easy access to money. By keeping these four principles at the center of your intelligent automation strategy – speed, scalability, trust, and impact – financial services leaders will be agile, smarter, and perhaps even one step ahead of fraudsters.