Cryptocurrency continues to be a top-trending keyword in the fintech landscape. The cryptocurrency lending platforms are among the fastest-growing categories in the fintech market. In 2020, lending platforms gained massive popularity, and since then, the total value of loans locked on different platforms has increased to billions.

There are two parts to cryptocurrency lending: interest-bearing deposits and loans. Similar to a bank account, deposit accounts have comparable functions.

In this article, let’s dive into crypto lending and how any crypto investor can make make monies from their investments.

Summary

- Learning About Crypto Lending

- Types of Crypto Loans

- Fintech Exclusive: Industry Viewpoint from 3 Fintech Leaders

- How to Lend Crypto

- 8 Steps for the crypto lending process

- Is Cryptocurrency Lending Secure?

- How Does Leasing Cryptocurrency Pay Off?

- Snippet from Global Fintech Interview Series

- Conclusion: The crypto lending market is the future of the money market

Learning About Crypto Lending

In order to borrow money, borrowers normally need to deposit at least 100% (and sometimes up to 150%, depending on the lender) in cryptocurrency as collateral. The interest rates differ by platform and call for monthly payments, much like with traditional loans. In contrast to conventional loans, cryptocurrency loans have durations as short as 7 days and as long as 180 days, with an hourly interest rate, like Binance. Some lenders, like Nexo, which offers 0% APR, provide an endless line of credit in their place. The lending platform accepts Bitcoin deposits from users and pays interest of up to 8% APY (depending on the platform and the cryptocurrency). Deposited money might be used by the platform to make loans to borrowers or for other kinds of investments. Deposited money might be used by the platform to make loans to borrowers or for other kinds of investments.

If you are aware of how a typical loan works, you can guess this too! You ask for a loan because you don’t have enough money for something you desire, like that new Range Rover or a six-figure Liberal Arts degree that you’re sure would be worthwhile. Once your application has been accepted, the loan provider (often a bank or other financial institution) will provide you with some money and a repayment plan. The repayment is usually made on a monthly basis and includes both the principal and interest payments or simply the interest in the case of an interest-only loan.

Bitcoin is a technological tour de force. — Bill Gates

By taking out a loan against your Bitcoin, you may get a one-time payment in exchange for pledging your cryptocurrency holdings as security. A tangible item like a vehicle or a home may be used as collateral in the event of a conventional loan, meaning the lender would gladly take them back if you don’t make your payments. The borrower deposits their cryptocurrency holdings as security for crypto loans.

Following the crypto catastrophes of 2022, 2023 provides a more sensible approach to borrowing in cryptocurrencies. Following the effects of the Terra Luna failure, two well-known cryptocurrency platforms, Celsius and BlockFi, filed for bankruptcy protection in 2022. We discovered that the sector is very linked, and if one firm collapses, it might have a domino impact on other businesses (FTX).

As loan providers re-evaluate their risk strategy while anticipating the collateral requirements for borrowers to rise in the future, since a large portion of the growth in 2023 is predicted to come from decentralized protocols, which are often over-collateralized (your collateral has to be worth more than what you’re borrowing) and are managed by computers and algorithms.

You will still be able to take out loans against your cryptocurrencies (and NFTs) in the decentralized finance (DeFi) world, but you will need to put down a little more money upfront or limit the loan amount.

Read: What Is Data Science?

Types of Crypto Loans

There are several types of cryptocurrency loans available:

Collateralized loans

The most common loans are secured by collateral, and they call for the deposit of cryptocurrency. The majority of platforms demand over-collateralization, which limits how much of the deposited collateral borrowers can access (usually below a 90% loan-to-value). The interest rate and the likelihood of having your margin called are both lower the loan-to-value (LTV) ratio.

Crypto line of credit

Some services provide a Bitcoin line of credit rather than a standard loan with a defined term length. Users can borrow up to a specific amount of the deposited collateral using this kind of collateralized loan, but there are no specified terms for repayment, and they just pay interest on the money they withdraw.

Uncollateralized loans

Although less common, uncollateralized loans operate in a manner akin to personal loans. To be authorized, borrowers must submit a loan application, be identified, and pass a creditworthiness assessment. Because there is no collateral that may be sold off in the case of a loan default, these loans carry a larger risk of loss for the lenders.

Flash loans

Flash loans are instant loans that are acquired and returned in the same transaction, and they are often offered on cryptocurrency exchanges. These are extremely risky loans that are generally utilized to profit from market arbitrage possibilities, such as buying cryptocurrencies for less money in one market and selling it right away for more money in another, all inside the same transaction.

Fintech Exclusive: Industry Viewpoint from 3 Fintech Leaders

Stephan Nilsson, Founder, CEO, Enterprise Blockchain Implementer & Evangelist contributed his insights to Global Fintech Series which forms the original content for this website. His views were enthralling.

“Crypto loans are incredibly risky, particularly in a bear market, where the value of cryptocurrencies plummets. One of the main reasons for this risk is the lack of actual utility for cryptocurrencies. Unlike traditional assets or currencies, cryptocurrencies lack tangible use cases or intrinsic value, making them dependent on a highly manipulated crypto market. In a bear market, when prices are falling, borrowers may struggle to repay their loans with crypto as collateral. The extreme volatility of cryptocurrencies leads to significant fluctuations in the value of collateral, potentially resulting in liquidation events and loss of assets.”

Jacob Lysick, CMO/Blockchain Engineer @ Orionblocksystems & Vantage Ventures Resident

contributed his insights to Global Fintech Series which forms the original content for this website. His views were breathtaking. I’m sure this is going to add relevance and a much deeper perception in regard to the same.

How to Lend Crypto

Users must register for a lending platform, choose a supported cryptocurrency to deposit, then pay money to the platform in order to become a crypto lender. Interest can be paid in kind or with the native platform token on a centralized crypto lending platform. Interest is paid out in kind on a decentralized exchange, but there may also be bonus payments.

An origination fee can be a flat amount or a percentage of the loan. Not all loan providers charge origination fees, but it can be costly if they do. For example, some platforms charge a 2% origination fee on crypto loans. Be sure to plug the fees into your calculations before you click the borrow button.

8 Steps for the crypto lending process

- The borrower chooses a cryptocurrency loan amount and an investing platform. There is no drawn-out application procedure, unlike when applying for a loan at a bank.

- The program determines how much cryptocurrency is needed as collateral depending on the intended loan amount and the LTV ratio.

- Cryptocurrency collateral is pledged by the borrower.

- Despite not being present while the loan is being funded, the investors do so via the investing platform.

- Over a predetermined period of time, the borrower repays the loan’s principal and interest. (Most platforms don’t charge fees when a loan is repaid early.)

- Regular payments are made to investors from their interest-bearing portion.

- After repaying the whole loan, the collateral is returned to the borrower.

- Although each crypto lending platform has its own distinct policies and processes, the overall workflow is same across all of them.

Read the latest article: 10 Best Applications Of AI In Banking

Is Cryptocurrency Lending Secure?

Lending cryptocurrency has two disadvantages. On the one hand, the majority of loans are secured by collateral, so even in the case of a default, lenders can recover their losses through liquidation. In comparison to conventional bank accounts, they also offer deposits at substantially greater interest rates. On the other hand, there are no legal safeguards for investors, giving lending companies the authority to arbitrarily lock consumers’ funds in place, as Celsius has done.

I see Bitcoin as ultimately becoming a reserve currency for banks, playing much the same role as gold did in the early days of banking. Banks could issue digital cash with greater anonymity and lighter weight, more efficient transactions. — Hal Finney

Borrowers run the danger of collateral losing value and having to be liquidated, which would result in a substantially smaller return on their investment. Regulators from all around the world are focusing on lending platforms; rules are emerging around deposit accounts, and the Securities and Exchange Commission (SEC) even fined BlockFi $100 million for breaking securities laws. Ultimately, crypto lending can be secure for careful users, but both borrowers and investors face significant dangers.

Like every loan, a cryptocurrency loan has dangers. However, if you don’t pay, nobody will come to your home and shatter your kneecaps. Additionally, nobody will harm your credit score. Instead, you run the danger of losing your collateral. The lending platform may sell your cryptocurrency to recoup the loan if you default on your payments or the value of the collateral decreases.

How Does Leasing Cryptocurrency Pay Off?

Users can earn a sizable amount of interest by depositing cryptocurrency to a lending platform, frequently more than traditional banks can. In addition to being lent to borrowers who cover a portion of the interest, the money deposited can also be invested in other ways to generate further yield.

Spot Trading Volume(24h)- $443,334,709.19

A fully decentralized financial-based loan and credit system is being brought onto the Binance Smart Chain by Venus, an algorithmic-based money market system. Venus provides the network with collateral that may be borrowed by promising over-collateralized cryptocurrencies, allowing users to utilize their cryptocurrencies. As a result, a safe environment is created for lending where the lender receives a compounded annual interest rate (APY) paid each block and the borrower is responsible for paying interest on the cryptocurrency borrowed.

These interest rates are automated and established by the protocol in a curve yield based on the demand of the particular market, such as Bitcoin. Venus differs from previous money market protocols in that it can create synthetic stablecoins with over-collateralized positions that safeguard the protocol using the market collateral in addition to borrowing other assets. These artificial stablecoins are supported by a cryptocurrency basket rather than a basket of fiat money. Venus accesses a vast network of wrapped tokens and liquidity while using the Binance Smart chain for quick, inexpensive transactions.

Spot Trading Volume(24h)- $126,550,060.86

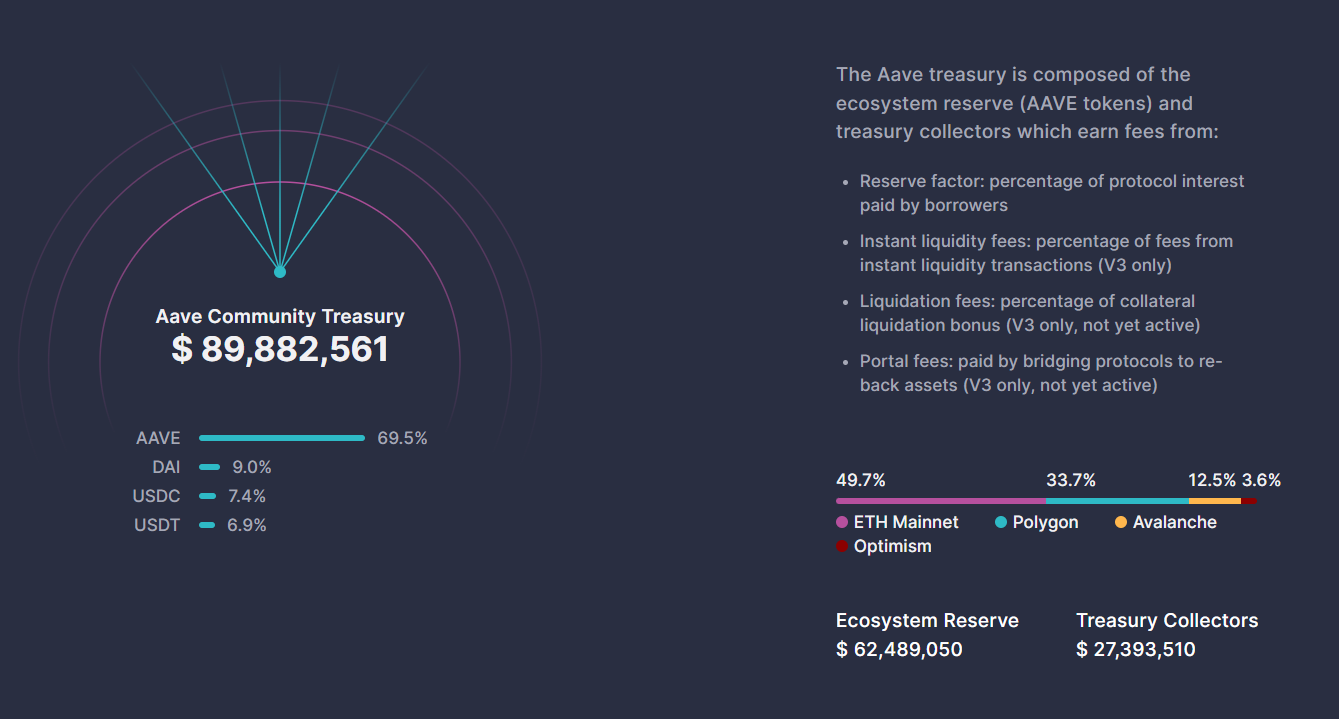

It’s here! Say “GM” to the most powerful version of the Aave protocol to date, V3.

Now live, Aave V3 builds upon the foundational elements of the Aave Protocol (e.g., aTokens, instant liquidity, stable rate, etc.) with groundbreaking new features that span from increased capital efficiency to enhanced decentralization.

Aave V3 is poised to accelerate the growth of DeFi with its fully revamped user experience,” said Sandeep Nailwal, Co-Founder of Polygon. “This is a huge milestone for one of the most popular liquidity protocols in DeFi and furthers our mission to bring DeFi to the next hundreds of millions of people.

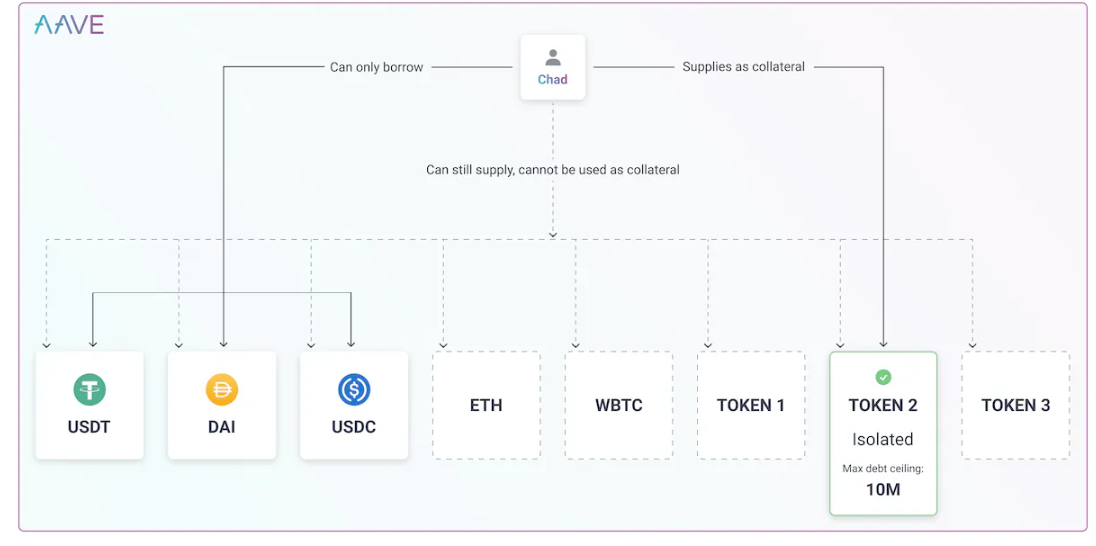

Aave is a non-custodial open-source protocol that enables the development of financial markets. On their asset deposits, users can earn interest, and they can also borrow assets at low rates.

Due to the technical expertise needed to implement one, flash loans are a feature created for developers. Flash Loans let you borrow whatever amount of assets that are accessible without having to put up any security, so long as the liquidity is returned to the protocol in a single block transaction. You must create a contract that requests a Flash Loan in order to execute a Flash Loan. The contract must then carry out the specified actions and make the loan repayment plus interest and fees in a single transaction.

Due to the technical expertise needed to implement one, flash loans are a feature created for developers. Flash Loans let you borrow whatever amount of assets that are accessible without having to put up any security, so long as the liquidity is returned to the protocol in a single block transaction. You must create a contract that requests a Flash Loan in order to execute a Flash Loan. The contract must then carry out the specified actions and make the loan repayment plus interest and fees in a single transaction.

These are the top 5 borrowed assets on Aave right now.

- Ethereum (ETH)

- USD Coin (USDC)

- Dai (DAI)

- Wrapped Staked ETH (wstETH)

- Wrapped Bitcoin (WBTC)

Spot Trading Volume(24h)- $11,250,811.98

Compound provides comparable alternatives, such as crypto loans and borrowing, while not being as simple to use as Aave. Compound Finance functions practically in the same way that Ave does. If a borrower has assets to use as security for the loan, loan providers fund pools from which the borrower may borrow. There are fewer cryptos available to borrow compared to Aave, but because both platforms employ variable rates, maintaining Compound Finance on your list of possibilities may help you get a better deal. Compound is the only network that it supports.

A decentralized DeFi protocol for interest rate markets is called a compound. Users “swap” their ETH (which they supply to earn interest) for cETH, which they can then exchange back for ETH at any time. All of the tokens that Compound supports are in this situation. Faux money, derivatives, futures, options, etc. are not included in the compound. Simply put, users can lend and supply assets. Due to this, borrowers pay interest to suppliers.

Read: A Global Map Of Cryptocurrency Regulations

Which cryptocurrency is lendable?

Your cryptocurrency serves as security for one of three different cryptocurrency loans:

- With cryptocurrency, you may borrow fiat (like USD).

- Stablecoins are digital currencies that follow the value of fiat currency.

- With your crypto, you may borrow another kind of cryptocurrency.

Borrowing stablecoins like Tether (UDST) or Circle (UDSC) is a common component of cryptocurrency loans. In these two instances, these stablecoins mimic the value of the USD fiat money. While you transfer your money to the location where you need to utilize it, stablecoins maintain their worth. It’s wise to avoid losing money between points A and B. In addition, you may borrow other cryptocurrencies. Really, it simply relies on which are offered by the lending site you’ve selected.

Perhaps you wish to take out a Wrapped Bitcoin loan using Ethereum as security. You may do so as long as the platform you use enables borrowing of Wrapped Bitcoin and accepts Ethereum as security. Tokens that are wrapped mimic the value of a “real” currency or token. Wrapped Bitcoin has a price that is the same to Bitcoin’s but is usable on the Ethereum network.

Snippet from Global Fintech Interview Series

Global Fintech Interview with Philip Meyer, Co-Founder & CEO at Vaultavo

- What advice would you like to give to our 420 million crypto investors?

Crypto is an extremely exciting field and is rapidly evolving into a significant portion of our digital experiences. I think Crypto should be part of everyone’s investment portfolio. Because of the relative newness of the sector, it still suffers from high volatility and therefore participants should appreciate the related risks.

- Digital assets are here to stay. Could you please elaborate a bit on this?

Digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology. Digital assets include (but are not limited to): Convertible virtual currency and cryptocurrency. Michael Demissie, the head of digital assets at Bank of New York Mellon (BNY Mellon), is adamant that the cryptocurrency market crash in 2022 won’t waver institutional interest in digital assets. At a conference run by Afore Consulting, Demissie said in February 2023, that the digital asset industry is “here to stay” as institutional investors have a strong interest in crypto. “What we see is clients are absolutely interested in digital assets, broadly,” he said, according to a report from Reuters.

Demissie backed up his thoughts by referencing a survey conducted by BNY Mellon in October 2022, which found that 91% of custodian bank clients are interested in investing in blockchain-based tokenized products. The survey also found that 86% of institutional players are adopting a “buy and hold” strategy, which may suggest that they see the cryptocurrency market as a long-term play. Of those surveyed, 88% also said that the severe cryptocurrency market turndown in 2022 hasn’t changed their plans to invest in the digital asset sector over the long term. Demissie did however state that more work needed to be done in Washington D.C., so that industry players can move forward with more regulatory clarity. So it is clear based on the research done by the influential BNY Mellon, that digital assets are here to stay.

Conclusion: The crypto lending market is the future of the money market

A crypto loan enables you to access the value of your cryptocurrency without selling your whole stack when you are short on cash but long on it. Generally speaking, there is no credit check, and you are free to spend the loan funds on almost anything. Like conventional loans, however, cryptocurrencies also carry inherent dangers, with forced liquidations topping the list. But if you plan well, you may borrow money without all the bothersome inquiries and for less money than personal loans.

“Digital currency is the future of money.”

Bill Gates

Despite the asset class’ rapid expansion, many investors continue to concentrate primarily on the dangers of crypto lending. While it is important to think about the dangers associated with your investments, there are various methods to minimize those risks and maximize your earnings with cryptocurrency lending. The immense prospects that crypto lending presents for the financial markets, the crypto financial system, and the conventional financial sector, in particular for you as an investor or borrower, should be understood above all else.

For crypto firms and investors acquainted with the asset class, crypto financing is now mostly a niche offering. Banks often won’t give their goods to cryptocurrency startups due to regulatory concerns, leaving them with no alternative but to depend on crypto loans in order to get funding. More businesses and individual investors outside the cryptocurrency sector will obtain financing via lending platforms and invest their liquid assets in this manner as asset tokenization becomes more widespread and politicians ensure legal clarity.

Long-term, the value chain of banks will be attacked by crypto loans and largely replaced by it. This will democratize financial markets and reduce the market dominance of banks. It is simply a question of time and technical advancement until crypto financing becomes generally accepted since this is in both investors’ and businesses’ best interests. What is now a specialized investment product might become a popular one in a few years. This implies that gains might possibly decline over time, making now an excellent time to invest.