The world of cryptocurrency isn’t new now, but is exciting, baffling, and everything in between. For those new to the crypto space, navigating exchanges – the platforms where you buy and sell digital currencies – can feel like deciphering a foreign language. Since the advent of Bitcoin in 2009, the cryptocurrency market has exploded in popularity, with exchanges emerging as crucial infrastructure facilitating the trading of these digital currencies. Yet how do you use the infamous cryptocurrency as a mode of transaction?

Here’s where cryptocurrency exchange swirls in – To start buying and selling cryptocurrencies and other digital assets, the most common way is to transact with Crypto Exchanges. These exchanges have become the cornerstone of the cryptocurrency ecosystem, facilitating the buying, selling, and exchange of these digital assets.

What is a Cryptocurrency Exchange?

Cryptocurrency exchanges serve as online platforms where users can trade cryptocurrencies for other digital assets or traditional fiat currencies like the US dollar or euro. These exchanges act as intermediaries, matching buyers with sellers and executing trades based on current market prices. Think of a cryptocurrency exchange as a digital marketplace for cryptocurrencies. Just like a stock exchange, it connects buyers and sellers, allowing you to trade crypto for other crypto or even traditional fiat money (like US dollars or Euros). Exchanges act as intermediaries, ensuring a smooth and secure transaction process.

At their core, cryptocurrency exchanges function similarly to online stock brokerages. However, instead of stocks and bonds, they deal in cryptocurrencies like Bitcoin, Ethereum, and countless others. Users can deposit funds into their exchange accounts, typically in the form of fiat currency (traditional government-issued money like USD or EUR) or existing crypto holdings. With these funds, they can then place orders to buy or sell specific cryptocurrencies at their desired price.

The crypto exchanges also provide trading of various cryptocurrencies such as margin or lending trading, and future and options trading. Based on the volume of your transaction or dependent upon which kind of transaction you carried out, the crypto exchange charges a certain type of fee, to aid their users with these numerous offerings. Investors were only able to receive crypto mining apps or by organizing transactions on various online and offline platforms, before crypto exchanges.

But now, there are hundreds of cryptocurrency exchanges operating worldwide and offering various digital currencies with varying levels of security and fee structure.

Browse more about Fintech Insights: Multi Party Computing – Collaboration Without Disclosure

Understanding the Mechanism: How Cryptocurrency Exchanges Work

The exchange acts as a facilitator, matching buy and sell orders and executing trades. Here’s a detailed overview of the functioning of cryptocurrency exchanges:

-

Matching Orders:

At the core of any cryptocurrency exchange is the process of matching buy and sell orders. When a user places a buy order for a certain cryptocurrency at a specific price, the exchange searches for a corresponding sell order at or below that price. Once a match is found, the trade is executed, and the cryptocurrency is transferred from the seller’s account to the buyer’s account.

-

Order Book:

The order book is a very important component of cryptocurrency exchanges. It is essentially a ledger that records all buy and sell orders placed by users. The order book displays the current buy and sell orders along with their respective prices and volumes. Traders use the order book to gauge market sentiment and make informed trading decisions.

This matching process can occur in two primary ways:

-

Market Orders:

In a market order, the user specifies the amount of cryptocurrency they wish to buy or sell and the exchange executes the trade at the best available market price. This is a convenient option for quick transactions, but the execution price might differ slightly from the user’s expectation due to market fluctuations.

-

Limit Orders:

For more control, users can place limit orders. These orders specify both the quantity and the desired price for the trade. The exchange will only execute the trade if the market price reaches the user’s predetermined limit. This method ensures the user gets their desired price but may result in slower trade execution or even order cancellation if the market price doesn’t reach the limit. While buying and selling cryptocurrencies form the core function of exchanges, many platforms offer a wider range of services:

-

Margin Trading:

This allows users to borrow funds from the exchange to amplify their trading positions. While it can potentially increase profits, it also magnifies potential losses. Margin trading lets you amplify your returns by borrowing funds from the platform. Imagine using a small amount of your capital to control a much larger position. While potential profits soar, so do potential losses. If the market moves against you, the exchange can force you to sell holdings to cover the loan, leading to significant losses even if a small portion of your capital was used initially. Margin trading is a risky game best suited for experienced traders with a high tolerance for risk.

-

Staking:

Certain cryptocurrencies utilize a “proof-of-stake” consensus mechanism. Staking allows users to lock up their holdings to support the network’s operations and earn rewards in return. Staking helps you to earn passive income on digital assets. By staking your holdings, you contribute to the smooth operation of the network and are rewarded for it. Think of it as putting your crypto to work for you. Staking typically involves locking up your coins for a set period so that they won’t be readily available for trading. However, it offers a way to generate returns without the volatility of actively buying and selling.

-

Fiat On-Ramps and Off-Ramps:

Some exchanges provide fiat on-ramps, allowing users to easily buy cryptocurrencies with fiat currency using debit cards, bank transfers, or other methods. Conversely, off-ramps enable users to convert their crypto holdings back into fiat for withdrawal. Fiat on-ramps and off-ramps act as bridges between the traditional financial world and cryptocurrency exchanges. On-ramps allow you to seamlessly convert your fiat currency (USD, EUR, etc.) into crypto using familiar methods like bank transfers or debit cards. This makes buying crypto easy and accessible. Off-ramps, on the other hand, let you convert your crypto holdings back into fiat for easy withdrawal or spending. These ramps eliminate the need for external services and streamline the process of entering and exiting the cryptocurrency market.

-

Margin Lending:

Experienced users can lend their crypto holdings to other users on the platform and earn interest on their loaned assets. Margin lending on cryptocurrency exchanges allows you to earn interest by putting your crypto holdings to work. You essentially act as a mini-bank, lending your coins to other traders who need them for margin trading. In return, you collect interest on the loaned amount. While attractive, it’s not risk-free. If the borrower defaults or the market crashes, you might not get your crypto back, or even lose some of your principal. Margin lending can be a good way to generate passive income, but careful research and understanding of the risks involved are crucial.

Types of Cryptocurrency Exchanges

-

Centralized Exchanges (CEXs)

These are the most common type, resembling traditional financial institutions. CEXs hold your crypto on their servers, offering a user-friendly interface and often a wider variety of payment options (debit cards, bank transfers). Users create accounts, deposit funds, and execute trades through the exchange’s platform. Popular CEXs include Coinbase, Kraken, and Binance. While centralized exchanges offer high liquidity and ease of use, they also face security risks due to their centralized nature.

CEXs use an order book system which means that orders are listed and organized by the intended buy or sell price. The buyers and sellers are matched based on the most suitable executable price given the desired lot size using the exchanges’ matching engine. Thus, whether it is fiat currency or cryptocurrency,a digital asset’s price will depend on the supply and demand of that asset versus another.

-

Decentralized Exchanges (DEXs) :

These operate on a peer-to-peer (P2P) basis, meaning no central authority controls the exchange. Transactions happen directly between users, offering greater anonymity and control over your crypto. However, DEXs can be more complex to navigate and may have lower trading volumes compared to CEXs. Popular DEXs include Uniswap and SushiSwap. However, DEXs can be more complex to navigate and may have lower trading volumes compared to CEXs.

These decentralized exchanges depend on smart contracts, self-executing pieces of code on a blockchain. Better privacy and less slippage(transaction cost) are offered by these smart contracts as compared to a centralized cryptocurrency exchange.

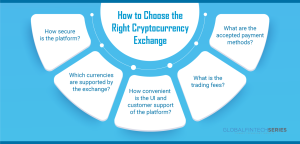

How to Choose the Right Exchange?

With a range of exchanges available, selecting the right one can be overwhelming. Here are some key factors to consider:

-

Security

This is paramount. Look for exchanges with robust security measures, including two-factor authentication and strong encryption protocols. Research the exchange’s past security breaches (if any) to gauge their response and recovery efforts. When selecting the best crypto exchange, its reputation and records matter a lot. Few important things that the user needs to do thorough research while choosing the right exchange – its founders, legitimacy, security issues, and how the exchange addresses any customer-related issues. Cryptocurrency exchanges are prime targets for hackers, so prioritize platforms with robust security measures in place. Look for features like:

- Two-factor authentication (2FA): This adds an extra layer of security by requiring a secondary login code after entering your password.

- Multi-signature wallets: These wallets require multiple signatures to authorize transactions, significantly reducing the risk of unauthorized access.

- Regular security audits: Opt for exchanges that undergo independent security audits to identify and address potential vulnerabilities.

- Cold storage: Reputable exchanges store a significant portion of user funds in offline cold storage, further mitigating the risk of online attacks.

-

Supported Currencies

Questioning if the exchange offers the cryptocurrencies you’re interested in buying and selling is very important. Popular exchanges typically support a wide range, while some specialize in specific coins but, not all exchanges offer the same cryptocurrencies. Ensure the platform supports the coins you’re interested in trading. Here are some additional considerations:

- Popular vs. emerging coins: Major exchanges typically list well-established cryptocurrencies like Bitcoin and Ethereum. You might need to explore specialized exchanges to access newer or niche coins.

- Trading pairs: Trading pairs represent the currencies you can exchange for your desired cryptocurrency. Choose an exchange that offers the trading pairs relevant to your investment strategy.

-

Trading Fees

Exchanges charge fees for various services, including deposits, withdrawals, and trades to provide a seamless transaction experience to the users. Do compare these fees across different platforms to find one that aligns with your trading volume. Transaction fees can eat significantly into your profits. Here’s what to consider:

- Maker-taker fees: “Maker” fees are charged for adding liquidity to the market by placing limit orders. “Taker” fees apply to those who remove liquidity by fulfilling existing orders. Understand the fee structure for both types of orders.

- Deposit and withdrawal fees: Some exchanges may charge fees for depositing or withdrawing fiat currency or cryptocurrencies. Be aware of these additional costs.

-

Payment Methods

Consider how you want to fund your crypto purchases. Ensure the exchange accepts your preferred payment methods (credit card, bank transfer, etc.)

-

Regulation

Navigating the Legal Landscape

Crypto regulations differ widely from country to country. Consider the following:

- Exchange location and licensing: Choose an exchange that operates in a jurisdiction with clear regulations for cryptocurrency exchanges. This provides a degree of legal recourse and consumer protection.

- Compliance with KYC/AML regulations: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations help prevent illegal activities. While KYC processes can feel intrusive, they contribute to a more secure environment.

-

User Interface (UI) and Customer Support :

A user-friendly interface is crucial, especially for beginners. Look for an exchange with a clear, intuitive design and helpful tutorials. Responsive and reliable customer support is also essential in case there are some abnormalities, as it gives some peace of mind.

Read More about Fintech : Gamification in Fintech: All About Customer Retention and Engagement

Look for platforms with:

- Intuitive design: A clear and uncluttered interface is easier to navigate, especially for beginners.

- Advanced features (optional): For experienced traders, features like charting tools and technical analysis indicators can be valuable.

- Responsive customer support: Reliable and responsive customer support is crucial for addressing any issues or inquiries you might encounter.

Security Tips for a Safe Exchange Use

-

Strong Passwords & 2FA:

Your password is the gateway to your account. Here’s how to make it a formidable barrier:

- Strong and Unique Passwords: Avoid using common phrases or personal information. Make your passwords extra secure with a mix of character types.

- Password Manager: Consider using a password manager to generate and securely store strong, unique passwords for each exchange account.

- Never Share Your Password: This golden rule applies everywhere, but especially in the crypto world. Never share your password with anyone, not even exchange representatives.

- Use complex, unique passwords for your exchange accounts and enable two-factor authentication (2FA) for an extra layer of security.

-

Phishing Scam Awareness:

Phishing emails or websites designed to mimic legitimate platforms are a common threat. Double-check the exchange URL before logging in and never share your login credentials with anyone.

-

Self-Custody:

For ultimate control over your crypto, consider storing it in a secure wallet that you control the private keys to (unlike CEX wallets). However, this requires a higher level of technical knowledge and personal responsibility.

-

Device Security:

The device you use to access the exchange is another potential vulnerability:

- Anti-virus and Anti-malware Software: Ensure your device is protected by up-to-date anti-virus and anti-malware software to prevent malware infection that could steal your login credentials.

- Software Updates: Keep your operating system and applications updated with the latest security patches to address known vulnerabilities.

- Avoid Public Wi-Fi: Public Wi-Fi networks are notoriously insecure. If necessary to access your exchange account on public Wi-Fi, consider using a VPN (Virtual Private Network) to encrypt your internet traffic.

The Future of Cryptocurrency Exchanges

The cryptocurrency exchange landscape is constantly evolving with advancements in digital currency every day. As the use of digital assets continues to rise, so too will the evolution of the platforms facilitating their trade. Here are some trends to watch:

-

Decentralized Finance (DeFi) Integration:

Decentralized finance (DeFi) protocols offer an alternative to traditional financial services built on blockchain technology. Advanced cryptocurrency exchanges are expected to integrate DeFi functionalities directly into their platforms. This could include features like:

- DeFi lending and borrowing: Users could directly lend their crypto holdings to others on the platform and earn interest, or borrow funds to leverage their positions.

- Yield farming aggregation: Exchanges could aggregate yield farming opportunities across different DeFi protocols, allowing users to easily access and optimize their returns.

- Decentralized asset management: Platforms might offer access to decentralized asset management tools where users can invest in professionally curated crypto baskets or follow the strategies of experienced traders.

By integrating DeFi, exchanges can cater to a wider range of user needs and offer more sophisticated financial instruments within a familiar trading environment.

-

Evolving Regulatory Landscape

As cryptocurrency adoption surges, regulatory bodies are scrambling to establish clear frameworks. This trend is expected to continue, with regulations likely to focus on aspects like:

- Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance: Exchanges might need to implement stricter KYC/AML procedures to verify user identities and prevent illegal activities.

- Token classification and licensing: Governments may categorize different cryptocurrencies based on their utility and function, potentially leading to specific licensing requirements for exchanges dealing with certain types of tokens.

While regulations might initially add complexity, a more defined legal landscape could ultimately bring greater legitimacy and trust to the cryptocurrency exchange ecosystem.

-

Focus on User Experience and Education

The user experience on cryptocurrency exchanges can be quite complex, especially for newcomers. To attract and retain a broader user base, future exchanges are likely to prioritize user-friendliness through:

- Simplified interfaces: Intuitive and user-friendly interfaces that cater to both experienced and novice traders will be crucial.

- Educational resources: Exchanges might integrate educational resources and tutorials directly into their platforms to explain complex concepts related to cryptocurrencies and blockchain technology.

- Improved customer support: Responsive and knowledgeable customer support will be essential to address user inquiries and resolve issues promptly.

By focusing on user experience and education, exchanges can create a more welcoming environment and empower users to confidently navigate the cryptocurrency market.

-

Rise of Security Token Offerings (STOs)

Security token offerings (STOs) represent a potential bridge between traditional financial instruments and the blockchain world. STOs tokenize real-world assets like shares or bonds, allowing for fractional ownership and potentially increased liquidity. Exchanges that integrate STO offerings could potentially:

- Offer a wider range of investment opportunities: This would cater to users seeking exposure to traditional assets within the cryptocurrency ecosystem.

- Attract institutional investors: The regulated nature of STOs might be more appealing to institutional investors, potentially leading to increased investment flows into the crypto space.

The rise of STOs on cryptocurrency exchanges could unlock new avenues for fundraising and investment diversification.

-

Integration with Emerging Technologies

Technological advancements can significantly impact the future of cryptocurrency exchanges. Some exciting possibilities include:

- Artificial Intelligence (AI): AI can be used for enhanced market analysis, personalized investment recommendations, and even automated trading strategies. AI is transforming cryptocurrency exchanges. Imagine AI algorithms sifting through mountains of data, predicting market trends, and generating trading signals. Exchanges can leverage this for real-time analysis and even personalized recommendations. Security gets a boost too, with AI sniffing out suspicious activity and protecting user accounts. While exciting, remember AI models are only as good as their data, and explainability is key for users to trust the recommendations.

- Blockchain Interoperability: Currently, many blockchains operate in silos. Interoperability solutions that allow seamless transfer of assets between different blockchains could be integrated into exchanges for greater user convenience.

Cryptocurrency exchanges bridge the gap between traditional finance and the expanding crypto economy. By understanding their functions, and different types, and choosing the right platform for your needs, you can achieve greater things on your crypto journey with confidence. Happy trading!

Latest Fintech Insights :Fintech Trends 2024: How Can Enterprises Be Better Prepared?

[To share your insights with us, please write to pghosh@itechseries.com ]