Codat, theuniversal API, has partnered with Basiq to bring “out of box” solution for data integration in open banking in Australia.

The concept of open banking for Australia is built on strong foundation of data management, data integrity and compliance. In 2019, Australia embraced the open data economy by passing the Consumer Data Right (CDR). But, it took almost 2 years to fully develop the plan for full IT integartion into the existing Fintech technologies that run the Loan, Banking, Credits and other Financial services systems. Last year, Australia announced major updates to the third-party accreditation, enabling bank customers more control over their financial data. If you are an Australian bank’s customer, your data shall be protected by the Rules of the ACCC– a powerful legal framework that has a major influence on the growing ecosystem of Australia’s Open Banking solution. To streamline the IT-Fintech integration in open banking for Australia, Codat and Basiq have joined hands. This fintechs partnership is aimed at creating an ‘out-of-the-box’, single integration solution for all data required for business underwriting, so financial institutions can lend with more confidence.

How?

Basiq, a leading open banking platform, would supercharge Codat’s Assess product for simplified underwriting. It will leverage Basiq’s unique 3.0 Platform to access financial data via Open Banking and web connectors. Codat was founded in 2017 and has offices in London, New York, San Francisco and Sydney. Both companies are strong Fintech and IT players in Australia.

More Digital Banking News: Capco and Plaid Announce Alliance to Drive Open Finance Innovation Across the Banking Sector

Let us understand more about this powerful Fintech integration for open banking features.

How does this partnership benefits Open Banking in Australia?

Codat, the universal API for small business data, and Open Banking platform Basiq, announced a partnership to enable better business underwriting; an essential initiative given the Australian lending market is tightening its belt amid RBA rate hikes.

The integration, which is now live, will make transactions from more than 20 Australian banks available to financial service providers and fintechs, alongside the 30+, accounting, eCommerce & payments data sources accessible via Codat’s API.

Bringing More Transparency to Every Financial Transaction with One-touch Integration

For providers, it will unlock all the data needed for underwriting in a single integration without asking clients to share sensitive financial data via email. Codat’s Assess product then enables lenders to automatically cross reference bank transactions with accounting data to validate accuracy.

For SMBs it means slashing the admin burden associated with applying for financial services like business loans, allowing them to provide all the necessary information in just a few clicks.

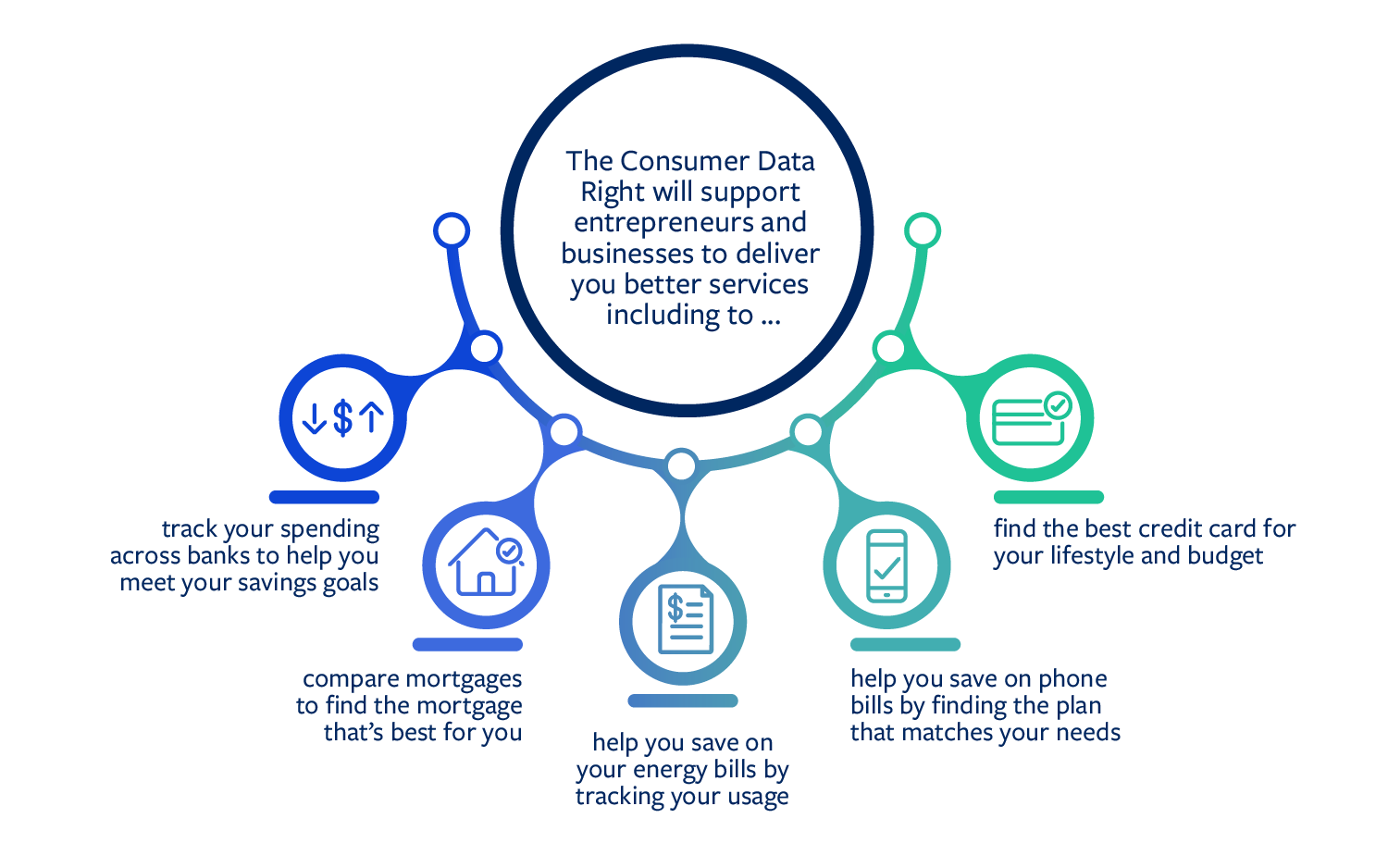

Understanding CDR for Open Banking System in Australia

Australia is one of the most prominent markets for Fintech players. It has a very strong ecosystem that supports digital banking and mobile transactions in the country. Currently, the Australian fintech market is brimming with innovation companies that strategically focus on the payments, lending and RegTech domains. All these are heavily guarded and influenced by data governance principles specific to the Australian laws. That’s where CDR comes into the picture.

CDR is an initiative by the Australian government to promote transparent data sharing between the users, service providers and technology companies that control the data sharing and data compliance systems. It is specifically structured to boost innovations in the Fintech market in Australia. Australian government has introduced CDR to breed competitiveness among Fintech service providers and innovation companies, inculcating fair market policies built around Open Banking legislation and enforcement.

Now, How does the CDR and Codat-Basiq Partnership Intertwine?

Codat chose to partner with Basiq due to the unique capabilities of the ‘Basiq 3.0 Platform’ which extends beyond the Consumer Data Right’s (CDR) Open Banking system. Basiq’s platform allows access to financial data across a number of institutions, including those available through Open Banking and others not yet part of the system. Combining this data with Codat’s Assess product, Codat’s Australian customers, which include the likes of Judo Bank, will be able to underwrite with more confidence – particularly in uncertain economic times.

The CDR initiative has come under recent scrutiny from the fintech community, some of whom have invested more than a million dollars into Open Banking Accredited Data Recipient (ADR) connectivity and say despite its enormous potential, is not yet fit for purpose.

Underwhelmed startups have labelled the initiative “disappointing” and “useless” for business data sharing, given that consent is needed from all responsible business holders means no account data is flowing.

At the time of this announcement, Damir Ćuća, CEO at Basiq said, “This partnership will enable access to financial data via the Basiq 3.0 platform. In an Open Finance world, financial data about a business can sit in a number of systems. While the CDR has the potential to transform financial services for business, it is not yet at a stage where we are able to rely solely on Open Banking data.”

Damir continued, “Our platform provides the flexibility to access financial data through both web capture and when it matures, CDR Open Banking. The key to better underwriting is to enable the most complete view of a customer’s financial situation, and that’s what we are able to provide together.”

Matthew Tyrell, Commercial Director APAC at Codat, said the partnership is the first investment the company has made in Australia following a $137 million Series C raise – part of which will be allocated to driving growth Down Under.

Matt said, “Since launching in Australia late last year, the demand for a product like Codat’s business data API has been steadily growing, which I see as an indicator of the health of the Australian fintech ecosystem, despite recent blows to the industry. The number of startups and SMEs looking for a plug-and-play data solution is on the rise, while more established players are sprinting towards financial transformation initiatives. Across the board, businesses are recognizing the benefits of digital data aggregation over legacy (and risky) emailed bank statements and spreadsheets, meaning more fintechs are knocking on our door, and the region has become a strategic market for the company.”

Matt continued, “Consequently, we’ve made the decision to invest in more functionality and more boots on the ground, specifically in Australia, to meet the demands of Aussie businesses who want to leverage the benefits of Open Finance but are realising the infrastructure hasn’t quite reached maturity. Our partnership with Basiq is one way Codat is bringing utility to financial data in a way that is otherwise not yet available in Australia.”

Partnership Goals for 2023: Fintech Innovations and Investments Outside of Australia

Codat and Basiq have both announced strategic investments from San Francisco-based fintech solutions provider Plaid, which has over 12,000 connections to banks globally and has previously signaled its intent to help bridge financial data gaps between North America and Australia.

This latest deal has the potential to support this shared mission to help fintechs more easily interconnect to data sources in their respective countries and also drive more competition between financial services providers.

Currently, the real-time connectivity that Codat provides enables software providers and financial institutions to build integrated products for their small business customers. Codat clients range from lenders to corporate card providers and business forecasting tools. Use cases include automatic reconciliation, business dash-boarding, and loan decisioning.

Recommended Fintech Update: Finance in Africa 2022: Navigating the Financial Landscape in Turbulent Times

Meanwhile, Basiq enables this by providing an Open Finance API platform for businesses to build innovative financial solutions. Our partners include some of the fastest-growing Fintechs and banks in the region. As the building blocks of financial services, the platform facilitates the relationship between fintechs and consumers by providing access to consented financial data and executing payments.

So, what do you think about growing your market in the Open Banking ecosystem?