With 105 Fintech unicorns, the United States of America has established itself as a leader on the global platform in this sector. In order to give my readers a comprehensive understanding of the fundamental offerings of the top 15 U.S. fintech companies amongst 105 unicorns listed below in this blog. I will focus on these all through this article with their present and potential offerings. The following points, which I’ve highlighted, are the result of much research and thoughtful analysis. Don’t miss out on this opportunity.

Table of Contents:

- Introduction: Development Of U.S. Fintech

- How Many Unicorns Exist In The U.S. Fintech Space?

- Here Is The Complete List Of 2023 Unicorns- U.S. Fintech

- Which Fintech Areas In The U.S. Have The Most Unicorns?

- Let’s Talk About The Top 15 Fintech Solutions & Offerings In The United States

- Startup Success Rate In the USA

- Conclusion

Introduction: Development Of U.S. Fintech

The history of fintech is longer than most individuals know. Fintech’s current iteration allows you to pay for a coffee cup using a smartphone app, but the history of the financial infrastructure dates back to the public’s acceptance of the first credit cards at the end of the 1950s. After the introduction of the credit card, other key financial milestones in the form of fintech Solutions & Offerings were invented and implemented in the mass market, including ATMs, electronic shares, mainframe bank computers, and online stock trading. The financial system that most people used but had to think about just occasionally per day was improved by many new technologies.

Fintech industry solutions today put the existing banking infrastructure to the test, for instance by using payment software on a mobile wallet rather than carrying actual credit cards in a physical wallet. Particularly in the financial, commercial, insurance, and risk management industries, fintech has changed many businesses. Fintech businesses include start-ups, tech organizations, and established financial institutions that use digital breakthroughs like big data and artificial intelligence to improve the usability and performance of financial services, blockchain, and edge computing.

Read: What Is Data Science?

How Many Unicorns Exist In The U.S. Fintech Space?

Evidently, the US fintech industry is significant. Compared to other nations, the sector has matured significantly. In the Fintech radar 2021, there were 10,755 fintechs in U.S., making it the country with the most startups worldwide. Just about 1% of the 10,755 fintech companies are unicorns, or companies worth $1 billion or more. Though it might appear insignificant, the 105 unicorns in the United States account for approximately 45% of all fintech unicorns internationally. China lags behind the US in the fintech unicorn chase, with only 13 unicorns, or one-tenth of what the US claims to have.

China lags behind the US in the fintech unicorn chase, with only 13 unicorns, or one-tenth of what the US claims to have. What then is encouraging companies to innovate and develop so quickly?

Regulating is important, too! Regulatory sandboxes and pilot programs have been the focal point of the expansion of the financial services industry, with the federal and state regulatory agencies in the US being “pro-fintech innovation.” Swarms of consumers are hopping aboard the Fintech bandwagon in the US market as well, propelling the nation towards a stage of mass adoption. According to Fortune, the percentage of American consumers utilizing Fintech increased to 88% in 2021 from only 58% in Plaid’s survey’s 2020 edition. It’s obvious that the US Fintech industry will prosper in the face of this rising demand.

The United States of America is the world leader in this area thanks to its 105 Fintech unicorns. A significant accomplishment in the financial technology sector is that the US has managed to lead the rankings in terms of the number of Fintech unicorns, unchallenged by its bitter rival China. The substantial funding the sector has received in the region is what is driving the continuous expansion in the number of fintech unicorns in North America.

Here Is The Complete List Of 2023 Unicorns- U.S. Fintech:

You can find below a comprehensive and well-researched authentic list of 105 U.S. fintechs for the current year 2023. Also, their respective type of company has also been mentioned which shall help to give you a fair and composed idea in regard to the same. Please note that the list is in descending order in accordance to their market valuation in The United States Of America.

|

|

Here is the full list of Fintech unicorns in the USA in 2023: |

|

|

|

Name of fintech unicorn |

Type of company |

|

1 |

Visa |

Paytech |

|

2 |

Mastercard |

Paytech |

|

3 |

Paypal |

Paytech |

|

4 |

Square |

Paytech |

|

5 |

Coinbase |

Cryptocurrency |

|

6 |

Affirm |

BNPL |

|

7 |

Robinhood |

Wealthtech |

|

8 |

Bill.com |

Paytech |

|

9 |

Chime |

Challenger Bank |

|

10 |

Upstart |

BNPL |

|

11 |

Ally Financial |

Challenger Bank |

|

12 |

Plaid |

Open Banking |

|

13 |

Sofi |

Challenger Bank |

|

14 |

Ripple |

Paytech |

|

15 |

Toast |

Paytech |

|

16 |

Brex |

Challenger Bank |

|

17 |

Carta |

Wealthtech |

|

18 |

Avant |

Diversified |

|

19 |

True Accord |

Infrastructure |

|

20 |

Flywire |

Paytech |

|

21 |

Hippo Insurance |

Insurtech |

|

22 |

Marqeta |

Paytech |

|

23 |

Chainalysis |

Blockchain |

|

24 |

Dataminr |

Infrastructure |

|

25 |

Better.com |

Wealthtech |

|

26 |

Kraken |

Cryptocurrency |

|

27 |

Next Insurance |

Insurtech |

|

28 |

iCapital Network |

Wealthtech |

|

29 |

Lemonade |

Insurtech |

|

30 |

Gusto |

Infrastructure |

|

31 |

FalconX |

Cryptocurrency |

|

32 |

Blend |

Challenger Bank |

|

33 |

Figure Technologies |

Wealthtech |

|

34 |

Cedar |

Insurtech |

|

35 |

HighRadius |

Infrastructure |

|

36 |

Oscar |

Insurtech |

|

37 |

Circle |

Paytech |

|

38 |

Blockfi |

Cryptocurrency |

|

39 |

Upgrade |

Challenger Bank |

|

40 |

Drivewealth |

Wealthtech |

|

41 |

Tradeshift |

Infrastructure |

|

42 |

Divvy |

Infrastructure |

|

43 |

Paxos |

Blockchain |

|

44 |

Greenlight |

Wealthtech |

|

45 |

Acorns |

Wealthtech |

|

46 |

Current |

Challenger Bank |

|

47 |

Fireblocks |

Cryptocurrency |

|

48 |

Addepar |

Wealthtech |

|

49 |

Green Sky |

BNPL |

|

50 |

ReCharge |

Paytech |

|

51 |

AvidXchange |

Paytech |

|

52 |

Clearbanc |

Wealthtech |

|

53 |

Pipe |

Challenger Bank |

|

54 |

Unqork |

Infrastructure |

|

55 |

Tipalti |

Open Banking |

|

56 |

Ethos Technologies |

Insurtech |

|

57 |

MX Technologies |

Open Banking |

|

58 |

LX |

Challenger Bank |

|

59 |

SpotOn |

Paytech |

|

60 |

CFGI |

Accounting |

|

61 |

Ramp |

Cryptocurrency |

|

62 |

Extend |

Paytech |

|

63 |

Mercury |

Challenger Bank |

|

64 |

Enfusion |

Wealthtech |

|

65 |

Collective Health |

Insurtech |

|

66 |

Persona |

Regtech |

|

67 |

Symphony |

Wealthtech |

|

68 |

M1 Finance |

Wealthtech |

|

69 |

Stash |

Wealthtech |

|

70 |

Alloy |

Open Banking |

|

71 |

Built |

Open Banking |

|

72 |

Signifyd |

Infrastructure |

|

73 |

TaxBit |

Cryptocurrency |

|

74 |

Enova |

Challenger Bank |

|

75 |

Feedzai |

Infrastructure |

|

76 |

Ascend Money |

Open Banking |

|

77 |

Socure |

Challenger Bank |

|

78 |

Root Insurance |

Insurtech |

|

79 |

BlockDaemon |

Blockchain |

|

80 |

Deel |

Infrastructure |

|

81 |

Kabbage |

Paytech |

|

82 |

Public |

Wealthtech |

|

83 |

DailyPay |

BNPL |

|

84 |

Guideline |

Wealthtech |

|

85 |

Sunbit |

BNPL |

|

86 |

Dave |

Challenger Bank |

|

87 |

Varo Money |

Challenger Bank |

|

88 |

WeBull |

Wealthtech |

|

89 |

Vise |

Wealthtech |

|

90 |

Trumid |

Wealthtech |

|

91 |

Tresata |

Infrastructure |

|

92 |

Sidecar Health |

Insurtech |

|

93 |

Pacaso |

Wealthtech |

|

94 |

Ivalua |

Infrastructure |

|

95 |

Ibotta |

Paytech |

|

96 |

Forte Labs |

Blockchain |

|

97 |

Clearcover |

Insurtech |

|

98 |

Chipper Cash |

Paytech |

|

99 |

Amount |

Challenger Bank |

|

100 |

Qualia |

Wealthtech |

|

101 |

Injective Protocol |

DEX |

|

102 |

MobileCoin |

Cryptocurrency |

|

103 |

Orchard |

Insurtech |

|

104 |

SumUp |

Paytech |

|

105 |

Sightline Payments |

Paytech |

Which Fintech Areas In The U.S. Have The Most Unicorns?

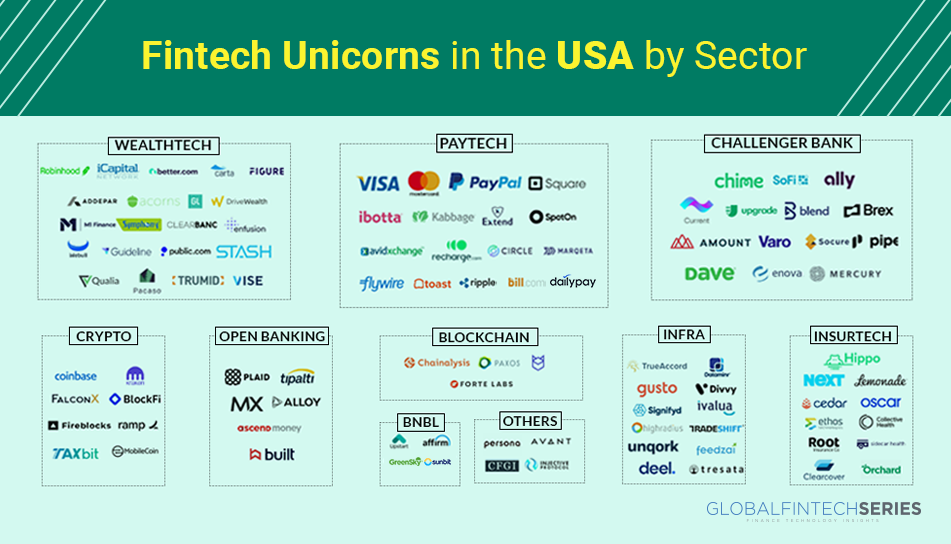

As we can see from the graphics below, there is a tough tie between wealthtech, paytech and challenger banks, followed by the groups of crypto, open banking, infra, and insurtech. Other sectors like blockchain and BNPL have also made its place.

Read the latest article: 10 Best Applications Of AI In Banking

-

With 38% of unicorns domiciled in this sector, Wealthtech and Payments, also known as Paytech, is by far the most well-liked industry in the Fintech billion-dollar club. The Challenger Bank sector, which is also a promising US industry, is ranked second on the list.

-

The retail investing boom that persisted in the wake of the epidemic was a major contributor to the wealth-tech sector’s unheard-of growth. The level of demand increased according to investments made by VC.

-

According to CBInsights, the sector received investments totaling $4.7 billion in Q1’21, a 562% increase from Q4’20.

-

The pandemic has also whetted the growing thirst for digital payments. Consider the 186% increase in the share price of PayPal over the past 12 months to put this into perspective using cold, hard numbers. In addition, the way that Square’s stock has increased by more than a scale factor of 5.

-

The e-commerce growth and the overall shift away from using cash as the primary method of payment are just two of the factors that have ignited the sector.

-

While the pandemic may have sparked the expansion of these two industries, it can be claimed that in the years to come, the shift in consumer behavior and the need for these modern financial services goods will continue to rise. We will be closely observed, but only time will tell how the industry will develop.

Let’s Talk About The Top 15 Fintech Solutions & Offerings In The United States

In the graphics below, the top 15 unicorns have popped up on the basis of their market valuations in U.S. The top 15 U.S. fintech companies have given an edge to the discussion in this blog so that my readers get a fair idea of their core offerings for their respective client base. What U.S. Fintech is currently offering to us and what more can we expect from them to come up! The key points highlighted below are well-researched and has taken a lot of patience and time to come up in a crisp way with the following points. So, don’t miss this out.

Read: A Global Map Of Cryptocurrency Regulations

VISA

-

A physical card can be virtually loaded into a mobile app with the help of digital wallets, which also store the value of the card for quick, easy access at the point of sale.

-

The lending industry has improved for both individuals and corporations. One may now provide a wider range of lending options thanks to Visa.

-

Throughout the past 30 years, there hasn’t been much of a change in vendor payments. You can automate and increase controls over payments to vendors with Visa digital disbursement solutions.

-

Clients can now reimagine the user experience, product features, and more flexible ways for clients to bank, consumer and small business banking is flitting.

-

Reduced costs and suggestions for the best Visa partners depending on the client’s requirements

-

Payment professionals offer practical assistance and direction to get up and running as soon as possible.

-

Easy integration into the global network of Visa.

-

Via Fintech Express, they offer flexible licensing frameworks through a single point of contact with market expertise and best practices, as well as the advantage of a worldwide network of professionals to aid in scaling.

-

A quick onboarding process with specialized support from them and access to Partners.

-

With the aid of a committed Visa team, one can easily utilize some of Visa’s strongest capabilities and network.

Mastercard

-

With the help of its secure, scalable, and reliable payments network, Mastercard’s Crypto Card Program enables the quick and real-time usage of cryptocurrency for regular transactions at more than 90 million acceptance points worldwide.

-

With unique data, resources, and tools, Mastercard Data & Services equips Fintechs to handle challenging and changing trends.

-

Although deposits have not yet been tokenized, Mastercard is working with banks and merchants to do so. Tokenized assets will be monitored on numerous public and private blockchains.

PayPal

-

Checkouts across devices and channels can be quick and easy with optimized cloud-based processing. The consumers can pay with their preferred payment methods thanks to PayPal, which accepts payments in more than 200 regions and 100 different currencies.

-

Paying swiftly and securely to practically any country in the world in a variety of currencies is made simple and secure by PayPal.

-

59% of consumers have given up on a purchase because PayPal wasn’t available

-

It is all in one platform with endless possibilities.

-

Enterprises benefit from PayPal Commerce Platform’s growth, effectiveness, and security.

-

Aids in boosting conversion rates and lifetime value of customers.

-

Employ solutions for full-funnel conversion, and streamline checkout across all channels.

-

For enterprise firms to weather unpredictability and realize their development potential, they want strategic partners that can provide the ideal combination of knowledge, technology, tools, and data.

-

Derisk your company by utilizing a complete fraud monitoring platform, including services for AI-based risk intelligence and real-time fraud protection. Their fraud systems have the capacity to learn from our network of customers, businesses, and financial institutions as well as from a sizable, proprietary dataset.

-

Use cutting-edge payment technology that is modular, interoperable, and simple to integrate to stay flexible and ahead of trends.

-

Get entry to new markets and clients.

-

Keep up with the complicated regulatory settings and quickly evolving consumer behavior.

-

Boost operational effectiveness- a single platform that supports payments made globally using many currencies and payment methods.

-

37% of customers are more likely to make a purchase when PayPal is present.

Read: Understanding the Basics of Stock Market Trading- An Enigma?

Square

-

Every business owner may now accept credit cards more easily thanks to Square.

-

They provide a full range of business tools and fair loans that provide every qualified company with a dream access to capital. They also assist enterprises to thrive on their own terms, from side hustles to sporting arenas.

-

To streamline how one likes to work and save his time, they easily integrate with hundreds of third-party technologies (and counting).

-

They also provides slick hardware and a user-friendly website which simplifies things.

-

It also has a user-friendly Dashboard gathers all of clients business data in one place, whether he is online, at a physical location, or both. One can have all the information when needed at their fingertips to make wise business decisions and confidently prepare for the future, from real-time reporting to customer contacts.

Coinbase

-

Being the most popular cryptocurrency exchange in the US, CoinBase has become a common entry point for new investors.

-

Founders: Fred Ehrsam and Brian Armstrong- created in 2012

-

An integrated trade network, institutional custody accounts, a retail investment wallet, and a safe US dollar coin are just a few of the many services offered by Coinbase.

-

Since developing its position as a reliable and regulated crypto-exchange, a personal wallet, and new currencies designed to appeal to people seeking additional anonymity.

-

Coinbase has taken the lead in providing cryptocurrency custody services to businesses. The business has excelled as a pioneer in the cryptocurrency sector.

Affirm

-

Created with the modern customer in mind.

-

Because credit cards aren’t functioning, we created Affirm. They entice us with benefits, but they wind up being very expensive: The typical American household owes $6,000 on credit cards.

-

Never pay more than you agreed to up front while using Affirm. Instead, you will always receive a flexible, clear, and practical method of making payments over time.

-

When you have a variety of payment options to select from, it’s simple to get that interview dress or take your ideal trip.

-

With credit cards, your purchase grows more expensive the longer it is left unpaid.

-

With Affirm, you always know exactly how much you’ll owe and when your purchase will be paid off.

-

Their solutions are designed to increase sales and effectively connect with your current technology, whether your primary focus is telesales, in-store transactions, or e-commerce.

-

Give the employees the knowledge and tools they need to sell Affirm over the phone to increase conversion. Clients fill out their applications on desktop or mobile with the bare minimum of information, letting you concentrate on sales while we take care of the rest.

-

The future of retail hinges on a strong omni channel experience as customers take more varied paths during their purchasing experiences.

-

A solution that integrates brick-and-mortar with online and mobile is the path into the contemporary era of retail, from mattresses and furniture to fashion and the biggest retailer in the world.

-

Advantages of in-store, pay-over-time solution with each new merchant.

-

Their team of omnichannel specialists can assist contemporary and legacy businesses in providing a smooth pay-over-time option to the customers via any available sales channel.

Robinhood

-

A fintech firm called Robinhood offers an online platform where one may trade and invest without paying any commissions.

-

In 2013, Vladimir Tenev and Baiju Bhatt launched the business.

-

The organization wants to familiarise and simplify investing for everyone. California, in the United States of America, is home to the company’s headquarters.

Bill.Com

-

Automated control will allow you to scale your AP with confidence.

-

Intended to increase the efficiency of financial processes so you have more time to concentrate on what’s essential

-

BILL integrates with top accounting software, enabling you to streamline your workflow at every stage and reduce manual entry and account reconciliation time.

-

At different stages of development, from the early stages through the IPO, BILL is utilized by different types of software and technology firms. As a result of the variety of business models utilized by the clients we service, including SaaS and pay-as-you-go, BILL is a frequently used platform to support industry growth.

-

The financial systems must be flexible and nimble to support exponential development as software and technology companies provide breakthroughs that upend the market and transform our society.

-

Software and technology businesses employ AP automation because it streamlines AP procedures and boosts efficiency.

-

These businesses are naturally digital and tech-savvy. The majority of AP automation solutions are simple to set up and adaptable to changing requirements in software and technology enterprises.

Chime

-

A growing number of startups are placing bets on the convenience of mobile banking.

-

San Francisco-based Chime, which offers a debit card with no yearly or overdraft fees, has seen an explosion in sales over the past year.

-

A source with knowledge of the subject claims that it will almost certainly reach $200 million in 2019, a fourfold rise from 2018.

-

Chime has attracted 5 million customers, or around 3.3 million users, depending on an annual average of 1.5 accounts per customer. To operate the primary features of Chime, you can pay for a direct deposit.

Upstart

-

One of the first companies to use AI in the multi-trillion dollar credit sector is Upstart.

-

Provides improved loan performance and increase consumer access to credit, Upstart goes beyond the FICO score by utilizing non-traditional characteristics at scale.

-

It has affordable finance which is essential for enabling opportunity and mobility.

-

A leading artificial intelligence (AI) lending platform, Upstart was created to increase access to credit at reasonable rates while lowering the risk and expenses associated with lending for our bank partners.

-

Upstart-powered banks may offer higher approval rates and experience lower default rates* while simultaneously providing the exceptional digital-first lending experience their consumers need by utilizing Upstart’s AI marketplace.

-

Conventional lenders choose who is given credit and at what interest rate using straightforward FICO-based formulas. These “scorecard” systems are easy to use and intuitive, but they can only measure a certain amount of risk.

Ally

-

Its a community for the client’s financial well-being.

-

Ally Corporate Finance provides senior secured loans to private equity-owned, U.S.-based middle market companies. Structuring individual opportunities requires a high level of craftsmanship.

-

These 3 principles drive their strategy – everyday, every deal.

-

As part of Ally Financial, they have access to stable funds that allow us to craft one-of-a-kind lending structures. Our clients depend on our core team’s experience, stability and reputation to provide a steady hand through all stages of each transaction.

Plaid

-

Financial Startup in the USA, Zach Perret and William Hockey are the founders created it in 2013.

-

It has straightforward front-end module which streamlines the onboarding process.

-

It only two or three lines of code to implement. Plaid allows users to move money between their bank accounts and payment applications like Square Cash and personal finance apps like Acorns.

-

Some of their customers include American Express, Venmo, Coinbase, and Betterment.

SoFi

-

Mike Cagney and Dan Macklin are the founders who created it in 2011.

-

SoFi started out as a modest company with just one product, launching a fintech service primarily for student debt refinancing.

-

Although the company now offers a variety of products, refinancing student loans continues to be its major offering.

-

SoFi is a mission-driven company whose goal is to assist its members in making a life.

-

They also create new financial products and services that help consumers borrow, save, purchase, invest, and preserve their money more effectively, achieve financial freedom, and realize their aspirations—including buying a home, contributing to pension plans, paying off student debts, and other goals.

Ripple

-

Arthur Britto, Chris Larsen, and Jed McCaleb founded the company created in 2012.

-

Ripple is a peer-to-peer network (RippleNet) and a provider of digital currency transfers (ripple XRP).

-

The platform itself is a protocol for two-party open-source transactions.

-

On its website, you can trade any type of currency, including air miles, bitcoins, and sterling currencies.

Toast

-

Going digital used to mean getting trapped in high rates and bad contracts. And if you didn’t move online, you were stuck taking orders over the phone.

-

With Toast one can open your virtual storefront on your own terms – without paying expensive commissions to third parties or losing out on essential customer data.

-

To help one can get the most from Toast, we designed services & support resources that work for your time, budget and needs.

-

Online or on-the-go, our Toast customer resources, support, and education tools help you learn or do what you want, when you want, how you want.

Startup Success Rate In the USA

New business statistics reveal that the new startups’ rate diminished in Q4 with over 1.1 million U.S. organizations, then raised again to 1.37 million in the principal quarter of 2021 and afterward to 1.44 million in the second quarter. The level of new companies that flop in their most memorable years in the USA is more than 80%. It implies the achievement rate is around 20%. Among the best instances of American new businesses in 2021 are: SHIFT is a digital coach for remote teams. It helps leaders to connect, evolve their culture, and build effective virtual teams.

-

The honeybee is a FinTech company, that takes care of the financial wellness of employees.

-

Hypeercare is real-time healthcare coordination for medical specialists.

Conclusion

Digital Investment will be the largest part of the market in 2023, with a total transaction value of US$51.04bn. In the Digital Investment segment, the average transaction value per user is expected to reach US$0.92k in 2023. Fintech will continue to be one of the most important things in the future. By 2024 or 2025, more financial transactions will use blockchain, AI, and IoT. Automation and integration will grow more sophisticated. As a result, consumers will have access to more tailored services that better suit their needs. Fintech is a fascinating field to work in right now. It changes all the time to meet the needs of businesses and consumers. Fintech is a good place to work if you like to learn new things and find solutions to problems that affect people’s daily lives. Neo-banking platforms that are only available online (neo-banks), technology-driven insurance (InsurTech), digital lending, and alternative investment platforms are some of the most important trends in the growing market.

In this exclusive blog I have covered the USA fintech unicorns for 2023, a list indeed which is worth scrolling down. Though it might appear insignificant, the 105 unicorns in the United States account for approximately 45% of all fintech unicorns internationally. On top of that the core offerings of the top 15 fintechs have been discussed in detail. The Fintech domain has created a revolution with the help of AI and ML but is still in its infancy stage where it has a long road ahead to shoot at the stars and pat itself!

[To share your insights with us, please write to sghosh@martechseries.com]