MagicCube’s unparalleled software-based security technology gains momentum fueled by worldwide chip shortage

MagicCube, the startup that created the Software Defined Trust (SDT) category, announced today a $15 million round of investments led by Mosaik Partners, with participation of Bold Capital, Epic Ventures, cardreader maker ID Tech, and individual investors in the fintech space. Funds raised in this round will be used to accelerate deployment of the company’s unmatched software-based security solutions aimed at replacing security chips used today as the standard to safely store sensitive data and authenticate whoever needs access to it.

“We are on the verge of a huge paradigm shift when it comes to how we secure data on all kinds of devices, especially the ones used for financial transactions,” said Sam Shawki, MagicCube’s CEO. “The chip shortage that is halting entire industries and hiking device prices has exposed how antiquated the current approach is and how valuable MagicCube’s solution is to tackle this issue—this round reflects that.”

Read More: Bank of Sun Prairie Partners with 360 View to Empower Their Customer Relationship-Focused Culture

MagicCube’s software-based Trusted Execution Environment (sTEE) is the first and only software solution to be recognized by EMVCo—the global consortium in charge of setting interoperability and acceptance standards to secure payment transactions—to deliver comparable levels of protection as hardware-based approaches.

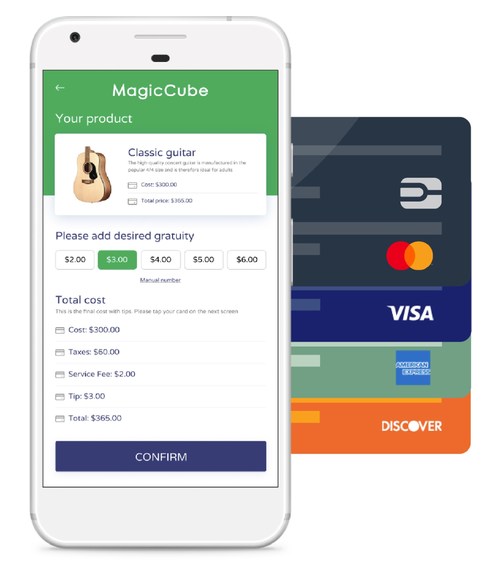

MagicCube’s sTEE is versatile and can be applied in a slew of use cases, to replace hardware secure elements, such as SIM cards, chips used on Internet of Things (IoT) devices like cars and smart home appliances, and even bank-grade Hardware Security Modules (HSM). The company’s first product, i-Accept, was designed to disrupt the more than $70 billion yearly spent by banks & merchants everywhere on point-of-sale card readers.

Read More: Piper Sandler Expands Credit Union Coverage with Addition of Jon Searles

Through i-Accept, acquiring banks and other financial services institutions can enable their merchants and retailers to accept payment cards, contactless transactions, and mobile wallets such as Apple Pay, Google Pay, and Samsung Pay—all at “card present” rates for merchants and without limits on transaction amounts for consumers. MagicCube’s i-Accept can also capture financial PINs and other verification methods, on any mobile device, including phone, tablets, and large smart screens—without the need for dedicated hardware or terminals.

“There is no other company out there, startup or incumbent, that has created a comparable solution to MagicCube’s software-based Trusted Execution Environment,” said Howard Mergelkamp, partner at Mosaik Partners, an enterprise fintech-specialized venture investing firm. “This tech can support mobile and IoT devices with a platform that is easy to integrate and not bound by device makers or specific use cases—this is unheard of on the current landscape.”

Funds raised in this round will be used to expand MagicCube’s sales and customer delivery teams, as well as accelerate new product development aimed at serving some of the industries affected by the chip shortage, such as crypto wallets, cloud and in-car security, and more.

Read More: Abra Launches Token-Based Rewards Program for Customers Powered by Crypto Perx (CPRX)

[To share your insights with us, please write to sghosh@martechseries.com ]