Artificial Intelligence – you either love it or you hate it; but either way you can’t ignore it. In so many ways, AI is neither Artificial nor is it Intelligent. Instead, it is a technology that is based on pattern recognition, something that as humans we have used for millennia to survive. The main difference is that this pattern recognition is supported by the explosive growth in computing processing power, which means we have the capability to recognise patterns far quicker than humans could hope to achieve by themselves. As a technology, it is primed full of both opportunities (and threats) for the Mining industry and full of expectations; perhaps even inflated expectations, a point that the great teams at Gartner Research highlight.

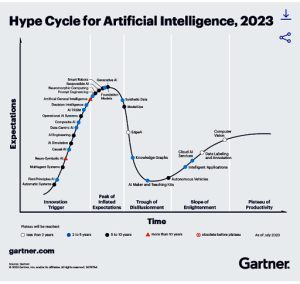

In August 2023, Gartner Research released its annual Hype Cycle on AI as an emerging technology. Their excellent visual reports review so many technologies to show where the expectations of new technologies meet their execution and adoption. As can be seen, Gartner suggests Generative AI has reached its high point in the hype cycle – the peak of inflated expectations. Typically the next stage of technology adoption slides down the steep curve into the Trough of disillusionment as collectively we question how effective the emerging technology really is. The global leading players in the mining industry have perhaps shown the market their own thoughts.

In August 2023, Gartner Research released its annual Hype Cycle on AI as an emerging technology. Their excellent visual reports review so many technologies to show where the expectations of new technologies meet their execution and adoption. As can be seen, Gartner suggests Generative AI has reached its high point in the hype cycle – the peak of inflated expectations. Typically the next stage of technology adoption slides down the steep curve into the Trough of disillusionment as collectively we question how effective the emerging technology really is. The global leading players in the mining industry have perhaps shown the market their own thoughts.

Global Data’s October 2023 report “Mining: Filings Trends & Signals Q3 2023” highlights that in the third quarter of 2023, there was a 60% reduction in the mention of Artificial Intelligence in the mining industry’s company filings compared to the previous quarter. Perhaps the slide into the trough of disillusionment has already begun. So where does this leave the mining industry and AI-based technologies?

Read More about Fintech : What Are The Fintech Lending Benefits?

In this article, I want to explore with you :

- How AI works in practice – all in plain English

- The source of AI’s inflated expectations,

- How AI is being sold as a result of these inflated expectations, and

- To go under the hood of AI to help you understand whether AI is right for you, what to look out for, and

- How AI can be part of the solution to business problems you may be facing.

At the same time, I want to explore with you how there are groundbreaking opportunities for the mining industry to embrace by combining proven AI with existing financial technologies associated with digital transformation. This combination has the potential to generate significant productivity benefits, a reduction in compliance issues, and a reduction in the vulnerability to fraud.

-

What Is Generative AI (In Plain English)?

You will probably have already heard of the key applications, such as ChatGPT and Midjourney. These apps are specifically designed to generate original text and image-based content solely based on the text inputs that you use to prompt the applications. If you have used these applications, already, congratulations, you are now officially a prompt engineer. These are just the tip of a very deep AI-based iceberg that can produce audio, code, simulations, videos, and so much more. These all have the potential to be game-changing, generating productivity benefits, but also highly disruptive for knowledge workers. As the technology continues to develop and improve applications have the potential to significantly alter the way you communicate both internally and externally within your mining business.

-

How Do AI Systems Work in Practice (In Plain English)?

AI systems learn by working with the data that they analyse. To do so they need data – and lots of it. This data is used to pick up on regular patterns that appear. These patterns are then stored and used to train the software to more effectively evaluate a set of potential matches from the next set of data. This could be images, text or other digital files.

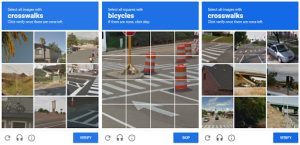

Take, for example, the reCAPTCHA images Google so often uses as a security mechanism to defeat automated bots online. These are those small tests where you have to identify street signs, cars, or bicycles in a series of pictures before you can progress. Each time we choose these objects correctly, it’s not just a security check – we’re actually helping to train Google’s AI.

Google is (quietly) open about how it wants its reCapture to help improve Google Maps. You can imagine these images could also be used to help train self-driving cars to recognise crosswalks, traffic signs, or bicycles. Every time we click on an image with a stop sign, for example, we provide a correct example for the AI to learn from. The AI observes the choices of multiple images that millions of people make when identifying stop signs. The AI starts to notice patterns – the octagonal shape, the red colour, the white letters – that define a stop sign. Each reCAPTCHA we solve is like a mini-lesson for the AI. With enough training with these reCAPTCHA tests, the AI gets better at spotting stop signs, which will be crucial for the accuracy and safety of AI-driven cars.

Google is (quietly) open about how it wants its reCapture to help improve Google Maps. You can imagine these images could also be used to help train self-driving cars to recognise crosswalks, traffic signs, or bicycles. Every time we click on an image with a stop sign, for example, we provide a correct example for the AI to learn from. The AI observes the choices of multiple images that millions of people make when identifying stop signs. The AI starts to notice patterns – the octagonal shape, the red colour, the white letters – that define a stop sign. Each reCAPTCHA we solve is like a mini-lesson for the AI. With enough training with these reCAPTCHA tests, the AI gets better at spotting stop signs, which will be crucial for the accuracy and safety of AI-driven cars.

Using similar methodologies, AI-based algorithms have been created for mining exploration, specifically to locate mineral deposits in undeveloped, greenfield locations. Additionally, drones are being used for autonomous drilling, effectively reducing costs. For larger and more intricate exploration sites, 3D mapping technology has been developed to provide detailed visual representation and mapping.

At an operational and financial level, at SpendConsole, for over three years, we have trained our AI model to work with our Optical Character Recognition (OCR) software to recognise millions of different supplier invoices, in different formats. We have meticulously trained our AI model to identify the likely location of key data required by internal ERP systems. We are delighted to say that our AI-powered OCR now automatically picks up over 98% of data from submitted supplier invoices, with our models having the flexibility to allow our clients to train the models further. (By the way, watch out for the latest buzzword creeping into the AI space – enhanced OCR recognition is just starting to be called Intelligent Character Recognition (ICR))

The Explosive Growth Of AI

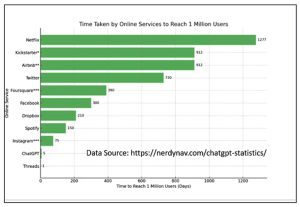

When ChatGPT first launched, it was very significant. Developed by OpenAI, this AI-driven chatbot set new benchmarks for the speed of technology adoption globally. To put this into perspective, let’s consider the historical growth rates of some of the most influential technologies and platforms. When ChatGPT launched in November 2022 it reached 1 million users in just five days; Facebook took 300 days to reach 1 million users.

Within 2 months, Chat GPT had 100 million+ users.

Within 2 months, Chat GPT had 100 million+ users.

It is not surprising, therefore, that with these explosive growth figures in the general media, mining companies have woken up to see the potential for this new landscape of AI opportunities.

-

Expectations Versus the Reality of AI

Sadly, the expectations of AI are far higher than their reality. The media and popular culture so often portray AI as a technology that is capable of human-like understanding and decision-making that can even surpass human intelligence. These portrayals often lead to the belief that AI can solve complex problems effortlessly, make autonomous decisions, and learn independently with little or no human intervention.

In reality, AI has limitations. AI systems are highly specialised and perform well when there are specific tasks for which they have been trained. They do, however, lack the general understanding and adaptability of humans. They can’t comprehend context or information outside of the set of data for which they were trained. This means their learning processes require extensive data and human input for ongoing training and fine-tuning.

AI’s capabilities in reality are impressive but narrower than often expected. They do, however, excel in data analysis, pattern recognition, and the automation of repetitive tasks.

-

Selling Ideas, Not Products – the Rise in Vapourware

Whenever hype overshadows reality, Vapourware appears. This is where technology companies announce a product with great fanfare but either never release it, or release it with significantly reduced functionality. Given that Generative AI is at the peak of inflated expectations, for those in the mining industry considering AI, it is critical to ensure that the reality matches your expectations. It is only when you undertake your due diligence that you may discover upon closer examination that many AI-powered solutions turn out to be underdeveloped, lacking in the promised features, or at worse non-existent.

This situation is further compounded by the complex nature of AI technology, which can be difficult for non-experts to evaluate. Without a deep understanding of AI and Machine Learning, it can be challenging to differentiate between genuine innovation and overhyped vapourware.

At SpendConsole, we are delighted to say that we have been working hard with AI for over three years – prior to the technology becoming a super-hyped trend. We have put in the hard yards to train our models in very specific areas of supplier invoice management and reconciliation so that we automate the collection and reconciliation of supplier invoice data with back-end ERP systems. Our AI works silently in the background as we automate the validation of supplier invoice line items against approved purchase orders, contracts, and suppliers. We are delighted to say that all our hard work has paid off, as we have recently welcomed ASX-listed Macmahon Holdings as a client. They have a very complex international mining services business that needed an intuitive tool that simplified its business processes and roles. Our proven AI is at the heart of our solution for them.

The Yin and the Yang of AI

Like so many emerging technologies, AI has its own strengths, which are inextricably linked to its weaknesses. AI’s capabilities bring a plethora of benefits, yet they also have drawbacks that mirror those benefits.

AI models such as ChatGPT have the potential as a productivity tool to generate early-stage content efficiently and creatively. This capability offers the rapid, scalable, and cost-effective prototyping of content. On the flip side, this same efficiency makes AI a powerful tool for bad actors. The ease with which AI can now produce convincing and personalised fraudulent communications is concerning and elevates the risks of scams and misinformation. For example, scammers can send very professional-looking phishing emails to your Accounts Payables teams requesting fraudulent payments. As the technology grows, exposure to these types of scams is likely to get worse.

As CEO of SpendConsole, I was on a recent panel at the Fintech Summit in Sydney where we explored the challenges around AI and Financial Services. We explored the issue of the cloning of audio, where a limited audio file, e.g., your CEO’s voice could be used to produce a fake voice file. This could be communicated to your Accounts Payables teams placing a fake request for a rapid payment for a new supplier. Naturally, it is the offline intelligence of your teams or of your existing workflows and processes that should act as the first line of defence to identify any underlying transactions that are likely to be fraudulent. Sadly, for so many organisations, especially those with international suppliers, there are so many processes that are manual, meaning fake transactions can still get through. This has the potential to create reputational risk, which no one wishes to face.

The challenge is that the efficiency of AI technology is only heading in one direction and is going to get even better at creating more sophisticated scams. As a result, many banks are now carefully re-assessing their security measures in regard to voice confirmations.

In essence, every leap forward with AI will bring its own shadow of caution. Balancing the Yin and Yang of AI involves recognising these challenges and proactively managing them with enhanced digital processes to harness AI’s full potential while at the same time mitigating its risks. Combining AI and traditional Financial Technologies can be extremely enticing to combat these new challenges.

-

How AI And Fintech Can Be Extremely Powerful for Digital Transformation When Working Together

The synergy between AI and Financial Technology presents a powerhouse in the context of digital transformation. AI can scrutinise financial transactions and customer data with unparalleled precision and speed. While AI is exceptional at analysing data and highlighting exceptions, it is the digital workflows that help organisations deal with those exceptions. It is this collaboration that goes on under the hood between AI and many standard technologies associated with Fintech that is a critical feature in any streamlined, digitally transformed business processes.

Within the SpendConsole platform, for example, we have absorbed 20 years of marketplace experience to develop an AI-powered, robust platform that effortlessly transforms Accounts Payables. Enhanced digital processes and workflows help mitigate the risks associated with exceptions. As highlighted earlier, our AI-powered OCR software can accurately pinpoint data in 98% of supplier invoice submissions from your suppliers. This data is then intelligently matched (2-way and 3-way) against purchase orders, contracts and receipts data directly within backend ERP systems. Equally, any new supplier uses the self-service supplier management portal (all under your control of course) that has automatic compliance processes supplier built in to confirm any required regulatory and tax compliance against your own business rules. In this way, any data from fake supplier invoices and fake supplier details would be flagged as exceptions for further investigation. Not only does the AI act as your silent watchdog over your payables, highlighting exceptions to appropriate stakeholders, but it also reduces your supplier invoice cycle times. We have Enterprise and Government clients who have reduced their supplier invoice cycle times for approval from 17 days to hours.

Within the SpendConsole platform, for example, we have absorbed 20 years of marketplace experience to develop an AI-powered, robust platform that effortlessly transforms Accounts Payables. Enhanced digital processes and workflows help mitigate the risks associated with exceptions. As highlighted earlier, our AI-powered OCR software can accurately pinpoint data in 98% of supplier invoice submissions from your suppliers. This data is then intelligently matched (2-way and 3-way) against purchase orders, contracts and receipts data directly within backend ERP systems. Equally, any new supplier uses the self-service supplier management portal (all under your control of course) that has automatic compliance processes supplier built in to confirm any required regulatory and tax compliance against your own business rules. In this way, any data from fake supplier invoices and fake supplier details would be flagged as exceptions for further investigation. Not only does the AI act as your silent watchdog over your payables, highlighting exceptions to appropriate stakeholders, but it also reduces your supplier invoice cycle times. We have Enterprise and Government clients who have reduced their supplier invoice cycle times for approval from 17 days to hours.

When AI is incorporated into your digital workflows, it has the power to enhance the robustness of your digital procedures. It is AI and traditional digitised workflows working together in perfect harmony.

Conclusion

In conclusion, AI has great potential to drive significant change. It is, however, still emerging, and its hype can be overstated against the reality of its power in the marketplace. It is important to recognise that if the AI solves a business problem that you need to solve, then it is worth considering further. With any due diligence, ensure the product you are considering is also ready for your needs – Vapourware won’t generate the ROIs you need within your Digital Transformation programs.

Finally, play to AI’s strengths in its ability to analyse data sets efficiently, but make sure your existing processes are sufficiently robust so that they have the ability to catch the exceptions that the AI will throw your way.

Latest Fintech Insights : How Does Fintech Makes Money?

[To share your insights with us, please write to pghosh@itechseries.com ]