Introduction

Processing a wide variety of financial data is at the heart of fintech. Data from multiple sources can be brought together in one place with the help of a unified data architecture. This allows for in-depth analysis and strategic decision-making that takes into account all available information. It reduces the inaccuracies, inefficiencies, and lack of actionability that come from having disparate data sources within a single system.

Understanding the many kinds of database systems out there and their benefits and drawbacks is crucial. When it comes to processing information, there is no universally applicable method.

Fintech : Global Fintech Interview with Luz Mabel del Valle, Chief Risk Officer at FV Bank

Are You Aware of the Trends in the Fintech Industry?

SaaS for various types of reporting, including those related to risk management, identification, and analytics using machine learning, is becoming increasingly popular in the financial technology sector. A further development in the fintech sector is an emphasis on data management.

According to a recent research by Forbes Insights, 83% of CEOs believe that better data management will help their organization boost customer service and profits.

The intersection of these two trends—providing SaaS and bettering data management—is currently a hotbed of activity and opportunity in the fintech sector.

Top News: Visa Cross-Border Solutions

How to Leverage Data Analytics for Fintech Success?

Data analytics is used in various ways by fintech companies to better their services. The ability to customize services is a major advantage of using data analytics in Fintech. Financial technology firms can better address the needs of their diverse clientele by researching their purchasing habits and preferences.

A personal finance management FinTech firm, for instance, may employ data analytics to examine a client’s spending patterns. The business is able to find ways for its consumers to save money by analyzing their purchase habits and other data points, such as recommending that they cancel unused subscription services or switch to a cheaper utility provider.

In the financial sector, data analytics is also employed to lessen the impact of potential disasters. For instance, data analytics is used by fintech lending firms to determine an applicant’s creditworthiness. Lenders can assess the probability of loan repayment by reviewing information such as a borrower’s credit score, income, and employment history.

Read More: Circle and Grab Pilot Web3 Experiences in Singapore

Data analytics is also used by FinTech firms to spot untapped business niches. Fintech companies may fill voids in the industry by evaluating customer behavior and trend data to determine where the market needs improvement.

A Fintech firm may see a shift in consumer preference for more adaptable and hassle-free savings options, for instance. The business might then create a smartphone app that helps people save money by letting them schedule regular contributions and monitor their savings.

Why Is Data Analytics Important in Fintech?

- As a first and foremost benefit, it helps businesses develop customer-specific offerings. In order to better serve their clients, Fintech firms analyze customer data to better understand their wants and needs.

- Companies in the FinTech industry can benefit from better risk management thanks to data analytics.

- Fintech lenders can mitigate their risk of bad debt and other losses by using data to assess borrowers’ creditworthiness and other risk indicators.

- Data analytics in Fintech also helps with detecting fraud.

- Digital payment service providers and other financial technology firms are prime targets for scammers.

- Companies can protect their clients’ assets against fraud by employing data analytics to detect trends of fraudulent conduct.

Exploring the Challenges of Data Analytics in Fintech

There are various ways in which data analytics may help Fintech businesses, but there are also some obstacles to overcome.

- The sheer volume of data that needs to be processed and analyzed is one of the biggest obstacles. The ability to manage and analyze massive amounts of data is critical for fintech organizations.

- Data privacy and security are also major issues in the banking sector. There needs to be a way for fintech companies to acquire and analyze data without compromising their consumers’ privacy and security.

- A further difficulty of data analytics in Fintech is the scarcity of appropriately trained personnel to handle the data once it has been collected.

- Data scientists, analysts, and other specialists able to effectively evaluate and understand data are essential to the success of any fintech company.

Conclusion

In conclusion, Fintech businesses can take advantage of new market prospects with the aid of data analytics. Companies can learn where there is a need for new products and services by monitoring consumer behavior and market trends. The company’s expansion and financial success may benefit from this.

Latest Fintech Interview : Global Fintech Interview with Jane Thomason, Web3.0 Leader at World Metaverse Council

Data management and ensuring adequate compliance become increasingly critical in the present context as FinTechs continue to employ ecosystem digitization methods, innovative data and analytics methodologies, and multi-organization alliances to expand and provide targeted services.

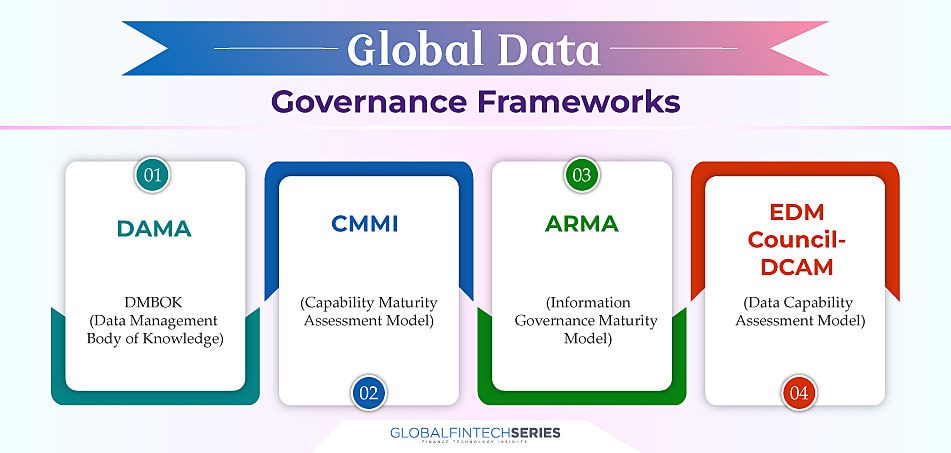

By adopting a strong corporate DG framework, FinTechs can meet the evolving data needs of their businesses and regulators while protecting customer information. Therefore, it is crucial and urgent to establish a reliable FinTech data ecosystem.

[To share your insights with us, please write to pghosh@itechseries.com ]