Insurtech is the era of new technologies that are continuously transforming the insurance industry, minimizing costs for its clients and insurance companies, thereby improving efficiency, and providing its customer with a new level of satisfaction.

Understanding Insurtech

Insurtech is built on the belief that the insurance industry is mature for such innovation and disruption. Insurtech is currently in a stage of exploration that large insurance firms have less incentive to exploit, such as offering ultra-customized policies, social insurance, and using new spheres of data from Internet-enabled devices to serve better to its clients. As far as traditional insurance is concerned, people might pay more than they should depending on their intellectual level and understanding of such markets. Among other things, insurtech is looking to tackle this data and analysis issue head-on. Using inputs from all manners of devices, this sphere allows its products to be priced more competitively. Besides better pricing models, insurtech startups are testing their luck on a pool of potential game-changers. It consists of deep learning (DL), and artificial intelligence (AI) to find the right array of policies to complete an individual’s demand. It also helps to disparate policies into one platform for monitoring and creating on-demand insurance for micro-events like borrowing an acquaintance’s car, and the adoption of the peer-to-peer model to create customized group coverage and incentivize positive options and selection through group rebates.

How Did Insurtech Market Bloom?

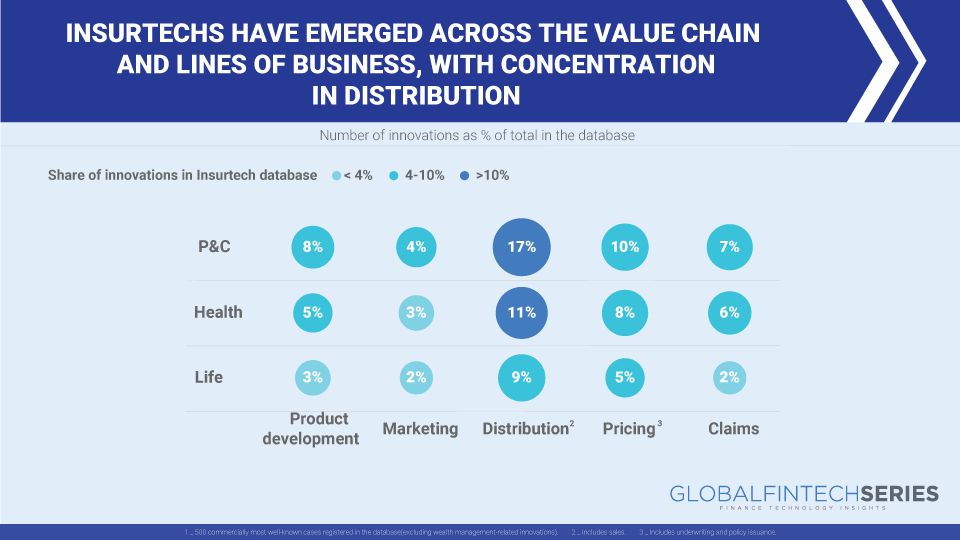

In the last decade, insurtechs have come up wonderfully in the insurance fintech space. Investments have taken their wings to fly. The Asia-Pacific region represents just 14% of the insurtechs, however, is supposed to be the quickest developing locale for this space. Insurtechs are profoundly dynamic for all protection items and business lines, with fixations in the P&C business and the showcasing and dissemination region of the worth chain, as we can see in Exhibit 1.

Read More: Understanding the Basics of Stock Market Trading- An Enigma?

Read More: Understanding the Basics of Stock Market Trading- An Enigma?

How Insurtech Has Transformed The Industry?

The retail sector receives the majority of the attention from insurtechs, accounting for 75% of their activity, with the remaining 25% migrating into the commercial sector. Similar to how insurtechs in personal lines have innovated their product offerings, commercial lines have done the same, frequently focusing on the small- and medium-sized business market. Examples of these innovations include peer-to-peer and digital brokerage. Yet, loss mitigation and effectiveness are also top priorities for commercial lines insurance (e.g., drone inspection for underwriting and claims). Technology like telematics and the Internet of Things have made it possible to produce new products in the automobile, home, and health industries that increase customer satisfaction and retention. Clients have been attracted by insurtechs using selective discounts based on risk-reducing habits and the junction of smart devices.

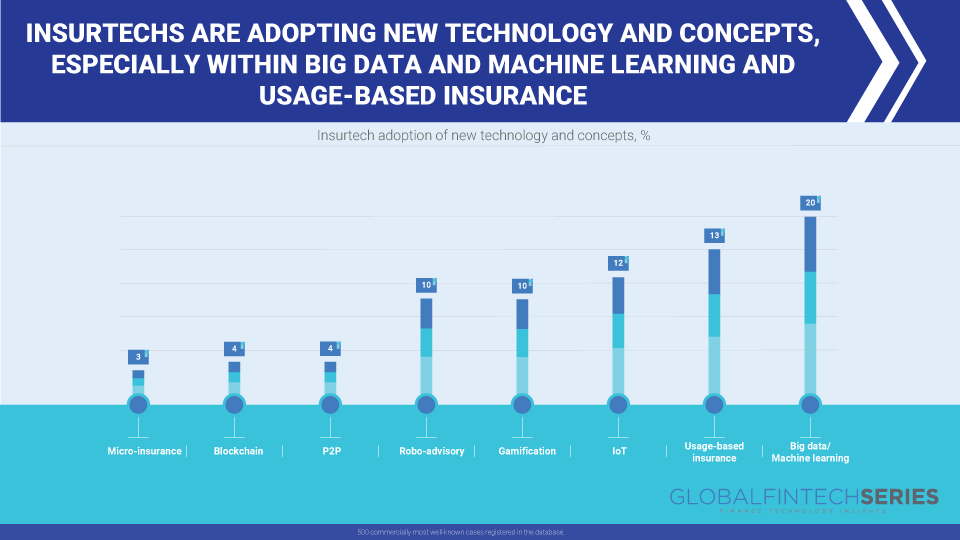

We have them everywhere, just to mention a few: car mileage or calorie counters, or in-home flood and fire detectors that automatically call for help. These initiatives draw on the achievements of aggregators like comparethemarket.com or confused.com, 21st-century financial services pioneers and current market leaders in digital insurance. This is seen in Exhibit 2 below.

Insurtech has affected virtually every section of the insurance business, igniting the advancement of less complex items and consumer services. It has been most noticeable in the individual insurance world, where clients confronting telephone applications, auto observing gadgets, and wearable movement following devices have permitted customers to find new advantages from their insurance. Insurtech organizations have started developments in business insurance too, permitting entrepreneurs to search for various sorts of insurance with one application, saving time and energy. With InsureTech, entrepreneurs can complete an application to look at insurance quotes from top carriers in only a couple of minutes. Insurtech likewise has been effective in making guaranteeing (assessing and estimating chances), claims to handle, and resource the executives more proficient for insurance experts.

Importance Of Insurtech

-

It helps in enhancing their client experience by leveraging technology where their customers are more engaged in understanding their needs to get personalized service. Instead of traveling to a branch physically or speaking on a call to a representative, the future of insurtech is moving towards self-serve, online dealings where customers have their choice of engagement channel.

-

It promotes efficiency as policy-seekers and policy-holders can easily do research using the internet and apps. Without having to wait for working hours or the availability of a representative now the insurtech companies are empowering users to quickly access any information they need without being bogged down in processes.

-

Insurtech emphasizes individuality. Due to the innovative features of information searching and data processing, many new tools are also now available to customize the user experience. This not only improves pricing but delivers more reliable and consistent coverage.

-

It improves flexibility since modern insurtech services are more customized, short-term or transferable plans. Instead of locking into long-term arrangements, insurtech is more likely to give individuals customized coverage for the client’s needs.

-

Insurtech decreases fraud to some extent by leveraging data, analytics, trend analysis, and ML, they can detect fraudulent activities. In addition, big data may also be able to discover potential loopholes that insurers can seek to close to avoid exploitation.

Insurtech Barriers

The fundamental hindrance to insurtech is the issue of privacy. Distributed ledger innovation is a shared database across numerous associations and locales, used to monitor FICO ratings. It is continually changing, which postures issues for data protection laws. International jurisdiction privacy concerns are likewise an issue for controllers who have different ways to deal with distributed ledger technology management. Because of its collaborative nature, distributed ledger innovation might be decentralized, This makes it a challenge to completely integrate into insurtech. Associations that are keen on this innovation ought to investigate the vital legitimate angles appropriate to their organization and ward. Another solution is to stay in steady touch with controllers to remain updated on global regulations.

Read: What Is Machine Learning?