Today’s customers want the speed and convenience of digital services combined with the empathy and trust of their finance or bank relationship manager. Now especially during the pandemic, financial services customers are demanding more authentic engagement with their financial advisors, bankers, and mortgage consultants. How can fintechs and FIs keep pace with the right tech? Clara Shih, CEO and Founder at Hearsay Systems shares a few thoughts and talks about Hearsay Systems’ latest partnership with Salesforce in this interview.

______

Can you tell us a little about yourself Clara? How did the idea of Hearsay Systems come about and what are some of the innovations you are working on for the near-future?

Sure! My family immigrated to America from Hong Kong when I was four. I grew up in Akron and Chicago, then came out west to attend Stanford. It was a magical time. Google was still a venture-backed startup. I got a job there and became enamored with technology. After Google, I wanted B2B experience and joined Salesforce.com in 2006, where I helped launch the AppExchange, their marketplace for partner apps. Right away, I noticed that enterprise software seemed outdated and inefficient compared to consumer apps. In my personal life, I was using Facebook every day to keep in touch with my friends from college— it was easy and enjoyable to use. Yet in the enterprise, we were still asking highly skilled knowledge workers to do manual data entry.

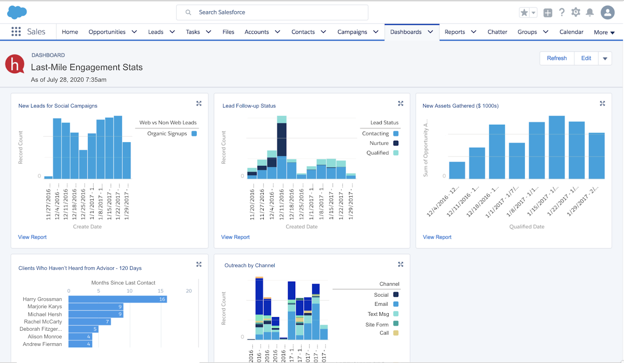

I realized there was an opportunity to create a new category around Social Selling and in 2009 co-founded Hearsay to help relationship sellers succeed using digital engagement and analytics. Today, as the pandemic makes personalized digital outreach more important than ever, Hearsay has expanded into a human-first client engagement platform that allows advisors to authentically and intelligently grow their relationships. We help firms like Morgan Stanley, Ameriprise, and U.S. Bank proactively guide and capture the last mile of their bankers and advisors’ digital communications— from social media interactions and web lead forms to compliant text messaging and mobile call logs— to deliver a human client experience at scale.

The “next normal” we are witnessing is continued acceleration of customers’ digital expectations and enterprise digital transformation. Nowhere is this more evident than in the “last-mile” between trusted advisors and their clients. It’s precisely during these moments of economic uncertainty that sales reps from advisors, mortgage consultants, and insurance agents at financial services companies need to connect quickly, easily, and compliantly with clients. Since the start of the pandemic, Hearsay has seen a 300% spike in client engagement activity across our platform, including a 50% surge in texting volume between advisors and clients.

On the one hand, clients need more help and guidance than ever before from high-empathy, trusted expert relationship managers. At the same time, advisors are having to rethink and reinvent service and engagement models that used to rely on conventional in-person meetings. As a result, we’re seeing a new engagement model emerge – one that is human-first, proactive, and also digital engagement. It’s no longer either-or; it’s human and digital.

Read More: GlobalFintechSeries Interview with Gerard Griffin, CEO at AnyDay

We’d love to hear about your latest partnership with Salesforce and how this will enable sales efforts/customer relationships at financial institutions?

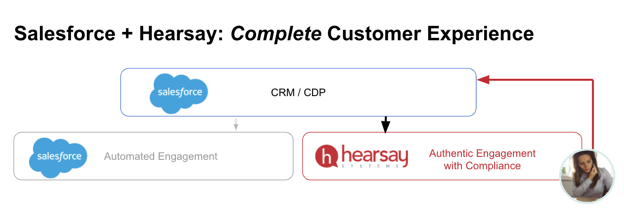

We’re connecting our system of engagement to our customers’ CRM systems of record, helping our customers orchestrate best practices and prescribe the right outreach at scale to deliver specific outcomes, like growing new business and share of wallet, retaining clients and preventing churn, and driving efficiency in repeatable processes. A few weeks ago, we announced a strategic partnership and investment from Salesforce, providing compliant social selling, text messaging, and advisor websites for their financial services customers.

Of course, in financial services, everything starts with compliance. Now, through our partnership with Salesforce, Hearsay is providing compliance at scale to enable firms to deliver a rich human-client experience across digital channels and helps Salesforce unlock a “last mile of value” for customers in regulated industries. When you think about a customer’s experience with a bank or insurer, there are automated communications and there are personal, authentic touchpoints. What we are doing with Salesforce is bringing together these two pieces to deliver a complete customer experience across all touchpoints, all in one cohesive system and experience. And, connecting Hearsay to Salesforce allows advisor activities to be captured in Salesforce CRM, providing visibility for corporate distribution leaders. These integrations result in up to 10X volume of last-mile activities captured in CRM, providing critical context to inform next best actions.

What according to you are some of the biggest lags you still see in digital communications run by financial institutions and what are your top tips for them – how can they use the right tech to help them with these?

The first phase of digital for banks and insurers was automated engagement – mobile apps and push notifications, email automation, chatbots. Now, especially in the pandemic, financial services customers are demanding authentic engagement with their financial advisors, bankers, and mortgage consultants. These automated digital tools are necessary table stakes, but not differentiators. Customers never switch banks because there is a better chatbot. Chatbots are commodities. In wealth management, commercial banking, and insurance in particular, over 70% of the client experience is actually through the advisor or relationship manager. So if you have invested only in digital marketing and service automation but neglected the advisor, you are missing a big chunk of the experience.

The reality is today’s customers want the speed and convenience of digital combined with the empathy and trust of their relationship manager. We see the biggest next opportunity in the “human last-mile” – empowering the authentic engagement to take place between a trusted relationship manager and her client. Especially in the last five months, the relationship has proven to be really important, valuable, and special. It’s only in the last mile that clients feel comfortable sharing the important changes happening in their lives. And in turn these critical field-level interactions enrich the table stakes investments like CRM and CDP, offering stronger product integrations and more actionable data insights. That’s why the real people that we serve are the bankers and financial advisors who are in what we call the ‘last mile’.

With Hearsay and Salesforce, the world’s leading financial services firms can deliver a complete client experience across both automated (Marketing Cloud) and authentic, compliant last-mile (Hearsay) engagement channels.

How according to you can financial tech companies / financial institutions specifically use text messaging effectively during this downtime to build stronger customer relationships?

Based on our product usage analytics, it is anything but “downtime” these days. We’re seeing advisors working around the clock to keep up with demands for their time– clients texting advisors because they are worried about retirement portfolios or paying off a mortgage, clients who have lost their job or had an elderly parent check into the emergency room for COVID. Clients are craving immediate and proactive communications, faster response, and more high-empathy touch points from their advisors.

This constraint in advisor capacity versus demand threatens the client experience. Advisors need help, and they need scalable tools to authentically connect with their entire book of business. Social media and texting offer a scalable, digital, and proactive means for advisors to reach their client base to reassure, reengage, and restore confidence. There is an unbelievable opportunity in this moment to take advantage of a more captive, focused audience, and engage with even clients who in the past were too busy to want to talk or think about legacy planning.

In our socially distant world, advisors must expand to multiple digital channels – inviting clients to text with them, connect on social media, and log into client portals– and clients in turn are more open to these new modes of engagement than before. With the extreme demands on their time, advisors are employing texting as an efficient means of checking in and staying in touch. Analyzing texts sent and received on Hearsay Relate, our compliant texting solution, we see that advisors’ texts are responded to by clients and prospects on average in less than 4 minutes. According to the wireless industry association CTIA, the average response time for a text message is 60 times faster than for an email. And with Hearsay’s tools, texts can be delegated and managed by team members, saving more time for advisors to focus on higher value-added activities such as advising on clients’ financial plans.

Ultimately, the key for relationship managers is to be proactive. This means reaching out first, even if just to let clients and prospects know they are available and that they care. Advisors can deepen their relationships by being more timely in your communications – providing thought leadership and insights, and relevant information on a regular basis (leverage everything your firm provides), and augmenting that with personalized 1-to-1 check ins.

What are some of the near-futures innovations you foresee transforming how financial services / fintech as a service will evolve over the years; and with this evolution how can their marketing and sales keep up better?

Most banks and financial firms don’t suffer from lack of technology; on the contrary, there are too many different apps, tech stacks, and data silos, resulting in wasted dollars and low adoption. The greatest next innovation is not more features and functionality, but rather smart integrations and consolidation of technology platforms. We are seeing this in response to our partnership with Salesforce– customers want to bring their CRM to life with Hearsay’s digital engagement layer. This trend will not only continue but expand – firms are evaluating new technologies only if they connect within their existing ecosystem. They are also looking to embed solutions to drive tighter integration to drive higher advisor adoption, more streamlined workflows, and ultimately better client experience.

Before we wrap up, would you like to share specific finance management or business tips for Marketing and Sales or Finance teams struggling through this uncertain time due to the Covid-19 pandemic?

Financial services is an essential business– whether it’s commercial banking, wealth management, home lending, or insurance, financial services enable dreams to be pursued and achieved, and businesses and families to survive difficult times. The uncertainty in the world means that more than ever, financial firms need to put customers first, to play the long game, and see the opportunity to win customers’ loyalty for life.

Of course, this is easy to say and hard to do. Most banks and financial firms were not created as customer-first organizations. They are still product-first, profit-first, or compliance-first. Here’s where we can all learn from Amazon, whose approach is known as “working backwards” from the ideal customer end state. Amazon business and product leaders usually start with writing an aspirational forward-looking press release announcing their finished product. The press release is written for the end-customer and describes the problem, how current solutions are failing, and why the new product will solve the problem. Amazon knows that you can have the smartest employees and best products, but none of that matters if you don’t deliver the last mile in a way that delights the customer. The last mile is where most companies fall down (and why Amazon is beating them), and represents an enormous opportunity right now for those leaders willing to truly shift to becoming customer-first and customer-obsessed.

Uncertainty favors the proactive – there is a huge opportunity to be there for clients now when it really matters. This is the time to build trust and connection– a chance to discuss new goals and plans. But you have to be proactive, empathetic, and authentic. I think Andy Sied, CEO of Merrill Lynch Wealth Management sums it perfectly, “With advisors reaching out to clients through calls, emails, texts and social media, we’ve seen client satisfaction levels with their advisor rise to all-time highs.” Now is the time to deepen human relationships with your customers!

Hearsay Systems offers the Hearsay Advisor Cloud for financial services, empowering advisors to efficiently and compliantly use social media, websites, text and email to engage with customers, build stronger relationships and grow their business. Its prescriptive technology processes and prioritizes data from across digital channels and data systems, providing actionable suggestions for advisors on how they should engage with clients next.