IntroLend, the first-of-its-kind, broker-owned digital lending platform, is challenging and transforming the housing industry. This breakthrough mortgage model and technology enables brokers and agents to unite home buying and finance under one trusted roof.

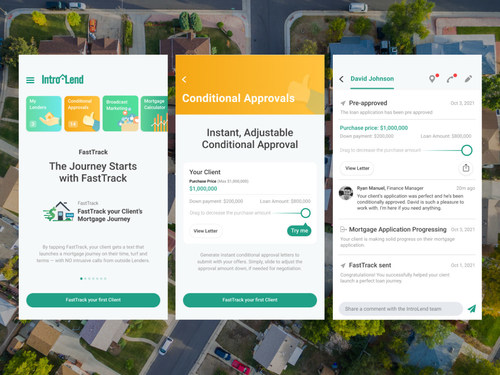

IntroLend is installed inside a successful real estate brokerage and allows agents to launch their client’s digital mortgage journey with just a few taps on their IntroLend agent mobile app. This sets in motion a rapid loan pre-approval and leads to competitive mortgage bids from an industry-leading network of wholesale and retail lenders.

Read More: Financial Services are Experiencing Massive Adoption in the Philippines Through GCash

“IntroLend is a digital mortgage platform powered by three differentiating technological features; a professional easy to use mobile experience, a consumer digital application, as well as a Loan Operating System (LOS),” said Dave Zitting, CLO of Avenu Technologies, Inc..”Our platform works with all stakeholders in real-time, and we are ecstatic to launch this technology that actually works with agents, not against them.”

This robust mobile app connects the entire mortgage marketplace — borrowers, agents, loan originators and lenders — holistically. It is the only lending platform that allows consumers to shop both wholesale and retail lending options, ensuring that borrowers get the most competitive loan rates and terms. Moreover, each borrower works with a dedicated licensed loan originator, called a Finance Manager, who is co-located inside the agent’s brokerage. Their Finance Manager stands ready to advise and assist with every step of the mortgage journey, from application to lender selection through closing.

Read More: DeFi Enabled, Enterprise Grade Hybrid Blockchain, XDC Network, Gains Compliance Edge

“Our technology empowers agents and homebuyers to transact with greater ease and control,” said Marc Diana, CEO of Avenu Technologies, Inc. “We’ve combined advanced technology with white-glove service to provide the ultimate customer-centric mortgage experience. And we must be doing something right, because we’ve attracted many of the nation’s top brokerages including high-performing REMAX, Keller Williams, and Better Homes & Gardens offices as early partners.”

IntroLend is also transforming the monetization model for real estate agents at these brokerages. For those who qualify, agent-investors can participate in mortgage origination service profits through its RESPA-compliant structure.

[To share your insights with us, please write to sghosh@martechseries.com ]