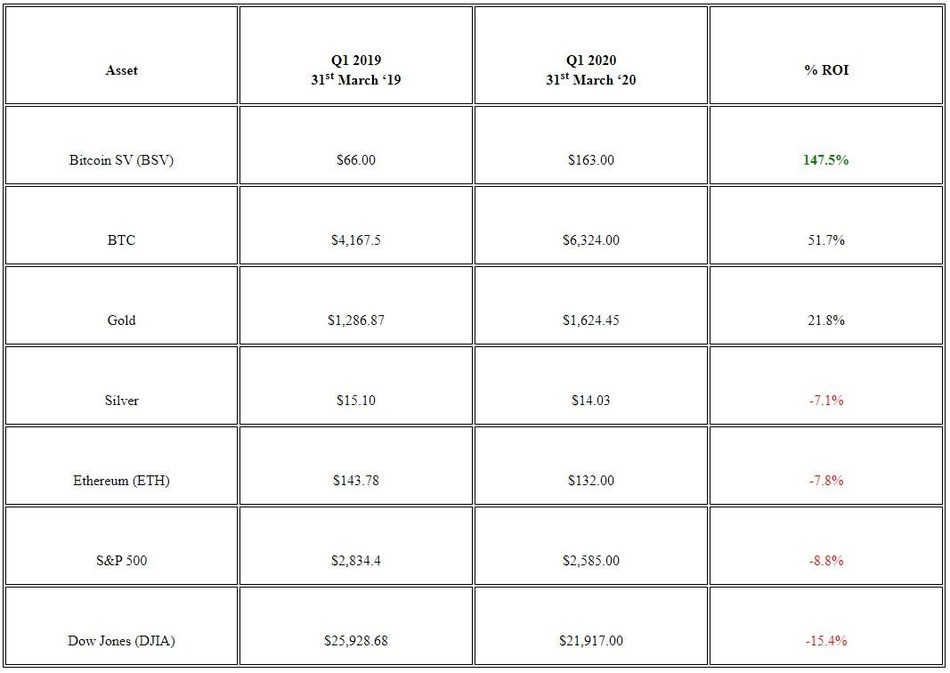

As we close off the opening quarter of 2020, we review the results of the past 12 months in the financial markets across different asset classes ranging from stocks, precious metals and digital currencies.

All of these assets share a common goal to provide individuals with a means to have a store of value that can preserve and increase wealth.

Read More: Remitly Partners With Alipay to Offer International Remittances

Infographic – https://mma.prnewswire.com/media/1141587/Bitcoin_SV_Infographic.jpg

Source: www.tradingview.com

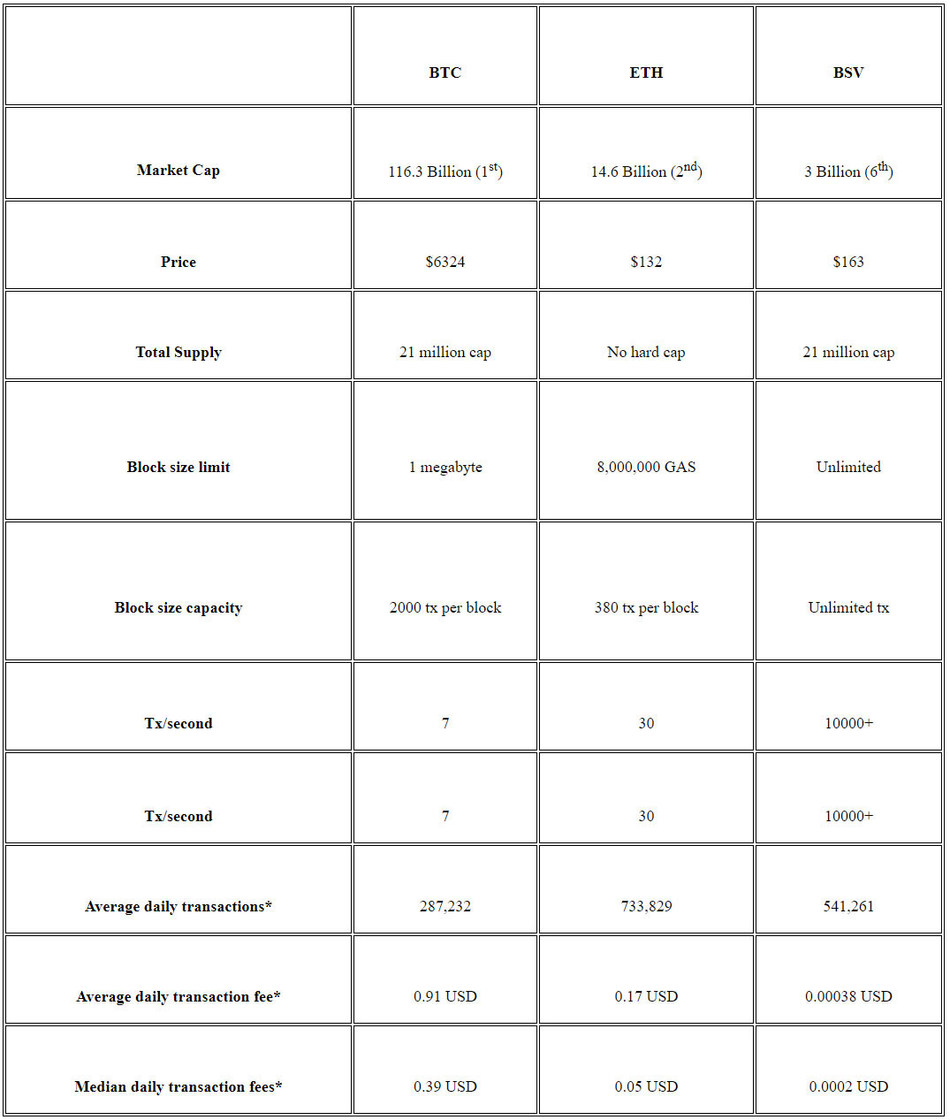

By far the performing asset over the past 12 months was Bitcoin SV (BSV), which saw a +147.50% increase in its value—nearly three times the amount of BTC and seven times the return of a universal safe haven gold. Ethereum (ETH), which has the second largest market cap in the digital asset industry, actually regressed -7.8% in value.

Read More: WorldRemit Partners with Wizall Money to Launch its First Mobile Money Transfer Service to Senegal

The S&P 500 and DJIA who continued to ride the biggest bull run in stock market history in the recent month had a decline to experience negative yields overall. It didn’t make a difference though as it still fell short against BSV overall by a very large margin of over +150%. This disproves the theory that all digital assets are correlated with traditional markets, however this may still ring true for digital currencies that are speculative in nature only and have no intrinsic value like BTC and ETH.

Read More: Celsius Network and Prime Trust partner to secure depositors funds and offer low-cost credit