LendingTree surveyed Americans to understand how they’re preparing for the coronavirus pandemic

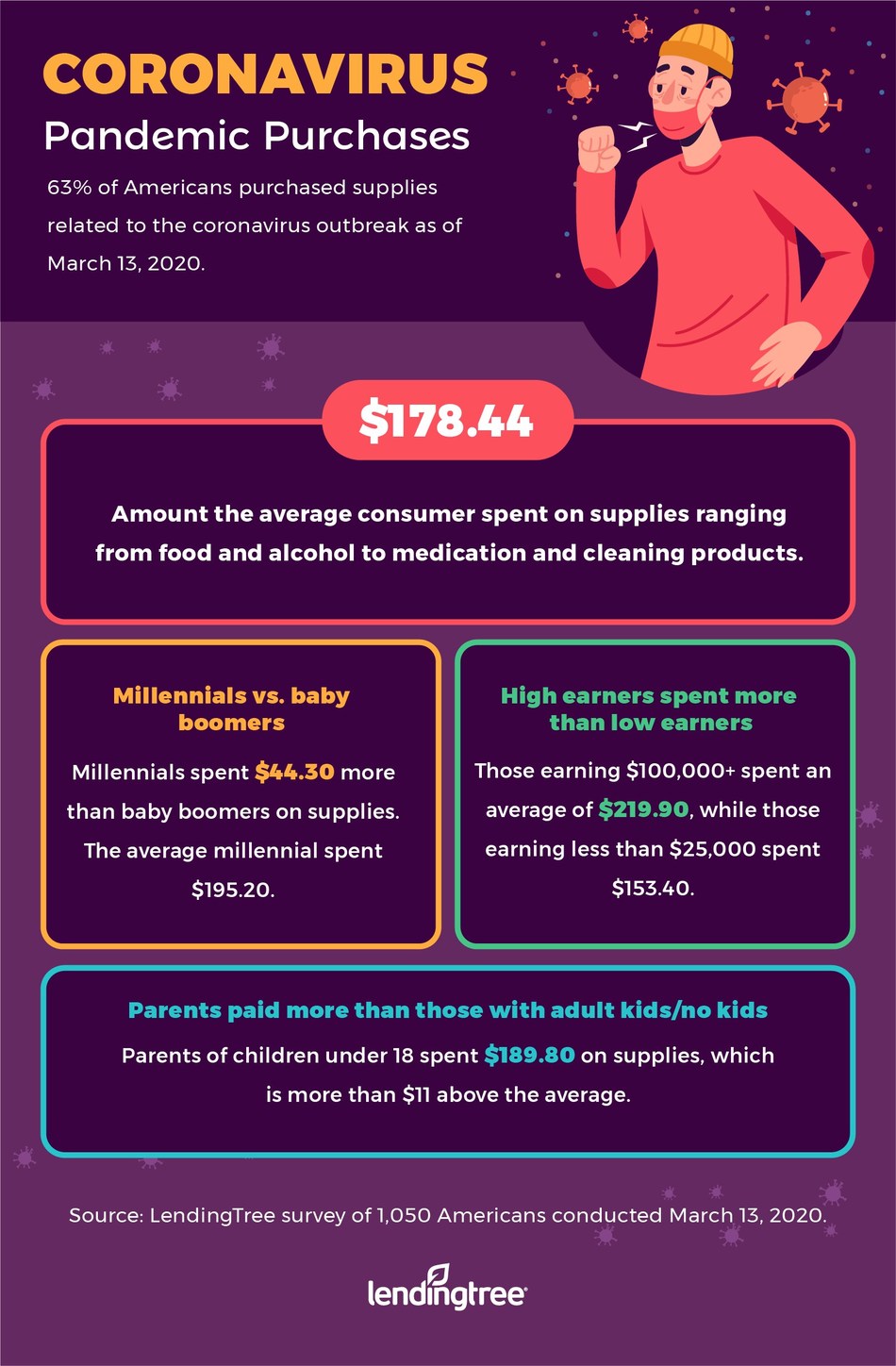

LendingTree, the nation’s leading online loan marketplace, released its study capturing how Americans are preparing for the coronavirus. The survey found that 63 percent of Americans purchased supplies related to the coronavirus outbreak, spending on average $178.44.

Read More: GlobalFintechSeries Interview with Tim Kelly, CEO & Founder at BitOoda

Key findings

- 63% of Americans purchased supplies in preparation of the coronavirus (as of March 13, 2020)

- The average consumer spent $178.44 on supplies, ranging from food and alcohol to medication and cleaning products

- The most popular pandemic purchases among those who stockpiled are cleaning products, food, and paper products such as toilet paper

- Parents of children under 18 spent $189.80 on supplies, which is more than $11 above the average

- Higher earners, those earning $100,00 or more, spent an average $219.90 on supplies

Matt Schulz, Chief Industry Analyst at Compare Cards, adds, “For most people, the financial margin for error is tiny, so this outbreak has the potential to cause a real money crunch for many Americans. If you’re concerned about being able to pay your credit card bills, call your issuer and tell them. You won’t be the first person to do so, and these are unprecedented times.”

Read More: Asia’s First Compliant Crypto Fund Has Emerged — Circle Fund

Many card issuers have programs to offer temporary relief to cardholders who are hit hard by disasters, and the coronavirus outbreak certainly fits that bill. Banks’ offerings will vary, but they can include: temporary APR reductions, waived late fees, extended payment deadlines, credit limit increases and more. In times of crisis, these changes can make a real difference, so it’s undoubtedly worth your time to make the call if your financial life has been upended.

Obviously, everyone’s primary focus should be on protecting your health and that of those around you. However, if you’re healthy and wondering what to do while social distancing, consider using this time at home to dive into your finances. This could be a good time to make that first budget, check your online statements, request your credit reports or even just learn something new about money.”