Embeding banking solutions are the crux of modern FinTech innovation. As many as 80% of the Fintech leaders in Europe are unable to distinguish between embedded banking and BaaS products. For these respondents, both Fintech terminologies mean one and the same thing. How does it impact the Fintech market? Well, the blurry line of distinction between BaaS products and Embedded Banking have led FinTech organizations to lose almost $11m per year in product delays by BaaS providers. The latest research from Aite-Novarica Group, commissioned by ClearBank, revealed the scope of current BaaS platforms and how fintechs are embracing Embedded Banking to improve their Fintech positioning in the market. 40% of the fintech companies saw services go down, 33% have lost customers, and 20% have faced intervention by the regulator due to BaaS issues. Despite industry confusion, 25% of fintechs are interested in moving from a BaaS to Embedded Banking provider to address these issues. There is a serious lag in understanding and the performance of BaaS providers.

Recommended: Global Fintech Interview with Ketan Patel, CEO at Mswipe Technologies

Aite-Novarica Group announced the launch of a new study, commissioned by ClearBank, that reveals one in five fintechs are losing $11m per year in product delays due to BaaS (Banking-as-a-Service) providers. According to the report “Confusion, cost, and compliance: The bifurcation of BaaS and Embedded Banking”, Baas providers are simply lagging when it comes to meeting Fintech’s expectations. This seriously impacts Fintechs GTM strategies, revenue pipelines and customer experience management goals. More so, BaaS providers are also lagging in terms of Fintech’s ever-growing compliance and regulatory demands. This is forcing fintechs to sway towards Embedded Banking providers, who are better at handling these demands with superior agility in terms of IT and Cloud computing preparedness.

At the time of this announcement, Enrico Camerinelli, Strategic Advisor at Aite-Novarica Group said –

“The term BaaS is loosely defined, and often confused with another fast-growing term: Embedded Banking.”

Enrico added, “Why does this matter? As fintechs look to deliver customer facing benefits and reduce their regulatory burden there is a clear difference between the two. Embedded Banking not only allows fintechs to embed licensed services directly into the user experience, it also embeds the mechanisms that automatically control regulatory compliance – rather than shift this responsibility onto the fintech as is the case with many BaaS providers.”

FinTech Analysis: Four Steps to Embedded Finance Success

So, how much money do Fintechs lose, on an average, due to ill-performing BaaS providers?

- $13.7 million, due to disruption in services

- $16.4 million, due to poor customer services and the rising volume of complaints

- $10.9 million, due to delay in a product launch

- $430k, due to revenue loss

- $710k, due to customer loss

- $690k, due to unforeseen cost inflation

Here’s an overview of what the report on BaaS versus Embedded banking found;

Speed to market, new services, and compliance are driving BaaS

- BaaS today is a ubiquitous tool utilized by 82% of fintechs, with BaaS-related services representing, on average, 45% of a fintech’s overall revenue stream.

- Accelerating time to market and adding services (60%) are the primary drivers of BaaS adoption.

- A third of respondents (33%) cited regulatory scrutiny as an emergent driver.

- While the initial investments into BaaS were driven by technology and capability, they are increasingly being driven by regulatory demands.

BaaS is primarily used for payments and accounts, but more complex demands are emerging

- 76% of fintechs identified domestic accounts and payments as primary BaaS uses. A further 59% of respondents identified FX conversion services.

- In the next two years, fintechs are looking to offer more complex BaaS capabilities including:

o Investments (56%)

o Crypto services (50%)

o Wealth management (38%)

- Today BaaS is primarily used for payments and accounts, but fintechs are looking to BaaS providers to enable them to offer more complex services in the future.

Market needs are evolving beyond BaaS due to complexity and compliance

- 73% of fintechs said the primary benefit of working with a BaaS provider was boosting internal capabilities, largely operational, vs. only 27% who cited customer-facing benefits.

- When we asked respondents what are the top three macro issues that will guide their future use of a BaaS provider they indicated:

o Speeding up time to market (44%)

o Accelerating growth (44%)

o Revenue driving services (50%)

- These priorities speak to a shift from internal to customer-facing capabilities for fintech, which can only be supplied by Embedded Banking providers.

As fintech priorities shift towards investments, crypto, and wealth management, BaaS aggregators and EMI license holders will be incapable of directly managing the governance processes and stringent regulatory controls associated with these services.

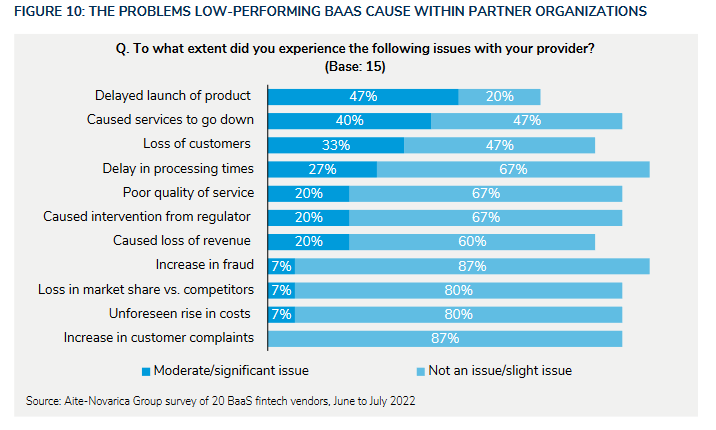

Lost revenue, increased costs, and regulatory intervention for fintechs due to BaaS issues

- 47% of fintechs experienced product delays which resulted in an average of $10,900,000 in missed revenue annually due to poor BaaS performance.

- 7% encountered unforeseen cost rises to the tune of $690,000 annually.

- 40% saw services go down and 33% have lost customers.

- 20% of fintechs have faced regulatory intervention due to their BaaS partner.

Fintechs are leaving BaaS providers and embracing Embedded Banking

- 31% of fintechs have changed their BaaS provider and 23% are currently planning to.

- 25% of fintechs said they will be using an Embedded Banking provider in the future – despite confusion in the market between the two categories

“The next two years will see a clear separation between BaaS and Embedded Banking providers as the market bifurcates,” concludes Camerinelli.

“Many BaaS and Embedded Finance offerings are no longer meeting the needs of their customers. They don’t offer the precision customers are demanding, and they can make it unclear what protections are in place to keep consumer funds safe,” said John Salter, Chief Customer Officer, ClearBank.

John added, “There must be a change to provide fintechs with the level of service they require and ensure account holders are aware what type of safety their money is afforded. We commissioned this research to better understand the state of the BaaS and Embedded Finance market, and how it can be improved. As a result, we’ve revealed some crucial issues and uncovered an appetite across European fintechs to move towards a new category, namely Embedded Banking.”

Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts.

ClearBank is a purpose-built, technology-enabled clearing bank. Through its banking license and intelligent, robust technology solutions, ClearBank enables its partners to offer real-time payment and innovative banking services to their customers.

Aite-Novarica Group interviewed 20 major fintechs in the UK and Europe with at least 50 employees and average annual revenues of $25m between June and September 2022. BaaS is defined as the distribution of regulated banking products by distributors, often aggregators, which may be licensed or non-licensed. Whereas Embedded Banking is defined as the integration of banking services only by a bank-licensed provider directly into the experience of the end user. The research aims to unpack the growing market confusion between BaaS and Embedded Banking, the benefits and disadvantages of working with a BaaS provider, and establish the appetite and motivations to move to Embedded Banking.

In an evolving market, Fintech players would give a partner at least 18 months to shape up with the market demands before splitting! However, 1/4th of the respondents don’t stretch the pain of working with lagging BaaS player beyond 6 months. Another 1/4th may take up to 2 years to decide on the future of relationship with BaaS before switching to an embedded banking platform provider. The losses kick in, in millions, by the time Fintechs decide to make a change in their vendor. For Fintech looking to grow their portfolio of new-banking and crypto offerings, going full-throttle on Embedded Banking technology could serve positively in the near future, particularly if the customers are targeting better compliance and risk-taking opportunities with superior pricing models from their BaaS providers.

So, are you setting up for embedded banking in 2023?

[To share your insights with us, please write to us at sghosh@martechseries.com]