Making a budget might take a lot of time. Newbies to budgeting might feel overburdened or unclear of where to begin. The right budgeting apps can help you with that. With the aid of budgeting applications, you may simplify your money management and strengthen your financial situation as well. Choosing the best budgeting software might be challenging because there are so many options available today in the market. The top budgeting apps for 2023 have been chosen after careful evaluation of the most downloaded applications from the iOS App Store and Google Play.

Do budgeting apps work?

Apps for personal finance and budgeting are wonderful for keeping track of your finances, but they function best if you’re reasonably tech-savvy and frequently use a debit or credit card for transactions. Those who frequently spend cash may find it tiresome to manually enter transactions into the program.

The Top 5 Budget Apps for 2023

- Mint is the top free budgeting app.

- PocketGuard is the best app for simple budgeting.

- Personal Capital is the best budgeting app for increasing wealth.

- Goodbudget is the best budgeting programme based on the envelope concept.

- Overall, You Need a Budget is the best (YNAB)

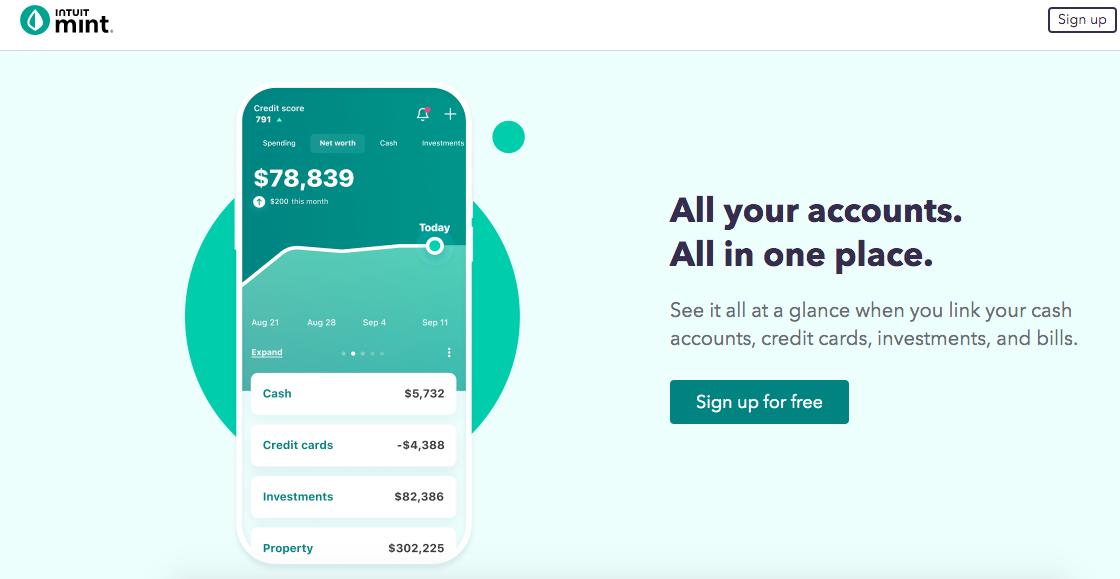

Mint is the best free budgeting app.

With Mint, you can access all of your financial accounts in one streamlined interface, including loans, credit cards, investments, and bank and savings accounts. With this all-in-one budgeting tool, you can create and track financial objectives like emergency savings and debt repayment while also keeping an eye on your cash flow. In addition to providing tools (such as a loan payback calculator) and a blog with plenty of budgeting advice, Mint can assist you in setting and monitoring your financial objectives. In addition to alerting you to upcoming obligations and letting you check your account balances with a thorough breakdown across all of your accounts, Mint also lets you view your cash-to-debt ratio. Also, you’ll receive tailored warnings when you go over budget, pay ATM fees, and more to help you achieve your financial objectives more quickly.

Latest Read: A Closer Look At Integrated Document Management And Accounts Payable Software

Latest Read: A Closer Look At Integrated Document Management And Accounts Payable Software

Pros:

Set financial targets and monitor your investments.

Reminders for payments

TransUnion credit monitoring is free.

Cons:

Advertising while using the app

Cost: Free

Platforms: Browser, iOS, and Android

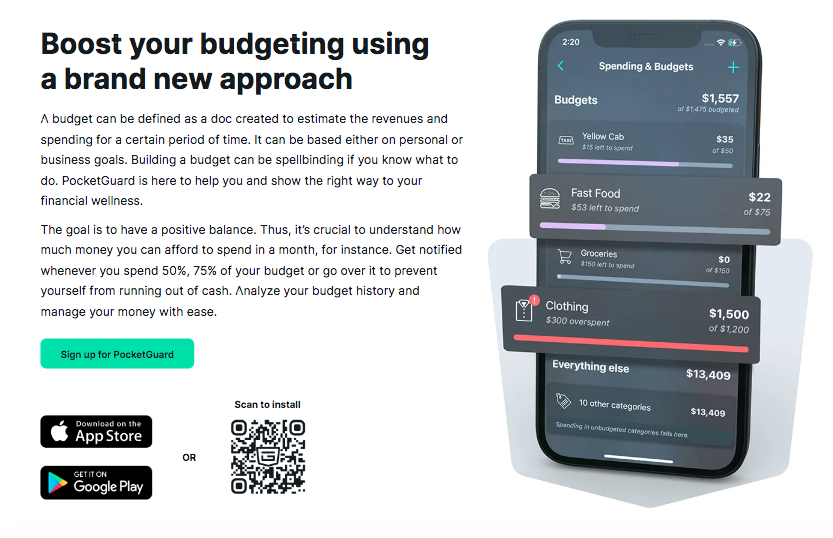

Easy Budgeting App of Preference: PocketGuard

All of your financial accounts are connected by PocketGuard, allowing you to keep track of all transactions and balances in one location. To quickly track your spending, the app lets you use hashtags to group expenses together. If you have a tendency to overspend, PocketGuard shows you exactly how much money you’ll have each month left over after paying your bills, achieving your savings objectives, and making purchases for groceries and other needs. Feel as though your bill-paying expenses are too high? When you may pay less for a service (such as cell phone service), PocketGuard notifies you and assists you in negotiating a discount with the provider. The app’s pie charts, which clearly display where your money is going and provide you with the tools you need to set financial goals, are ideal if you learn best visually.

Pros:

Pros:

The “In My Pocket” function displays your available funds for daily, discretionary spending.

To assist with saving objectives, the AutoSave feature transfers money from a linked bank account to a custodial account that pays no interest.

Cons:

takes a 40% cut of any savings made through negotiating cable, cellular, and other bill costs.

Cost: The basic plan is free; PocketGuard Plus costs $34.99 per year or $4.99 per month.

Platforms: Browser, iOS, and Android

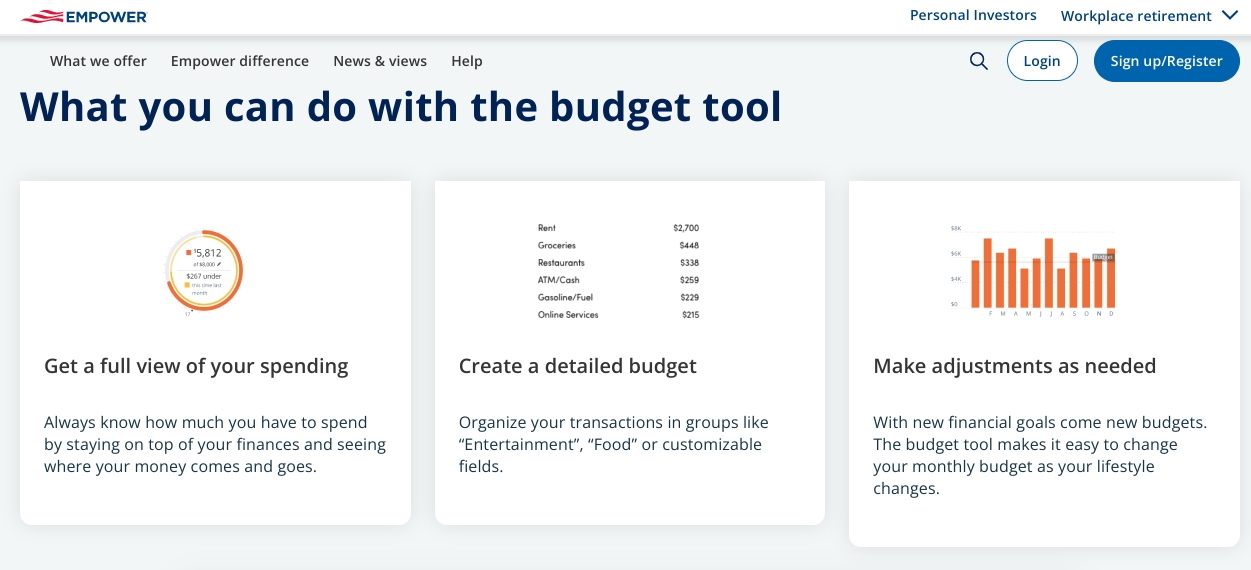

Personal Capital is the best budgeting app for increasing wealth.

Personal Capital is a thorough budgeting and investing programme with an emphasis on assisting you in increasing your wealth. For a thorough overview of your money, sync all of your bank accounts, including your investment portfolios (such as IRA and 401k). Although you can’t set particular goals using the programme (like conserving money), you may add a budget, assess your spending by category, and contrast your financial condition with that of previous months. With the Education Planner tool to help with college savings and the Retirement Planner, the Personal Capital app gives excellent tools to get ready for the future. For accounts under $1 million, the app also provides investment management services for 0.89% of your investment capital.

Pros:

Your investment portfolio’s details are included in the money-tracking dashboard’s net worth tracker.

Education and retirement planning

Free portfolio fee analysis software

Cons:

Not as extensive as investing aspects are the budgeting features

Cost: Free

Platforms: Browser, iOS, and Android

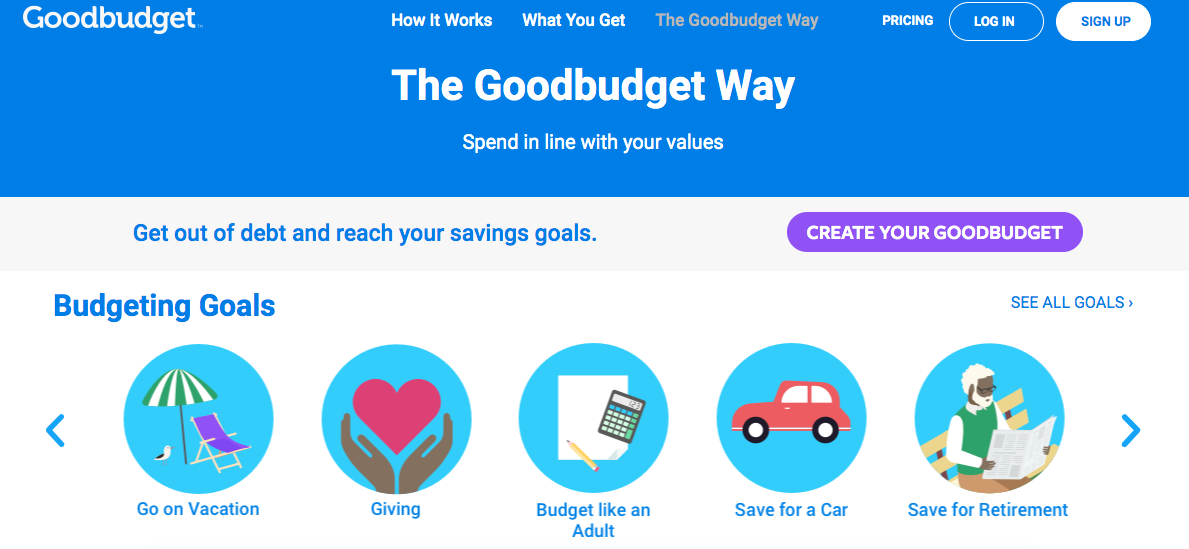

Goodbudget is the best budgeting program based on the envelope concept.

The envelope budgeting approach has a digital version called Goodbudget. The envelope technique basically entails dividing your monthly revenue into several spending categories (envelopes) in order to keep you within your budget for each category. For each envelope category, including mortgage, food, entertainment, and more, you enter your budget using Goodbudget. With the free version, you can create up to 10 envelopes; with the paid version, you may create an unlimited number. You must manually enter each purchase and spend because the app does not connect to your bank or credit card accounts. This software is very useful for visual learners because it provides detailed visual reports. The program also has helpful functions for tracking debt payback, budget sharing with a partner, and savings.

Pros:

Pros:

Attractive, simple-to-understand imagery

Save time by quickly adding recurring payments to the app.

The tried-and-true envelope budgeting system has been updated.

Cons:

Financial accounts cannot be synced; costs must be entered manually.

Cost: Basic plan is free. Goodbudget Plus costs $7 per month or $60 per year.

Platforms: Browser, iOS, and Android

You Need a Budget is the best overall budgeting app (YNAB)

One of the top budgeting apps is without a doubt You Need a Budget (YNAB). This extensive program is packed with beneficial features that will allow you to sync your bank and credit card accounts and track every dollar spent. The debt relief app YNAB claims the typical user saves $600 in the first two months of using the program. Every dollar you earn is allocated to a category, such as savings, investments, bills, or debt repayment, according to the zero-based budgeting method. With YNAB, you must actively manage your money allocation in order to gain control over your finances and achieve your financial objectives.

Pros:

Personal customer service and live Q&As every day Educational materials, such as a blog, budgeting manuals, and more than 100 free classes each week

assists customers in actively allocating and monitoring every dollar to increase financial literacy.

Cons:

a longer learning curve and more time investment than other budgeting apps

Cost: Free trial for 34 days; $14.99 per month or $98.99 per year

Platforms: Apple Watch, iOS, Android, Browser, and Alexa

Latest Read: 10 Of The Best Stock Market Podcasts