This blog compiles what is trust in banking and how reliable is it for all of us as a layman. Are banks really necessary or we can manage without banks if trust is being betrayed? Let us have a brief look on the pillars of trust in the banking system along with 10 live examples of the big banking logos covered in here.

Summary

- Introduction

- The five cornerstones of establishing credibility in the financial sector

- Exclusive industry insights

- Components of Trust

- 10 Live Examples from the banking industry

- Measuring and Tracking Trust

- How to build trust the right way and keep it that way

- Tech to improve results above and below the surface

- Conclusion

Introduction

A network of trust underpins the financial system. In fact, the Middle French phrase for belief or trust is where the word “credit” got its etymology. When it comes to customers’ choice of banks, trust comes out on top above almost every other criterion, including cost and level of service.

The costs of these precautions may be little, but they are far surpassed by the advantages of trust on both a micro and global level. For instance, a return transport of financial assets using the famous stagecoaches of Wells Fargo cost more than $23,500.

According to estimates, a 10 % rise in the proportion of trusting citizens within a country boosts yearly GDP development by almost 0.5 %. Additionally, in a globalized society, the advantages of trust transcend national boundaries. According to research, a one-standard-deviation rise in trust is positively correlated with a 90–150% improvement in bilateral commerce. And in the case of banking, these advantages are in addition to the direct effects of rules like Basel III, where it is projected that the net advantages are overwhelmingly advantageous to society.

Why am I bringing this up?

The idea of “trustlessness” serves as the central theme of a narrative that goes along with some of the rising streams of financial innovation. This is often promoted as a better and more effective model than the current banking system since it enables people to deal in a quasi-pseudonymous way and replaces trust with automated verification procedures. In this environment, saying “Trust me, I’m a coder” is nearly a mantra.

While some may find such a vision intriguing philosophically, it falls short of delivering the stability, gravity, and social advantages that come from laws, oversight, and the rule of law. In essence, a trustless financial system would need society to put its trust in a complicated collection of codes and models, which we know from experience may be prone to mistakes and model risk.

Furthermore, as financial technology develops, the operational and cyber resilience of banks are exposed to growing dangers. A breach in these areas may erode the foundation of banking confidence. The operational resilience principles developed by the Committee and completed last year are meant to increase banks’ capacity to endure operational risk-related occurrences that could result in substantial operational failures or significant market disruptions. I firmly advise member countries and institutions to go forward with putting these ideas into practice.

Read the latest article: 10 Best Applications Of AI In Banking

I assume that few people would want to deposit their money in a banking system devoid of any regulatory and supervisory protections, just as few would be ready to board an airplane that does not adhere to regulatory requirements and that has not been examined by certified supervisors.

You may have noticed that I’ve been using the word “banking” rather than “banks” throughout this paragraph. It is the degree to which entities that offer banking services are subject to relevant regulatory and supervisory requirements that counts when it comes to protecting public faith in banking, not so much the individual firms involved.

For this reason, rather than Bank Supervision, I preside over the Basel Committee on Banking Supervision. And this is the reason the Basel framework was created in a manner that allows authorities to choose the proper area of application with a reasonable amount of flexibility. It will be crucial for authorities to keep reviewing the proper breadth of the regulatory perimeter and the kind of rules to apply as new banking channels, services, and competitors continue to emerge.

The goal of this work, which has to be undertaken on both a national and international scale, is to guarantee that activities with the same hazards are governed by the same laws. In fact, the Committee’s Core principles for effective banking supervision incorporate this idea. Additionally, the Committee’s most recent high-level considerations on proportionality give authorities looking to implement the Basel framework for various institution types in a way that is proportionate and does not jeopardize financial stability or the safety of financial institutions another tool.

The five cornerstones of establishing credibility in the financial sector

- Security

It is typical to hear about data security lapses or hacking incidents that may swiftly destroy whatever confidence a financial institution has created with its clients. The security and dependability of the digital technology used by banks must be ensured. Building confidence in digital financial services depends on cybersecurity.

- “Human” interactions

Despite technological advances, there are certain circumstances when human contacts are necessary. People are trustworthy. Although technology may be utilized to enhance experiences, engagement, brand satisfaction, and loyalty depend on the human element. Financial institutions need to provide a human-like quality to engagements because customers still want to talk to reliable professionals, whether it be via online content or a chatbot.

- Personalization

The consumer now expects a different kind of experience and a higher degree of personalization from their financial services partner as a result of the expansion of digital services. Personalization at scale is now feasible because of technologies like machine learning, AI, and cloud computing. By offering customized and relevant suggestions, insights, and nudges that improve their ability to manage their money, banks may delight their clients. The consumer must be at the core of digital strategies in order to establish trust, and data should be leveraged to give relevant and beneficial information depending on the customers’ demands.

- Excellent client experiences

Building client loyalty and trust in financial services is crucial. Eliminating friction points, simplifying services, and offering effective procedures that meet customer requests, lower customer drop-off rates, and boost engagement are all part of creating smooth customer journeys. The experience should be consistent and on-brand whether making a transaction online or contacting the financial institution via social media.

- Radical transparency

Trust is created through openness. Customers may make wise financial choices and build confidence in the bank by receiving all the pertinent and required information about the goods and services that are accessible to them. Banks should be honest with their consumers and avoid using deceptive messaging and marketing, and not simply because they are afraid of the authorities. Customers may feel confident in their choice and know they can trust their bank by being open and honest about the Terms & Conditions.

Read: A Global Map Of Cryptocurrency Regulations

The success of a bank depends on trust. It affects a bank’s bottom line directly and may boost loyalty and engagement. Customers should have faith that their financial services provider will provide them the goods and services they really need. In order to provide excellent customer experiences, secure long-term loyalty, and establish and maintain trust, banks need to understand their customers’ motivations and habits.

Components of Trust

Admittedly, it is difficult to precisely describe consumer trust in the banking system, as the general public may have different concerns in mind when asked about their level of trust in financial organisations. Research has indicated that a customer’s trust in a financial institution is affected by a number of factors, including the institution’s competency, goodwill, integrity, and transparency.

When talking about a financial institution’s competence, it’s important to consider their track record of providing reliable services, their responsiveness to consumer concerns, and the measures they take to keep sensitive information safe. Goodwill can be defined as the degree to which the financial institution is attentive to and concerned with the well-being of its clients.

Financial institutions with high levels of integrity do not commit fraud on their customers and do not abuse their personal data in any way. The term “transparency” can be used to describe the extent to which a financial institution helps its consumers understand the features and potential drawbacks of the products and services it offers.

Read More: How Does Visa Generate Money From International Transactions?

Measuring and Tracking Trust

Surveys may be designed to either directly measure trust (e.g., rank level of trust from 1–5) or indirectly, by inferring trust from reported behaviors (e.g., closing a bank account, switching financial institutions).

It may also be helpful to distinguish between broad-scope trust (trust in the financial system as a whole) and narrow-scope trust (trust in one’s own financial institution) when attempting to measure the public’s trust in financial institutions, as well as to identify the various drivers that influence the public’s level of trust. According to the study, there are four factors that could influence customers’ faith in banks:

(1)The unemployment rate, the financial crisis, and other facets of the economy

(2) First-hand knowledge (of the quality of the financial services provided, for instance),

(3) Customers’ individual traits (such as their level of financial education, demographics, and worldviews),

(4) Financial regulators, legislation, and government are all examples of governmental monitoring and policy actions.

10 Live Examples from the banking industry

VISA

Visa contactless transactions are conducted over the same dependable payment network as magnetic stripe transactions and are just as safe. Additionally, the danger of fraud is decreased with Visa contactless transactions since you maintain control of one’s payment device.

Barclays

They are dedicated to granting their clients discretion and adaptability. Even if they share one’s information with other organizations, such as the government, according to legal requirements, we do so in a secure manner and only as much as is necessary.

Mastercard

They have adequate security measures in place to secure your personal information. They are dedicated to safeguarding the data we gather. They keep appropriate administrative, technological, and physical precautions in place to ensure against accidental, illegal, or unauthorized destruction, loss, modification, access, disclosure, or use of the Personal Information one submits or that they collect. On a few of our websites where we send specific Personal Information, they employ SSL encryption.

Read: Let’s Dive Deep Into Fintech Vs The Conventional Banking

When one’s personal information is no longer needed for the purposes for which it is processed, unless they are obliged by law to retain it for a longer time, they also take steps to delete it or preserve it in a form that makes it impossible to identify the client. The type of products and services one has requested or received, the nature and duration of their relationship with you, the possibility of one’s re-enrollment in our products or services, the effect on the services they provide to anyone if they delete some information from required statutory retention periods, and the statute of limitations are all factors they consider when determining the retention period.

JP Morgan

They are among the largest technology-focused businesses in the world. They invest $15 billion in technology at a size and rate that are unmatched on a global basis.

Standard Chartered

The transactions are encrypted to prevent hackers from intercepting and stealing one’s data. They will log you out of your online banking session after 15 minutes of inactivity to prevent others from accessing one’s account since prolonged login inactivity may raise the risk of fraud and other problems. All internet activity is continuously being watched by them. When they anything suspect, they take precautions to protect one’s account.

DBS bank

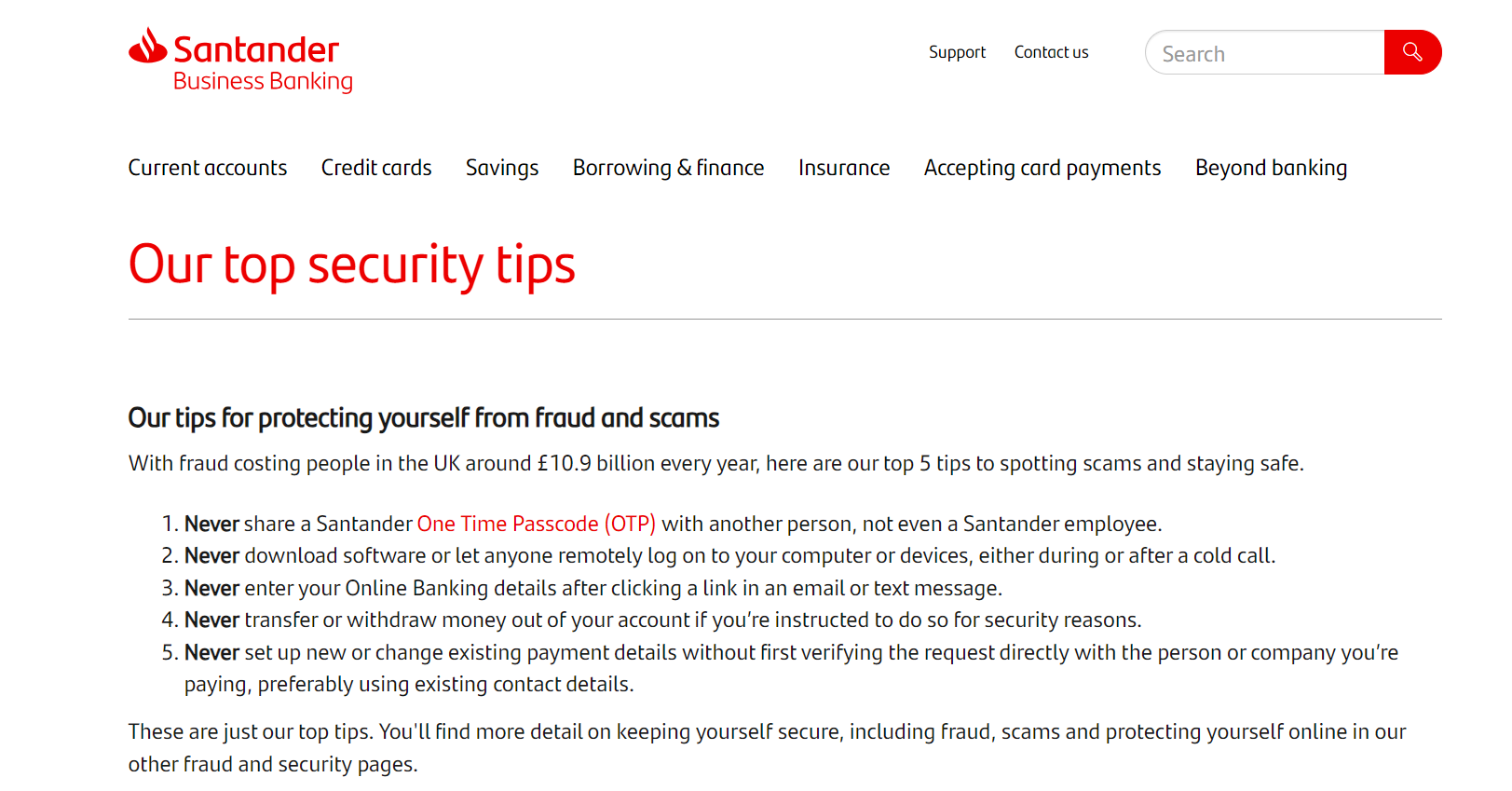

Santander UK

The Financial Services Compensation Scheme (FSCS) will cover your deposits with Santander UK plc up to a maximum of £85,000 per customer. The insured amount is deducted from the aggregate deposit balance maintained across all of one’s Santander UK plc accounts.

National Australia bank

They care about the security of one’s accounts. They are striving to keep you secure and to teach you how to avoid fraud. They have developed a resource portal with useful articles, training, tips, and toolkits to help you defend yourself or your company against cyber risks, fraud, and scams.

Royal Bank of Scotland

RBS detect and safeguards you against fraudulent activities using cutting-edge technology. Their assurance may assist you remedy the wrongs one might have suffered as a result of fraud. Their primary goal is to protect and safeguard the money of one’s consumers.

Bank of Singapore

How to build trust the right way and keep it that way

There are a number of really practical techniques to advance customer trust significantly. I’m talking about the successful union of strategic planning and practical execution.

A bank must adapt to sociological and cultural changes in order to earn people’s confidence.

For astute financial service companies seeking to expand sustainably, this alignment may take the form of:

- Addressing the unique demands of the large wealthy clientele

- Offering clients self-service choices for financial goods that take their time into consideration

- Taking practical measures (such as notifications, educational nuggets, saving nudges, budgeting, etc.) to satisfy society’s demands for financial literacy

- Simple financial solutions with clear pricing and little overhead are provided directly or through digital platforms.

- Helping consumers discover the optimum financial solution, even if it is not provided by the institution directly, but rather through combining services from several third parties.

- The list could go on and on: seamless solutions for accumulation and decumulation, easily accessible wealth management products and services.

All of these things and more are what customers want from their financial service providers!

Tech to improve results above and below the surface

- Reduce friction by offering fast, easy onboarding processes, financial products with self-service alternatives, and thoughtful app connections.

- Eliminate surprises with real-time asset performance updates, backed by professional advice and direction.

- Include focus, need-based communication, clear terms and conditions, and openness.

- Educate with informational tidbits and proddings tailored to the demands and financial situation of the clients.

- Aggregate by making it simple for companies to include data and services from other parties, enhancing their products and giving consumers more options.

Customers expect assurances from banks that they can effectively safeguard their accounts against fraud. They want chatbots to be able to provide authentication. They want smartphone applications that, among other things, let people plan payments, block a stolen or lost credit card, keep track of their spending, and easily save money.

Read the latest article: The New Wave: Decentralized Finance

There are several ways that financial institutions may meet the requirements of their clients and help them achieve their potential for financial well-being.

Conclusion

Because trustworthiness supports growth and profitability, banks that prioritize it may create a self-reinforcing positive feedback loop.

The good news is that using an omnichannel strategy makes trust-building simpler than ever.

The transition…

- From towering buildings to user-friendly apps

- From complex information to comprehensible conditions

- Rather than forcing items onto the market, they should be built with the help of customers who are prepared to share their data.

Is it both an incredible opportunity and a source of added responsibility?

Customers already depend on banks to secure their funds and personal information, but that is just the bare minimum. To create win-win propositions that benefit both themselves and their clients, financial service providers must combine technology, data, and cultural changes.

Human interactions have long been a part of banking. Although improvements in financial technology that aim to improve efficiency, inclusiveness, and quality of services should be welcomed, they will not replace the crucial role of human judgment in banking and supervision. The word “bank” derives from the Late Latin for bench, referring to the place where money handlers sat in the market to transact in person. Additionally, they are insufficient to replace the significance of continued coordination between Basel Committee members in preserving global financial stability.

[To share your insights with us, please write to sghosh@martechseries.com]