Key findings of the EPAM Continuum report reveal the rate of transformation across the financial landscape, and the need for traditional banks, fintechs and neobanks to offer more personalized advice and services

Knowing what a customer wants—and what they need—is difficult in the best of times. With the current landscape changing at a record pace and expanding in so many different directions, it’s an almost impossible task. EPAM Continuum, the integrated business, technology, and experience consulting practice of EPAM Systems, Inc., announced the release of its Consumer Banking Report 2021, that allows financial services providers to see how customers’ evolving attitudes and expectations are reshaping the industry, changing how banks compete and win in an increasingly crowded and competitive marketplace.

Access the Full Report Here.

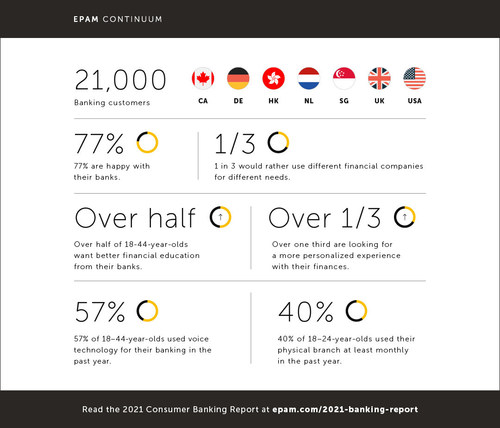

Surveying 21,000 people across key banking regions—including the U.K., U.S., Canada, Germany, Netherlands, Hong Kong and Singapore—the report builds on the inaugural Consumer Banking Report 2020 to explore how consumer attitudes towards banking have changed since the pandemic. Key findings highlight the increasingly diversified and fragmented banking landscape, the financial needs of younger consumers, the complex relationship between digital and “real-world” banking, and the hype surrounding crypto investing.

Read More: Bank of Sun Prairie Partners with 360 View to Empower Their Customer Relationship-Focused Culture

“EPAM has been at the forefront of this exciting period of change, helping financial services companies keep pace with emerging technologies, rising customer expectations, ever-changing regulations and disruptive business models,” said Balazs Fejes, President of EU and APAC Markets at EPAM. “We have seen a phenomenal rate of transformation across every part of the fintech landscape over the last 12 months. As the landscape becomes more complex, banks have to adapt to delivering personalized services and advice and find ways to monetize these whilst remaining within the regulatory frameworks.”

In the report, EPAM provides a detailed look at how the global pandemic has affected consumer banking relationships, and highlights key emerging themes, including:

- Consumers are embracing the “unbundling” of financial services. While consumers aren’t looking to make a wholesale switch away from traditional banks, over a third (36%) would rather use different financial providers for different needs, including investments and cryptocurrencies, money management and personal financial management and financial education and coaching.

- Thirst for information is growing and Gen Z is leading the charge. This year’s survey identifies opportunities that are based on education and support. Gen Z customers (60%) reported that they would like their bank to give them advice on how to manage their money and would use their bank’s physical branch more often if they were able to offer financial education, talks and interactive tools. Two out of every five are still using their banks’ physical branch at least monthly.

- Ubiquitous banking comes of age. This year’s report shows a leap in the number of people using voice-activated personal assistants to access financial services as well as an increased use of social platforms in financial activities. Over a third of respondents said they had used a personal assistant (e.g., Alexa, Google Home, Siri) for banking in the last year.

- Cryptocurrency: headline hype translates to genuine interest. Alternative investment platforms are now mainstream and there is a latent interest for cryptocurrency investment. Almost two fifths (38%) of all adults are willing to consider cryptocurrency, and over a third (36%) of Gen Z want their bank to offer cryptocurrency investment options.

Read More: Piper Sandler Expands Credit Union Coverage with Addition of Jon Searles

EPAM Continuum’s Consumer Banking Report summarizes how these emerging trends, attitudes and behaviors might influence banking’s future across multiple demographics and geographies.

Read More: Abra Launches Token-Based Rewards Program for Customers Powered by Crypto Perx (CPRX)

[To share your insights with us, please write to sghosh@martechseries.com ]