Let’s Discuss Cloud FinOps.

It’s an organizational structure and cultural transformation that integrate technology, finance, and business to promote financial accountability and hasten the realization of company value through cloud transformation.

FinOps is an evolving cloud financial management discipline and cultural practice that enables organizations to get maximum business value by helping engineering, finance, technology and business teams to collaborate on data-driven spending decisions.

• FinOps empowers businesses to increase business value and enhance financial accountability.

• FinOps aids in comprehending the difficulties and complexities of conventional IT financial management.

• FinOps aids in identifying the fundamental components and crucial performance indicators for corporate value realization.

Getting started with FinOps on Google Cloud

Technology, finance, and business are brought together by Cloud FinOps, an operational framework and culture shift, to promote financial accountability and quicken the realization of commercial value. The steps in this whitepaper can be immediately put into practice by your company to deploy FinOps and get the most out of your cloud investment on Google Cloud.

Latest Read: A Closer Look At Integrated Document Management And Accounts Payable Software

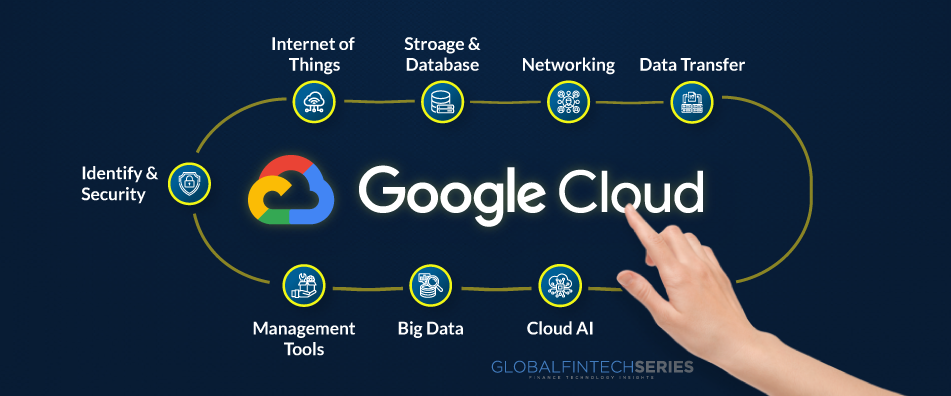

Why Google Cloud?

More than simply “lifting and transferring” outdated IT infrastructure to the cloud for cost and convenience’s sake constitutes digital transformation. The real change affects the entire organization and empowers each individual to transform. We are fully aware of the demands placed on modern technology and the necessity for constant innovation. Because of this, businesses use Google Cloud to alter their infrastructure and overcome their most difficult problems.

Cloud FinOps’s potential

1. Accelerate the realization of corporate value and innovation

2. Promote financial transparency and accountability

3. Increase cost-effectiveness and cloud usage

4. Promote cooperation and trust among organizations

5. Limit the spread of cloud spending

The five key building blocks of cloud FinOps

Accountability and facilitation

To build governance and establish standards for controlling cloud spend, this pillar focuses on creating lean, centralized cross-functional teams that include representatives from engineering, architecture, finance, operations, and app owners.

measurement and accomplishment

This pillar concentrates on creating a set of KPIs and business-value measures to assess the progress of the transformation. Customers frequently begin with a set of cost-optimization criteria before switching to metrics that focus on unit economics and business value, including cost per transaction or cost per customer, served.

Cost reduction

This pillar focuses on identifying the important cost-optimization drivers and offers a consistent methodology to manage cloud consumption in the most cost-effective way. It is an iterative and continuous process.

Three crucial areas for optimization are as follows:

- Optimization of resources

- Price improvement

- Architecture improvement

Preparing and Predicting

A deeper understanding of the cost drivers, spending allocation, and efficiency benchmarking are necessary for effective planning and forecasting in the cloud.

Tools and speedups

Finally, putting all of this together, it’s critical to use the right tools and accelerators to manage and track cloud spending. This comprises:

Using Google Cloud cost-management resources to examine current billing and expense information creating a dashboard reporting system to control cloud spend and value tracking putting automation scripts in place to establish budget alerts and account guardrails.

Latest Read: One Of The Industry’s Best Kept Secrets: Expense Management By CFO’s

The following are a few top advantages that businesses can obtain by implementing FinOps best practices and procedures

Cost-effectiveness

- Evaluate cost-effectiveness by reducing the costs associated with migration, support, and infrastructure.

- Put your attention on implementation, support, and infrastructure.

Resiliency

- Service quality and security risk posture improvements will increase operational resilience.

- Put an emphasis on operational stability, security posture, and service quality.

Velocity

- By accelerating flexibility in the distribution of goods and services, shorten time to market.

- Put an emphasis on business agility, release frequency, and development productivity.

The Future of Cloud Financial Operations with FinOps

The existing trends of increased complexity and greater use are predicted to continue with cloud computing. These four themes, according to Gartner4, will propel cloud computing in the upcoming years:

- Cloud accessibility. According to Gartner, public cloud investment will account for more than 45% of total commercial IT spending by 2026, up from less than 17% in that year.

- Ecosystems for local clouds. According to Gartner, regional and vertical cloud services are growing as businesses diversify their cloud strategies by including cloud providers from other nations.

- Sustainability. Over the coming years, new sustainability standards will be required, and choosing a cloud services provider may depend on the firm’s “green” ambitions, predicts Gartner.

- Cloud infrastructure that is programmable. Gartner anticipates CSPs will widely use fully managed, AI-enabled cloud platforms and services.

These and other changes raise the demand for a thorough FinOps approach and increase the pressure on cloud financial operations.