All banks rely heavily on the Know Your Customer (KYC) procedure to confirm the identification of their clients. KYC verification is essential to stop criminal elements from using banks for money laundering schemes like drug trafficking, terrorism, and other crimes. Currently, the widely used manual KYC method is out-of-date, time-consuming, and less safe.

In this blog, DKYC will be discussed in a detailed format and how will it help the business firms.

Summary

- Introduction

- What is “Decentralized KYC”?

- Fintech Exclusive: Industry Viewpoint from two Fintech Leaders

- How Can a Decentralized KYC Solution Help Your Business?

- Existing issues and shortcomings with KYC

- Exploring the KYC Challenges of 2023

- Adopting the Right KYC Solution in 2023

- Conclusion

Introduction

We’re living in an age where new technology offers gigantic upsides. Yes, you heard this right!

Financial service providers must implement Know Your Customer (KYC) processes for all clients, both new and old, as a matter of regulatory and compliance responsibility. For KYC, the most crucial player is the bank. To ensure their clients are who they say they are, banks need them to fill out Know Your Customer (KYC) forms. To prevent financial crimes including money laundering, terrorism funding, and fraud, banks normally practice due diligence by comparing client data given by different customers. Customer details, identification or address verification, and a picture are all included in the KYC paperwork.

According to international data, the biggest banks spend about £100 million each year on Know Your Customer (KYC) processes. The increasing complexity and expense of KYC are also having a detrimental effect on their operations.

Each financial service provider develops criteria for its KYC paperwork under the present centralized system. The user is thus required to adhere to the KYC specifications of all organizations and services that the providers employ. The blockchain and the idea underlying KYC need all financial institutions and service providers to further submit a separate notification of any ensuing adjustments to user data. Identity verification is a requirement for all organizations, which is crucial for FIs. These days, the Know Your Customer standard aids businesses in knowing with whom they are doing business. This often entails drawn-out procedures where certain papers are inspected and background checks or screenings are conducted.

It is crucial that market players collaborate to discover solutions that would enable them all to concentrate on their consumers since the promise of blockchain technology for KYC, digital identities, and AML is yet largely unrealized. For KYC, digital IDs, and AML to be effective initiatives using blockchain technology, many issues could be resolved in a better and easier way. The network effect, which powers this technology, can only happen when market players find a win-win solution, allowing all parties to concentrate instead on the demands of their clients.

What is “Decentralized KYC”?

To access current user information in a safe and timely manner, a decentralized Know Your Customer (KYC) procedure is the best way to go. As a result, less time is spent compiling data by the agency. Decentralized know-your-customer (d-KYC) solutions provide a transparent and tamper-proof method of confirming user identities by keeping credentials in a decentralized repository. After a user’s identity has been confirmed, it may be shared with other people or services without further confirmation.

Read More links for Fintech – FinTech RADAR: 105 U.S. Fintech Unicorns And Their Core Offerings

The above diagrammatic representation describes briefly the entire process. In the conventional KYC system, each bank creates its own KYC design based on the legislation governing KYC compliance. While this increases expenses for banks, it also has an impact on how customers are treated. Buyers must go through KYC procedures in order to get associated with banks. The buyer must provide the array of identity and address proof papers as required. The bank, on the other hand, continues the client onboarding process by managing the plethora of data along with the buyer’s statement. Purchasers must go through the same procedures again if they wish to open an account with another bank. Therefore, validating each identification is a waste of time.

Fintech Exclusive: Industry viewpoint shared by Fintech Leaders

We had an one-on-one discussion briefly with a renowned market leader Aiman Mirzakhmetova, Chief Executive Officer – Inka Finance and Mentor at HyperNest.

Below is her exclusive view in regard to decentralized KYC which has been given to the Global fintech series.

We also had a one-on-one discussion briefly with a renowned market leader Sanjay Darbha, Founder & CEO at PeerLend. Below is his exclusive view in regard to decentralized KYC which has been given to the Global fintech series.

“As discussed, here are my views on the tough topic – “Role of Decentralized KYC solutions for today’s businesses”. This is straight typing out the thoughts in my mind about the topic, so kindly excuse me for any semantic errors. Also, please edit/modify as required without changing the intent.

The KYC process is mainly used for 2 reasons – customer identification, and customer due diligence. In financial services and related industries, this is mainly done to assess the customer, understand their risk profiles, and determine their creditworthiness. A streamlined customer verification process will improve operations significantly. This can mean faster and safer means of providing services to customers, but it does not necessarily mean decentralizing the KYC.

Decentralized KYC solutions like setting up customers’ database on a Blockchain definitely helps authenticate and upkeep the integrity of transactions (financial and otherwise). But the cost-benefit analysis should be made to understand whether such a system is required at all. And 100% reliance on a fully decentralized KYC system may fit the requirement of every business that needs to use KYC. It is very synonymous with giving an AI/ML tool to an underwriter in an insurance company and asking them to fully rely on the system. The underwriter will finally check the documents physically before finalizing the application.

But, given that organizations have different requirements, one should also know which KYC verification method will best suit their needs. This is the crux of setting up the KYC systems and processes. For example, PAN, Aadhaar can be authenticated with the available centralized systems (and a Passport and Driving license may be authenticated too in similar ways), but how does one validate the physical address of the customer using any KYC system? How efficient are KYC systems in correctly processing an old KYC document bearing the photo of the customer?

Do we really want to make the KYC systems so democratic by decentralizing them fully? when the products and services being served to the customers are so much similar (not so diverse) – the use cases are not unlimited. And, they are categorized in their function and implementation well not to overlap with one another. Guess, we are years away in India from having systems where we are able to ‘fully’ authenticate the customer using the KYC system.”

Read: 5 Unconventional Ways To Make Money On Crypto In 2023

How Can a Decentralized KYC Solution Help Your Business?

Superior Data Security

Traditional KYC systems are centralized, which often leaves them open to data breaches since sensitive data is kept in one place. On the other hand, decentralized KYC systems depend on distributed storage, which shards data over a network of nodes. With this strategy, there is a substantially lower chance of a single point of failure and it is harder for the hackers to access or alter any crucial data.

Higher User Privacy

Users have greater control over their personal data with decentralized KYC systems. In order to safeguard their privacy, people may decide what information to disclose and with whom. Contrast this to centralized systems, where consumers often have little option but to entrust third parties with critical information.

Dependence on Third-Party Intermediaries is Lessened

Users’ information is validated and stored by third-party intermediaries as part of centralized KYC systems. This dependency may lead to inflated expenses, delays, and security risks. However, decentralized KYC systems may let individuals verify their own identities over a distributed network, doing away with the requirement for middlemen and the accompanying hazards.

Both time and money are effectively used.

Decentralized KYC solutions without third-party middlemen decrease security concerns while also streamlining the procedure, making it quicker and more affordable. Traditional KYC procedures often include thorough background investigations and document verification processes, which may be time- and labor-intensive. These procedures may be sped up and made simpler using decentralized KYC systems, which also saves money.

Increased Reliability and Accuracy

Decentralized KYC systems provide a tamper-proof and transparent way to validate user identities by keeping credentials in a distributed repository. A user’s identification may be simply shared with several parties without requiring further verification after it has been established and documented. This guarantees that the data is correct, trustworthy, and consistent across different platforms and services.

Enhanced Compliance with Regulations

Businesses may more easily comply with regulatory standards with the use of decentralized KYC solutions. The ability to verify compliance with anti-money laundering (AML) and other regulatory frameworks is made simpler for firms by these systems, which may provide a clear and unchangeable record of user identities and transactions.

Compatibility Across Borders

Cross-border identity verification is made easier by decentralized KYC systems, which is one of their main benefits. When it comes to validating overseas customers, traditional KYC procedures may be laborious and time-consuming, often necessitating numerous layers of verification and producing delays. However, decentralized KYC systems may expedite this procedure, providing quick and easy cross-border identity verification.

Identity verification procedures may change as a result of the implementation of decentralized KYC solutions. These solutions may benefit from less dependence on third-party intermediaries, improved data security, higher user privacy, and other factors by using distributed technology. Decentralized KYC solutions may provide a more effective, cost-effective, and secure alternative to conventional KYC procedures as organizations and people continue to negotiate the complexity of the digital world. It’s time to embrace identity verification’s future and take advantage of all the benefits that decentralized KYC solutions have to offer.

Existing issues and shortcomings with KYC

Although KYC is a crucial regulatory obligation, the current procedures are inefficient and out-of-date. In order to maintain compliance with regulatory standards, financial institutions and banks throughout the globe are expected to keep a close eye on the identities of their customers. They risk getting into a lot of difficulties if they don’t have a verified client user base, and they risk being hit with hefty penalties for breaking the law.

Banks and other FIs often encounter obstacles while negotiating between several regulatory agencies. Additionally, safeguarding vast swaths of sensitive client data can be dangerous. Additionally, it’s possible for numerous institutions to replicate the process of gathering the necessary KYC information and confirming client-related information. The processes involved in tracking down and confirming their customers’ identities turn out to be quite time-consuming and expensive.

Exploring the KYC Challenges of 2023

Despite its significance, organizations may find it difficult to create a successful KYC procedure, especially in 2023. Among the principal difficulties are:

Technology is Developing Quickly

The rapid development of technology has given leverage to hackers to conceal their identities and carry out illegal activities. To properly identify and verify consumers, companies must remain abreast of the most recent technological advancements and modify their KYC procedures appropriately.

Juggling security and customer experience

Businesses need to find a way to reconcile offering a flawless client experience with putting in place reliable security measures. Long and onerous KYC procedures may put off prospective clients, which may lead to missed business possibilities. Companies must make investments in effective and user-friendly KYC solutions that reduce friction without sacrificing security to meet this issue.

Data Security and Privacy Issues

Businesses must make sure their KYC procedures adhere to the necessary data protection laws in an age of rising data privacy concerns. This includes protecting client data and making sure it is only used to confirm customers’ identities.

Rise in Regulatory Complexity

Businesses must negotiate an ever-more complicated regulatory environment as governments continue to enact new legislation to fight financial crime. To maintain compliance, this necessitates ongoing regulatory change monitoring and KYC process adaptation.

Generate AI Images From Text Using DALL-E : A Revolutionary Tool By OpenAI

Adopting the Right KYC Solution in 2023

In 2023-2024, organizations will need to invest in a trustworthy KYC solution with the following capabilities to meet these issues and remain in compliance with KYC regulations.

The right KYC solution is important for any business house. Below are a few key points which might lead the way to the right road.

- Select a Know Your Customer (KYC) solution

A solution that makes use of cutting-edge methods like AI, ML, and biometrics. These innovations have the potential to improve the efficiency and reliability of the identity verification procedure while reducing the potential for fraud.

- Secure self-service digital portals

Secure self-service digital portals that accept customer-completed KYC profiles to remove difficult-to-manage email traffic. Self-service portals with electronic signature capabilities also do away with the requirement for paper documents and actual signatures that are necessary.

The self-guided procedure offers simplicity, convenience, and security to the consumer. Self-service portals with obligatory fields provide additional value to the financial institution by ensuring that all necessary data is examined and provided, acting as a systematic or “built-in” quality check and allowing for more focused outreach based solely on what is missing. Overall, this shortens the processing time and eliminates the need for repeated client engagement.

- KYC systems that programmatically generate KYC requirements depending on entity type, jurisdictions serviced

In order to ensure that all necessary data is gathered in line with policy criteria, in one unified request to the client, digital KYC systems that automatically construct needed fields based on key characteristics may be quite helpful.

The normal KYC form is filled out by the customer, the risk rating is determined in a subsequent KYC process step, and then the customer may be contacted again to complete a high-risk or enhanced due diligence form depending on the risk attributes. Customers benefit from digital KYC platforms since they can fill out fewer forms and make fewer requests than traditional methods. Digital KYC platforms can help you find the right mix of papers to provide to satisfy a wide range of requirements. For instance, the KYC platform might be developed to ascertain what pertinent content will maximize coverage for all potential document demands by categorizing papers according to policy expiry dates, hence reducing the overall amount of outreach required.

- Technology enablers that reduce manual processes

The usage of technological enablers yields superior results for the customer experience, whether stand-alone or integrated into the implementation of other KYC program innovations, such as self-service portals. Application programming interfaces (APIs) have been successfully used by financial institutions, in particular large banks, to automatically source internal and external data sources to reduce error-prone manual processes, help pre-populate KYC forms, and automate negative news searches. For the client, this can mean a more thorough first information request and awareness of any needs or documentation gaps.

- Data integration

A comprehensive KYC system will integrate data from several sources, such as government databases, watchlists, and worldwide registers. This makes it possible for companies to do complete identity checks on their consumers.

- Compatibility with Preexisting Infrastructure

The best KYC solution will work in tandem with the current infrastructure, eliminating the need for costly adjustments. This will aid in lowering implementation costs and guaranteeing a trouble-free transition for your company and its consumers.

- Ability to scale and adapt

Your Know Your Customer (KYC) solution has to be adaptable to the changing needs of your organization. Select a program that can be modified to accommodate future changes in legislation, technological developments, and user preferences.

- Security and privacy safeguards for sensitive data

Choose a Know Your Customer solution that places a premium on protecting user information. To secure your customers’ personal information, you must adhere to data protection laws and use robust security protocols.

- Simple-to-Use User Interface

Choose a KYC solution with a simple and straightforward UI to make things easier for your consumers and your staff. As a result, the onboarding process will become more streamlined, and client satisfaction will rise.

Read: Let’s Dive Deep Into Fintech Vs The Conventional Banking

Conclusion

In my hypothesis, the development of a DKYC platform will solve many of the fundamental issues which existed in the context of conventional KYC. DKYC is the new norm that has been accepted worldwide and institutions actually want to dive in. Although this will not be simple and will need the involvement of authorities. Fintech, Regtech, and challenger banks may all make significant contributions to the future of KYC in this space.

As the influence of technology grows from the perspective of financial institutions, knowledge of technology grows among regulators. Not only that, the trust in blockchain technology will paramount globally, and the difficulties faced with banking issues like know your customer (KYC) may be solved with less effort.

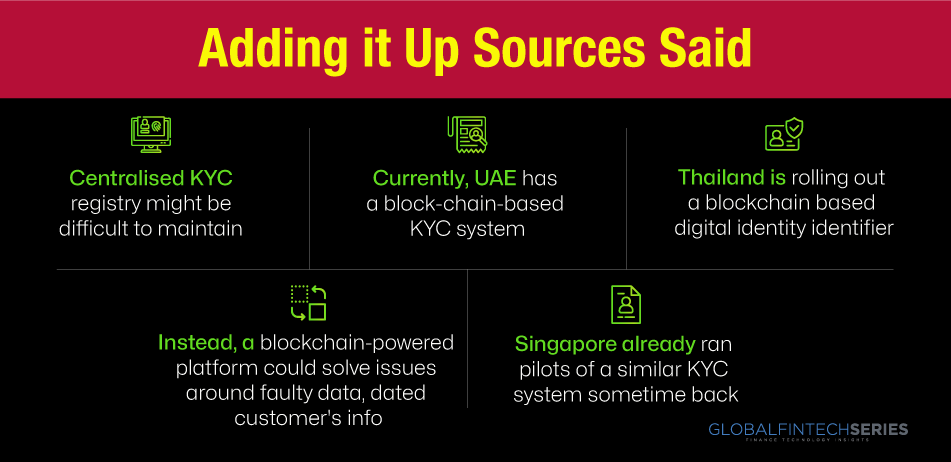

The DKYC platform was first implemented and made available to banks in Dubai. There are also other investigations happening in many other Asian nations. European and other nations are standing in cue. Spreading the word about DKYC has several advantages. Problems cannot be solved with the same level of thought that brought them into existence.