It is my pleasure to bring this topic up and discuss the South East Asia sphere in the context of payments.

Introduction

South-East Asia moves closer to economic unity with a new regional payments system. Residents in Singapore, Indonesia, Malaysia, and Thailand can now pay for goods and services in each other’s countries using local currencies, which analysts expect will boost tourism, consumer spending, and remittance flows.

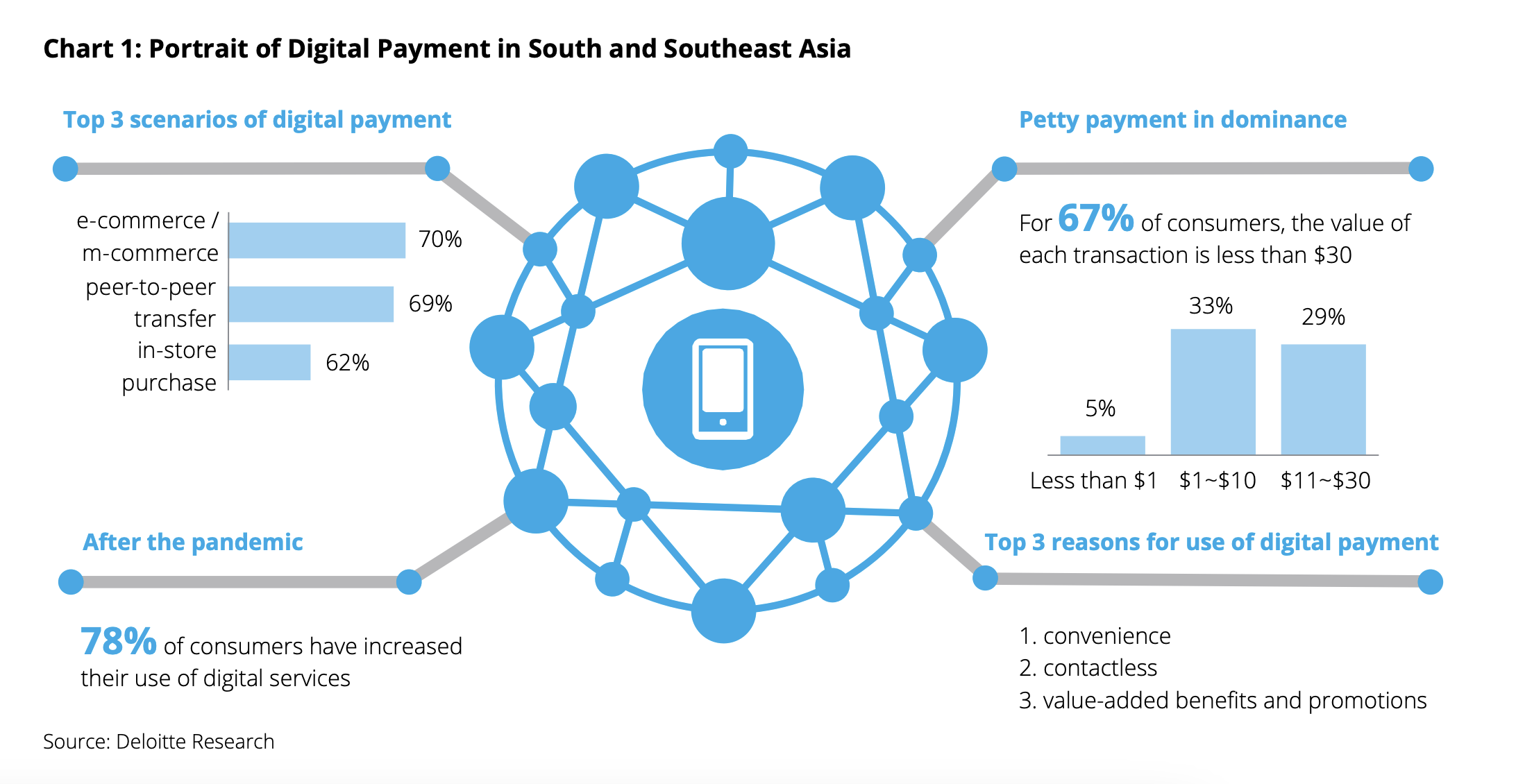

Digital commerce offers both C2B and B2C marketplace opportunities; cross-border business in both areas is expected to grow by more than 12 % to 15 % a year over the next five years.

Competition has intensified due to a fast-expanding regional economy, which has fueled e-commerce and boosted digital and financial inclusion. Multiple regions in Southeast Asia have become important hubs for the digital economy, with Indonesia expected to enjoy annual growth of 25% until 2025.

What Are the Latest Developments in South-East Asia for CBP?

In an effort to facilitate international financial transactions, the Central Bank of Vietnam signed an agreement with the central banks of five other Southeast Asian countries. The agreement was reached in Jakarta during a meeting of the ten finance ministers and central bank governors that make up the Association of Southeast Asian Nations (ASEAN).

Read the latest article: 10 Best Applications Of AI In Banking

Using the QR (quick response) code technology, Vietnam will join Indonesia, Malaysia, Thailand, the Philippines, and Singapore in connecting their respective payment systems. Indonesia has already connected its payment system using QR codes with Thailand and Malaysia and is aiming to link up with Singapore later this year. Southeast Asian nations are building links between their national payment networks and working to set up a framework for direct cross-border transactions in their own currencies to accelerate regional economic integration.

Association of Southeast Asian Nations leaders’ summit in Labuan Bajo, Indonesia, bloc members declared they would improve regional payment connectivity and promote local currency transactions. They pledged to work on a road map to expand regional payment links to all 10 bloc members. The group’s finance ministers and central bank governors are now tasked with overseeing implementation. When they met in Bali sometime back, ASEAN chair Indonesia stressed the importance of deepening regional integration due to the uncertain global economic outlook.

The quest for regional payment connectivity is projected to enhance cross-border retail transactions by paving the way for buying via QR codes and real-time fund transfers (RFT).

There are already a number of retail payment systems in Southeast Asia, although most of them are only bilateral. A QR payment link between Indonesia and Malaysia was launched last month, joining an existing link between Indonesia and Thailand. Besides Cambodia, Indonesia, Malaysia, and Vietnam, Thailand has also established QR linkages with these countries.

Using their mobile phones to scan QR codes in stores is a fast and easy way for tourists from participating countries to make purchases while abroad.

Two years ago, Singapore and Thailand established the sole RFT payment link in the area. It links Singapore’s PayNow with Thailand’s PromptPay so that up to SGD$1,000 ($740) or 25,000 baht ($717) can be transferred daily using simple mobile phone numbers.

Read: Top 10 Fintech CEO Watchlist

A Guide to Cross-Border Payments and How They Work

In simple words, cross-border payment is nothing but a financial transaction where the payer and recipient are based in separate countries. It’s categorized into two types, Wholesale cross-border payments and, Retail cross-border payments.

There are several different types/ways that cross-border payments can be made, they are Credit card payments.

- APMs (Alternative Payment Methods) Such as e-money wallets and mobile payments.

- Bank transfers.

How does it work?

If a bank has direct contact with a bank in another nation, a payment message transmits an instruction to debit from Bank A and Credit to Bank B.

Read: AI Dynamics In Financial Services- WEF

Since not all financial institutions have direct links with one another, a Correspondent Bank may be required to facilitate the payment or transaction. (Correspondent banking is a critical part of the international monetary system)

Here’s a quick rundown of how to make payments via e-wallet, credit card, bank transfer, and wire transfer.

-

Online banking

It’s a way to electronically move money from one bank account in one country to another bank account in another country. One to two business days is the typical transfer time. Large sums of money cannot be transferred since the charge is too high and the restrictions differ from country to country.

Bank transfer, International bank transfers allow money to be sent from one country to another using SWIFT Network. Most of the bank transfers happen through this SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. It’s a secure messaging mechanism that assures the payment is received by the recipient successfully.

-

Credit Card Payments

Using a credit card is easy. All we need to do is enter our card details to initiate the payment. But behind the scenes, things like currency conversion between accounts will be taking place.

Although a transaction between two digital wallets is not technically a cross-border payment, it does help to ease online or in-store purchases made with e-wallets like Apple Pay, Google Wallet, PayPal, and others.

[To share your insights with us, please write to pghosh@itechseries.com ]