One of the leaders in digital payments globally is Visa. The goal of Visa is to unite people, businesses, and economies by creating the most cutting-edge, dependable, and secure payment network.

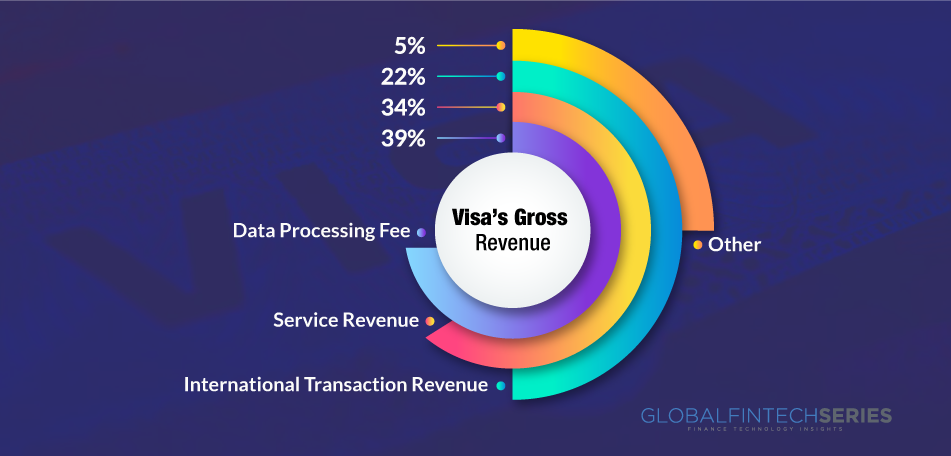

- The majority of service income comes from offerings that let customers use Visa payment systems. The main factor influencing service revenues is the volume of payments.

- Authorization, clearing, settlement, value-added services, network access, and other maintenance and support services that support transaction and information processing among the company’s clients globally are included in data processing revenues.

- Cross-border transaction processing and currency conversion activities generate revenue from international transactions. Cross-border transactions happen when the beneficiary’s country of origin differs from the issuer’s or financial institution’s country of origin.

- Value-added services, license fees for utilizing the Visa brand or technology, account holder service fees, certification and licensing costs, and card advantages including enhanced account holder protection and concierge services make up the majority of other income.

- Client incentives: Visa enters into long-term contracts with financial institution clients, merchants, and strategic partners for various programs that offer cash and other incentives designed to increase revenue by growing the volume of payments, increasing the acceptance of Visa products, winning merchant routing transactions over to Visa’s network, and driving innovation.

Read latest article: Best Loan CRM Software

With the Visa business model, what are the company’s core products?

Visa offers products in three main categories: value-added services, new flows, and consumer payments.

Value Added Services

Issuer Solutions: Visa Debit Processing Service (DPS) offers clients a comprehensive range of value-added debit, prepaid, and credit services, including call center services, data analytics, campaign management, fraud, and risk solutions, and a white-label branded mobile app. As well as these services and digital solutions, Visa also offers to buy now pay later (BNPL) capabilities, digital issuance, account controls, and branded consumer experiences to issuers.

Acceptance Solutions: Cybersource, a global payment management platform, connects merchants to payment processing while also offering modular, digital capabilities. Moreover, Visa provides dispute management services, such as Verifi, a network-independent solution that lets businesses prevent and settle conflicts over a single connection.

Risk and Identification Solutions: Visa’s risk and identity solutions help clients prevent fraud and safeguard account holder data by transforming data into insights for choices that may be made in close to real-time. Visa assists in addressing issues with payment security and fraud prevention for businesses and financial institutions.

Advisory Services: Visa Consulting and Analytics is the payments consulting advising division of Visa. Visa Consulting and Analytics provides consultancy services that cover the complete customer lifecycle from acquisition through retention to issuers, acquirers, merchants, fintech, and other partners.

Net Flows

Via the facilitation of P2P, B2C, B2B, B2B, and G2C payments, Visa’s network of networks approach offers opportunities to consumers, businesses, and governments globally to capture new sources of money movement through card and non-card flows.

Visa Direct: Visa Direct is a worldwide, real-time push payments infrastructure that allows payment originators to push funds directly to certain debit and prepaid cards and accounts, in place of the conventional card payment flow. In addition to domestic and international payouts and payments, P2P payments, small enterprises, and corporate, worker, insurance, and government payouts, it enables businesses and consumers to deposit money straight to a bank account or card.

Visa Business Solutions: Visa provides a variety of business payment options, including small businesses, corporate (travel) cards, purchasing cards, virtual cards and digital credentials, non-card cross-border B2B payment options, and disbursement accounts. These solutions span the majority of the world’s most important industry sectors.

Business solutions range from employee travel to fully integrated, invoice-based payables and are made to bring efficiency, controls, and automation to small enterprises, commercial payment processes, and government payment processes.

Consumer Payments

The effectiveness of Visa’s primary products—credit, debit, and prepaid products—has been a key factor in the company’s success.

Credit: Customers and businesses can access credit to pay for goods and services using credit cards and digital identities. Credit cards are linked to initiatives run by customers of financial institutions, co-brand partners, fintech companies, and affinity partners.

Debit: Customers and small businesses can make purchases using monies from their bank accounts using debit cards and digital credentials. Via issuing and purchasing relationships with financial institutions and independent ATM operators, the Visa/PLUS Global ATM network also offers cash access and other banking features to holders of debit, credit, and prepaid accounts in more than 200 nations and territories across the world.

Prepaid: Prepaid cards and digital IDs draw money from a predetermined sum that has been provided by private persons, companies, or governments. Payroll, general purpose reloadable, government and corporate disbursements, healthcare, gift, and travel are just a few use cases and needs that prepaid cards cover. Prepaid cards with the Visa logo also contribute significantly to financial inclusion by providing payment options to people who have little or no access to conventional banking products.

Read: The New Digital Mobile Banking Sphere

How does a credit card function?

How a credit card functions when we travel overseas is depicted in the diagram below.

Steps 1-3: A US cardholder visits India and uses their credit card to make a purchase of 1000 INR at a POS terminal. The transaction is transmitted by the acquirer to the card network, which then contacts the issuing bank.

Steps 4-5: Using the foreign currency rate offered by a cross-border payment source, the card network converts 1000 INR to 12.6 USD. Moreover, a little proportion is charged by the card network as a foreign transaction fee. In this instance, 1% is billed. The issuing bank receives the transaction.

Step 6: The cardholder settles the USD credit card bill, which consists of the following 3 items: – 1000 INR in USD; – Foreign transaction fee paid to the card network; – Foreign transaction fee paid to the issuing bank (some issuers do not charge for this);

Step 7: This is the cross-border payment provider’s foreign exchange (Forex) settlement procedure. The provider looks to the forex market for liquidity. To accommodate currency conversions, it opened multiple multi-currency bank accounts at the exchange bank.

To what end does Visa charge its customers? Exactly how does Visa make money?

In 2021, Visa generated $24.1 billion. By the use of cutting-edge technologies, Visa makes money by facilitating the transfer of funds among customers, retailers, financial institutions, companies, alliance partners, and governmental organizations. After deducting client incentive agreements Visa has with its clients, net revenues are made up of service, data processing, international transaction, and other income.

Source: Visa Annual Report 2021