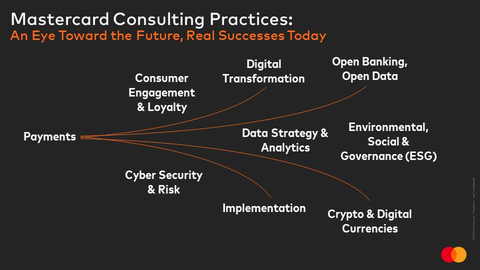

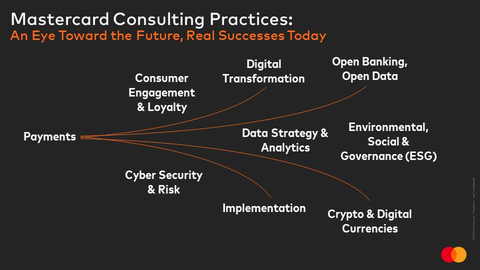

The business world is facing an influx of innovation: changing consumer preferences, rapid digital transformation and geopolitical shifts. To help businesses evolve and supercharge their growth enterprise-wide, Mastercard announced that it is expanding its preeminent payments-focused consulting service with new practices dedicated to Open Banking, Open Data, Crypto & Digital Currencies, and Environment, Social & Governance (ESG).

For more than two decades, consulting has been a key part of Mastercard’s customer engagements, whether designing multi-rail payments strategies or advising on data governance opportunities. Today, Mastercard’s Data & Services includes more than 2,000 data scientists, engineers and consultants, serving customers in 70 countries around the world. As part of growth plans, Data & Services—a talent incubator for the broader company—is expanding its team at pace, including the addition of more than 500 college graduates and young professionals.

Latest Fintech News: Reliance Standard Enhances Benefits Integration with Ease

“Payments are just the beginning,” says Raj Seshadri, president of Data & Services, Mastercard. “Over the past 20 years, we’ve worked with our customers across banking, fintech, retail, travel and other sectors, helping them understand and navigate every challenge and opportunity thrown their way. This evolution of consulting is in recognition of the changing world and of our changing business. It’s about helping customers navigate today’s challenges and anticipating what’s next.”

With these new practice groups, Mastercard will continue delivering an integrated approach that draws on world-class thinking, services and tools and assets—such as Ciphertrace, Finicity and Aiia, Cyber Quant and the Priceless Planet Coalition—to drive smarter decisions with better outcomes across a customer’s entire business.

Driving Consumer & Business Value with Open Banking

Open banking puts businesses and consumers at the center of where and how their financial data is used and furthers access to services they want and need. To help businesses maximize open banking opportunities, our consultants use data-driven insights, advisory and product development services, in alignment with Mastercard’s Data Responsibility Principles. We recently worked with a major Eastern European banking group looking to provide new services to its consumers. Our team helped them prioritize and prototype a multi-banking app that allows users to conveniently manage their accounts from different banks. The app is now live.

Latest Fintech News: Northern Credit Union Now Live on Scienaptic’s AI-Powered Credit Decisioning Platform

Helping Banks Navigate the Adoption of Digital Currencies

Mastercard’s consulting efforts with banks and merchants cover a range of digital currency capabilities, from early-stage education, risk assessments and bank-wide crypto and NFT strategy development to crypto cards and the design of crypto loyalty programs. Mastercard has curated partnerships with digitally native firms that offer best-of-breed solutions in cryptocurrencies, and has helped fintechs expand into new markets, working through go-to-market planning and commercialization strategies. For instance, one focus is helping central banks explore the design and deployment of a central bank digital currency (CBDC) using Mastercard’s testing platform, allowing them to research various scenarios before deployment, and drawing on deep expertise around payment systems, policy and regulation, and governance.

Putting Purpose into Practice

Consumers are more socially and environmentally conscious of the products and brands they interact with than ever before. Mastercard’s consultants are helping clients better understand what that means for their businesses, and then transform these insights into actionable strategies that bridge purpose and profit. For example, Mastercard and a leading bank in Latin America joined forces with cardholders to combat climate change. The collaborative approach designed by Mastercard empowered consumers to make a positive impact on the planet by restoring forests through the Priceless Planet Coalition, while also driving card usage.

Latest Fintech News: RR2 Capital Expands Portfolio with Strategic Investment in DAG-based DeFi Platform Aleph Zero

[To share your insights with us, please write to sghosh@martechseries.com]