Indeed currency exchange holds an important place in the financial jungle. Let’s understand what exactly is currency exchange and all its aspects which shall give a good insight into this topic.

What Is Currency Exchange?

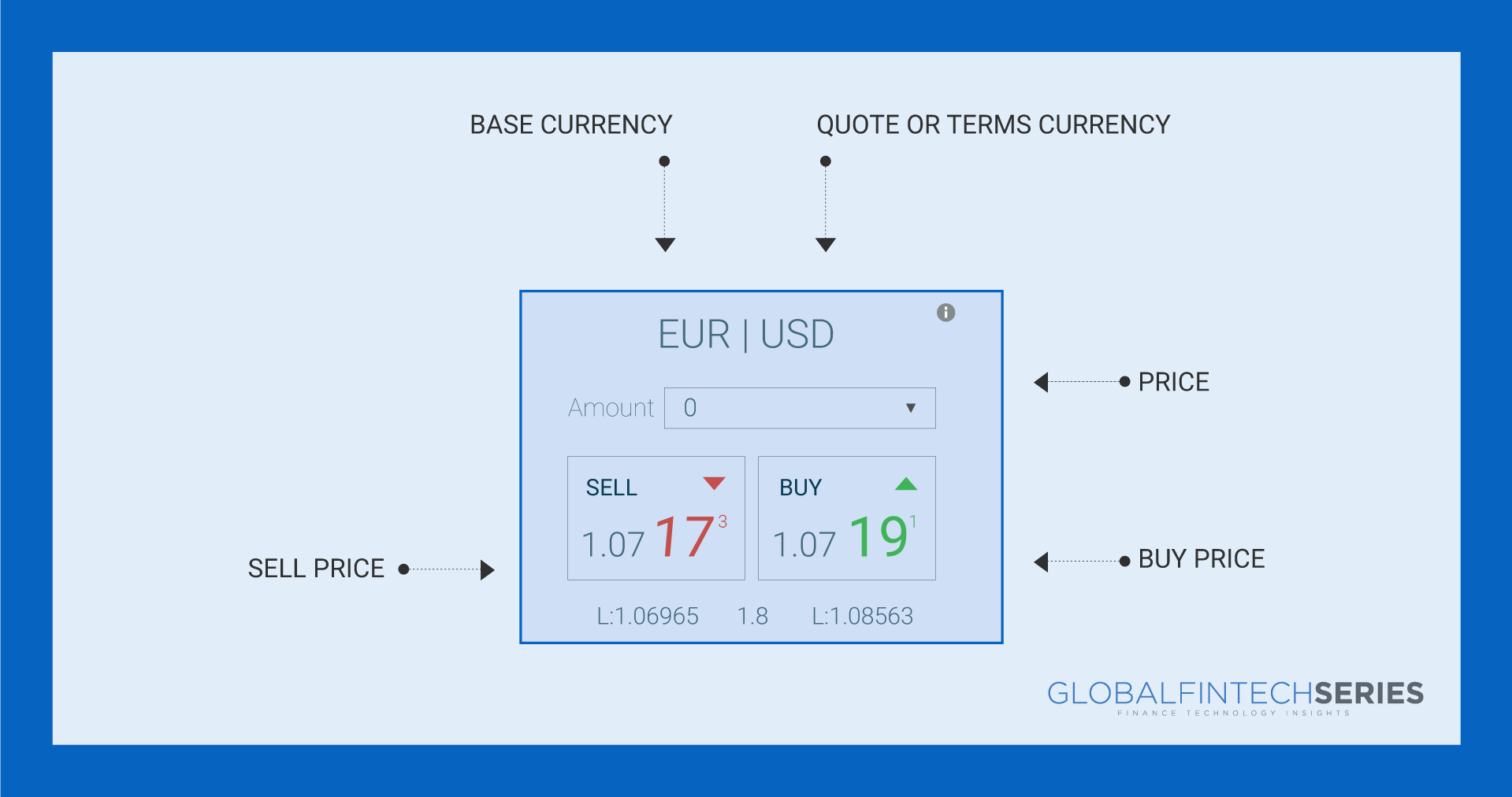

Currency exchange is a systematized platform where customers can exchange one currency for another. Currency exchange of physical money is usually done over the counter (OTC) at teller stations, which can be found at many places such as airports, banks, hotels, and resorts. Currency exchange functions is such a manner by which they can make some money by charging a nominal fee and through the spread in a currency normally known as bid and ask spread.

What Is FOREX?

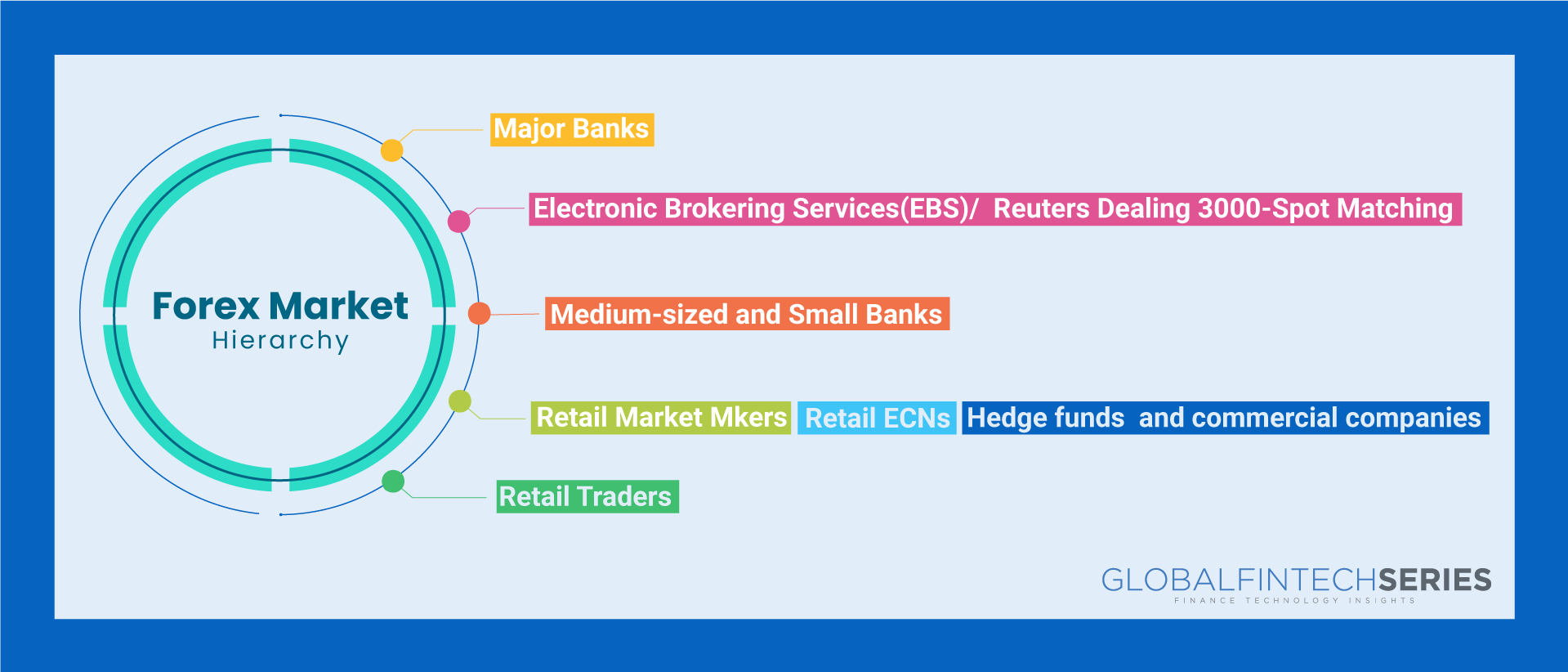

The forex market permits banks, funds, and people to purchase, sell or trade monetary standards. The market works 24 hours, 5.5 days seven days, and is liable for trillions of dollars in every day exchanging movement as traders hope to benefit by wagering that a currency’s worth will either appreciate or devalue against another currency.

Types Of Exchange Rates

There are mainly four main variants of exchange rate: freely floating, fixed, pegged (also known as an adjustable peg, crawling peg, basket peg, or target zone or bands ), and managed float. A fixed exchange rate means a nominal exchange rate that is set solidly by the monetary authority regarding foreign currency or a basket of foreign currencies. Paradoxically, a floating exchange rate is not set in stone in foreign exchange markets relying upon request and supply, and it for the most part fluctuates continually. A managed floating exchange rate is an exchange rate framework that permits a country’s national bank to mediate routinely in foreign exchange markets to steer the cash’s float or potentially reduce the amount of currency volatility.

Importance Of Currency Exchange

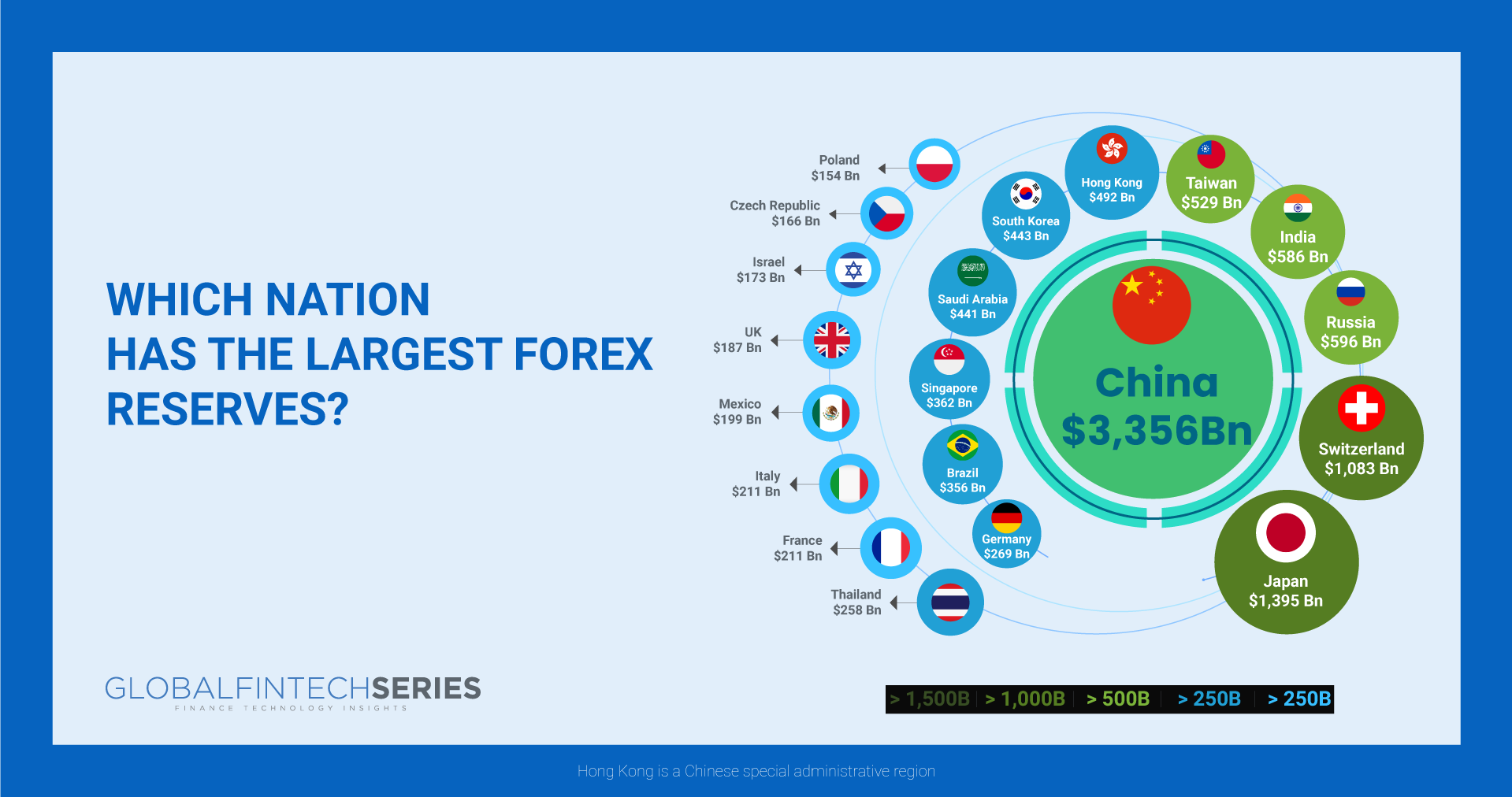

Besides interest rates and inflation, the currency exchange rate is one of the main determinants of a country’s overall degree of monetary well-being. Currency exchange rates assume an imperative part in a nation’s degree of exchange, which is important for any free market economy on the planet.

How Does A Currency Exchange Work?

Currency exchange businesses, both physical and on the web, permit you to trade one country’s currency for another by executing buy and sell transactions. For instance, if you have U.S. dollars and you need to trade them for Australian dollars, you would bring your U.S. dollars (or bank card) to the currency exchange store and purchase Australian dollars with them. The sum you would have the option to buy would be subject to the international spot rate, which is a daily changing value set by a network of banks that trade currencies.

Read Further: Understanding the Basics of Stock Market Trading- An Enigma?

How Do Exchange Rates Affect The Supply And Demand Of Goods?

Changes in exchange rates influence organizations by changing the cost of supplies that are bought from a different nation, and by changing the demand for their items from overseas clients.

Where To Find A Currency Exchange?

Currency exchange businesses can be tracked down in different structures and settings. It very well might be an independent, private company working out of a solitary office, a bigger chain of small exchanges at air terminals, or a huge worldwide bank offering currency exchange services at its teller stations. Airports are typical for currency exchange services, empowering to buy cash during their travel preceding their flight or trade any overabundance of cash back to their local currency upon their return. Since air terminals are viewed as the last port of call, the rates at air terminal trades will, as a rule, be more costly than those at a bank in the city of departure. Going cashless is becoming more common as some banks offer cards that can load multiple currencies on them with little or no fees. In addition, offshore ATMs are a viable option for those banking with a global bank. For instance, HSBC ATMs are predominant in Europe, North and Latin America, Asia, the Center East, and North Africa.

The Bottom Line

While most trade rates are floating and will rise or fall in light of the market interest on the lookout, some trade rates are fixed or fixed to the worth of a particular nation’s currency. Exchange rates influence organizations and the cost of supplies and demand for their products in the international marketplace.

Read: Global Fintech Interview with Jitin Bhasin, Founder & CEO at SaveIN

[To share your insights with us, please write to sghosh@martechseries.com]