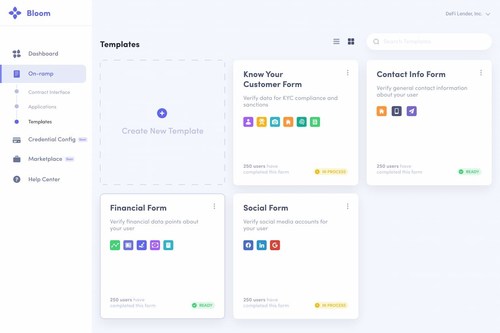

Bloom, a leading blockchain solution for digital identity and reusable, verifiable credentials (VCs) is pleased to announce the launch of a new DeFi-focused product called OnRamp. OnRamp helps enterprises with KYC & AML compliance as well as enabling risk assessment via traditional and alternative data, all while preserving user privacy.

DeFi has experienced massive growth over the past year, topping both 1 million users and $100 billion in value for the first time. But with this growth has come more scrutiny from regulators as many DeFi companies have not achieved compliance with KYC/AML and other applicable rules.

With OnRamp, enterprises can prioritize user privacy while still working towards compliance requirements. OnRamp enables secure access to reusable, verifiable credentials (VCs) for ID verification, sanction screening and PEP Screening. Other identity credentials include phone number, email as well as social accounts like Facebook, Google, Linkedin and Twitter.

Read More: Bank of Sun Prairie Partners with 360 View to Empower Their Customer Relationship-Focused Culture

Beyond achieving compliance, the use of reusable, verifiable credentials will help DeFi companies enable risk assessment, transcending the collateralized lending structure that has limited growth in the sector up to this point. OnRamp offers reusable, verifiable credentials (VCs) for bank account activity, balances and other financial signals. Future plans include the integration of traditional credit scores, utility bill payment history, and other alternative signals that could be helpful in determining creditworthiness.

In addition to OnRamp’s direct integrations, the platform also supports the ability for third party credentials to enter the OnRamp platform via the WACI specification. This feature can enable unique localized use cases where financial infrastructure isn’t supporting local populations.

Read More: Piper Sandler Expands Credit Union Coverage with Addition of Jon Searles

“We are excited to give enterprises the ability to leverage verifiable credentials for identity verification and risk assessment, all while respecting user privacy and mitigating the risk of data leaks,” said Jace Hensley, Head of Platform at Bloom. “But what we are even more excited about is what our WACI integration enables. Now third party data sources around the world can enter the platform, giving the opportunity for people outside of the standard financial system to prove reliability and creditworthiness. This is a major step for DeFi to go global and truly expand financial inclusivity.”

Bloom plans for OnRamp to be a key piece of infrastructure for DeFi companies, whether they are in launch or growth mode. The developer-friendly application includes no integration fees, no monthly minimums, no long term contracts, and flexible pricing. OnRamp reduces the barrier to entry for new builders, allows growing companies to expand, and most importantly, opens the door a bit wider for those who deserve access to the decentralized finance markets.

Read More: Abra Launches Token-Based Rewards Program for Customers Powered by Crypto Perx (CPRX)

[To share your insights with us, please write to sghosh@martechseries.com ]