Blockchain technology, the fundamental idea behind cryptocurrencies like Bitcoin, is changing many industries. Initially conceptualized as a decentralized ledger system to facilitate secure digital transactions, its applications have expanded far beyond finance. Blockchain technology has emerged as a revolutionary force, disrupting traditional systems and bringing in a new era of trust and transparency. It has the power to change lots of fields – from finance and supply chain management to healthcare and voting. However, understanding its core concepts and functionalities can be a daunting task.

Understanding Blockchain Technology

At its core, blockchain technology revolves around a decentralized and distributed ledger system. It is a distributed ledger technology (DLT) that enables secure and transparent record-keeping without the need for intermediaries like banks or governments. A blockchain is a digital ledger comprised of individual blocks. Each block stores a record of transactions and chronologically links to the previous block, forming a continuous chain. Imagine a vast, shared record book, accessible to a network of participants, where every transaction is meticulously documented and chronologically ordered. Unlike traditional ledgers maintained by a central authority, a blockchain distributes the ledger across a network of computers, eliminating the need for a single point of control.

This decentralized nature empowers blockchain with several key characteristics:

Immutability

Once a transaction is recorded on a blockchain, it becomes virtually impossible to alter or erase it. Each block in the chain is linked to the previous one using cryptography, creating a tamper-proof audit trail. Any attempt to modify a block would require altering all subsequent blocks, which becomes computationally infeasible on a secure blockchain network. In blockchain, immutability is like having a permanent marker for transactions. This is achieved through clever coding. Each block contains a unique fingerprint of the data inside and the fingerprint of the block before it. If someone tried to alter a block, it would mess up all the following blocks’ fingerprints, raising a red flag for the entire network. This makes blockchains a safe bet for things needing a tamper-proof record, like financial transactions or important documents.

Transparency

All participants on the network can access and verify transactions on the blockchain. This fosters trust and accountability, as every step of a process is visible to all stakeholders. Unlike traditional systems with gatekeepers, blockchains are often public ledgers. Anyone can view the history of transactions, creating a clear and open record. This transparency fosters trust. You can see for yourself if a product came from the source it claims, or if a vote was cast correctly. Blockchains aren’t perfect – some are private – but transparency remains a core strength, bringing accountability and reducing the risk of hidden errors or fraud.

Security

Cryptographic hashing functions secure the data stored on the blockchain. Each block contains a unique hash, a mathematical fingerprint of the data it holds. Any alteration to the data would result in a change in the hash, making it immediately evident to network participants.

- Cryptography: Each block is like a fortress, secured with complex codes. Altering them requires immense computing power, making hacking nearly impossible.

- Decentralization: Information isn’t held in one place, but spread across a vast network of computers. This makes it almost impossible for a single entity to tamper with the data.

- Immutability: Transactions are like permanent etchings. Once added, they can’t be erased or changed. Any attempt to do so would be obvious to the entire network.

This combination of features makes blockchain a powerful tool for securing sensitive data and transactions.

Efficiency

By streamlining processes and eliminating the need for intermediaries, blockchain technology can significantly reduce transaction costs and processing times. Here’s how:

- Reduced paperwork: Forget mountains of documents! Blockchain stores everything digitally, eliminating paper trails and manual verification.

- Smart contracts: Imagine self-executing agreements. Blockchain’s smart contracts automatically trigger actions when pre-defined conditions are met, speeding up transactions.

- Fewer intermediaries: Blockchain cuts out the middleman. Transactions happen directly between parties, reducing time and costs associated with third-party involvement.

- By automating tasks and eliminating unnecessary steps, blockchain can significantly improve efficiency in various industries.

Fintech Insights: Hyper-personalization in Banking: The Tech Journey to Serving a Segment of One

Key Components of Blockchain

1. Blocks

These are the fundamental units of data storage on a blockchain. Each block acts like a container, holding information such as transaction details, timestamps, and cryptographic references to the preceding block. This chained structure forms the core of the blockchain, ensuring the chronological order and immutability of data. Imagine them like secure filing cabinets. Each block stores a batch of verified transactions, along with a unique digital fingerprint and a timestamp. This fingerprint is linked to the fingerprint of the previous block, creating a chain. Changing one block means altering all the following ones, making tampering nearly impossible. This secure chain of information is what makes blockchains reliable and trustworthy.

2. Decentralization

In contrast to centralized systems with a single authority, blockchain relies on a distributed network of computers, each holding a complete copy of the transaction history. This eliminates a central point of control and vulnerability. Instead of relying on a single authority like a bank, blockchain distributes control across a network of computers. This eliminates a central point of failure and makes the system more secure:

- No Single Point of Control: No one entity can manipulate the data.

- Increased Trust: Transparency fosters trust as everyone can verify transactions.

- Enhanced Security: A network-wide attack is much harder than breaching a single server.

Decentralization empowers individuals and fosters a more democratic system for managing information and transactions.

3. Hashes

Cryptographic hash functions play a vital role in securing blockchain data. A hash function takes an arbitrary amount of data and generates a unique fixed-size string, known as a hash. Any modification to the data will result in a completely different hash, exposing any attempt to tamper with the information. In blockchain, hashes are like unique digital fingerprints for data. Here’s how they secure the blockchain:

- Tamper Evident: If someone alters data in a block, the hash changes completely, alerting the network to a potential hack.

- Chain Integrity: Each block’s hash links to the previous block’s hash, creating a chain. Altering one block means changing all following hashes, making tampering obvious.

- Data Verification: Hashes allow quick verification of data integrity. By recalculating the hash, anyone can confirm if the data matches the original block.

These fingerprint-like hashes play a vital role in maintaining the blockchain’s security and trustworthiness.

4. Consensus Mechanisms

With a decentralized network, ensuring agreement on the validity of transactions becomes crucial. Consensus mechanisms establish a set of rules for verifying transactions and adding new blocks to the chain. Consensus mechanisms are the democratic backbone of blockchains. In a decentralized network, how do computers agree on what’s true? Consensus mechanisms provide the answer. Imagine a group voting on the validity of transactions. Several methods ensure agreement on the state of the blockchain, including Proof of Work (PoW), Proof of Stake (PoS), and Byzantine Fault Tolerance (BFT). These mechanisms ensure:

- Agreement: All computers on the network agree on the current state of the blockchain.

- Security: Malicious actors can’t disrupt the network by adding false transactions.

- Fairness: Everyone has a chance to participate in validating transactions.

Different blockchains use different mechanisms, like Proof of Work (solving complex puzzles) or Proof of Stake (holding a stake in the network). The choice of mechanism impacts factors like speed, energy consumption, and security.

5. Cryptography

Cryptographic techniques such as hashing and digital signatures are employed to secure the data stored on the blockchain. Hash functions ensure that any change to the data in a block will result in a completely different hash, making it virtually impossible to alter the information without detection. Cryptography acts as the vault door in blockchain’s high-security bank. It uses complex codes and algorithms to scramble data, making it unreadable to anyone without the decryption key. This safeguards information in two ways:

- Confidentiality: Only authorized parties with the key can access the actual contents of transactions.

- Data Integrity: Any alteration to the data changes the encrypted code, alerting the network to a potential tampering attempt.

Blockchain utilizes various cryptographic techniques, like digital signatures for verification and hashing algorithms to create unique fingerprints for data blocks. This robust cryptography ensures the privacy and

authenticity of information within the blockchain.

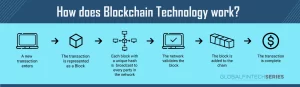

How does the Blockchain Technology Work?

Imagine a public record book for everything, from money to votes, that everyone can see but no one can change. That’s the essence of blockchain technology! Here’s a breakdown of how it works:

- Blocks and Transactions: Blockchain stores information in “blocks,” like a series of filing cabinet drawers. Each block holds a batch of verified transactions. These transactions could be financial transfers (like Bitcoin), product movements in a supply chain, or even votes in an election.

- Security with Cryptography: Each block is like a mini-fortress secured with advanced encryption. Cryptography scrambles the data using complex codes, making it unreadable without a decryption key. This ensures confidentiality and data integrity – any alteration to the information would be detected by the network.

- Hashing: Every block has a unique digital fingerprint called a “hash.” This hash is like a summary of the block’s contents, created using a complex mathematical formula. Here’s the key: the hash also includes the fingerprint of the previous block!

- Chaining the Blocks: This connection between block hashes is what creates the “chain” in the blockchain. If someone tried to tamper with the data inside a block, it would change the hash. But here’s the catch – that change would also alter the hash of all subsequent blocks in the chain, raising a red flag for the entire network. Altering the chain would be nearly impossible!

- Decentralization – No Single Authority: Unlike traditional systems with a central authority (like a bank), blockchains are decentralized. The information isn’t stored in one place but on a vast network of computers around the world. This makes it super secure and prevents any single entity from controlling the data.

- Reaching Consensus: But how do these independent computers agree on what transactions are valid and which blocks to add to the chain? This is where “consensus mechanisms” come in. Different blockchains use different methods, like:

- Proof of Work (PoW): Here, computers compete to solve complex puzzles to verify transactions. The winner gets to add the next block to the chain and earn a reward (like Bitcoin mining).

- Proof of Stake (PoS): Instead of solving puzzles, computers holding a stake (ownership) in the network validate transactions. This uses less energy than PoW.

- Adding a New Block: Once transactions are verified, a new block is created with the verified data, its unique hash, and the hash of the previous block. The newly created block is then shared with all participants in the network.

- Network Validation and Update: Each computer on the network checks the new block’s validity (ensuring the hashes match and transactions are legitimate). If all checks pass, the new block is added to the chain, and everyone updates their copy of the blockchain ledger.

This is the core process of how blockchain technology works. It offers a secure, transparent, and decentralized way to store and manage information, making it a revolutionary force with vast potential across industries.

Applications of Blockchain Technology

Financial Services

Blockchain’s secure and transparent nature makes it a game-changer in finance.

- Faster and Cheaper Transactions: Cross-border payments can be slow and expensive. Blockchain streamlines the process by eliminating intermediaries and enabling direct peer-to-peer transactions.

- Enhanced Security: Blockchain’s immutability makes financial records tamper-proof, reducing fraud and errors.

- Smart Contracts: These self-executing agreements automatically trigger actions when pre-defined conditions are met. This eliminates paperwork, expedites processes, and reduces transaction costs in areas like lending, insurance, and trade finance.

Supply Chain Management

Tracking the movement of goods through complex supply chains can be challenging. Blockchain can revolutionize this process by:

- Improved Transparency: Every step of a product’s journey, from origin to final destination, can be tracked on an immutable blockchain ledger, ensuring authenticity and provenance. This is particularly valuable for industries like food and pharmaceuticals, where counterfeiting is a major concern.

- Enhanced Efficiency: Real-time tracking and data sharing across the supply chain streamline logistics and optimize inventory management.

Healthcare

Blockchain holds immense potential in the healthcare sector:

- Secure Medical Records: Patients can control access to their medical records stored on a secure blockchain platform. This empowers them to share information securely with authorized healthcare providers.

- Drug Tracking and Anti-Counterfeiting: Blockchain can track the movement of pharmaceuticals from manufacturing to distribution, ensuring the authenticity and safety of medications.

- Streamlined Research and Development: Blockchain can facilitate secure and transparent data sharing between researchers, accelerating medical breakthroughs.

Voting Systems

Traditional voting systems can be vulnerable to fraud and errors. Blockchain offers a secure and auditable alternative:

- Enhanced Security: Blockchain’s immutability creates a tamper-proof record of votes, reducing the risk of manipulation.

- Increased Voter Confidence: Blockchain can improve trust in the voting process by ensuring transparency and verifiability.

- Improved Accessibility: Blockchain-based voting systems could potentially allow for secure remote voting, increasing voter participation.

Identity Management

The current system of identity management is fragmented and prone to security breaches. Blockchain can offer a more secure and efficient solution:

- Self-Sovereign Identity: Individuals can control their own digital identities stored on a blockchain platform, granting access to specific parties as needed.

- Reduced Fraud: Tamper-proof digital identities can help prevent identity theft and fraudulent activities.

Challenges and Limitations

1. Scalability

One of the biggest hurdles for blockchain is scalability. The speed of traditional blockchains is limited by the number of transactions they can process per second. This limitation becomes a significant issue when dealing with high-volume applications, like global payment networks or stock exchanges. Imagine a crowded highway – transactions pile up, slowing down the entire system.

2. Energy Consumption

The PoW consensus mechanism, used by some popular blockchains like Bitcoin, requires significant computing power. This translates to massive energy consumption, raising environmental concerns and hindering wider adoption. It’s like running a power plant just to maintain a digital record book!

3. Regulation and Legal Uncertainty

The rapid evolution of blockchain technology has outpaced existing legal frameworks. Regulatory uncertainty creates hesitation for businesses and institutions considering blockchain adoption. It’s like building a house without knowing the local building codes.

4. Security Vulnerabilities

While blockchain itself is highly secure, vulnerabilities can exist in smart contracts, and applications built on top of the blockchain. These vulnerabilities can be exploited by hackers, leading to potential loss of funds or data breaches. Imagine a high-tech lock but with a faulty key!

5. Interoperability and Integration

Currently, different blockchains often operate in silos, with limited communication and data exchange capabilities. This hinders the potential for seamless integration across various applications and industries. It’s like having different filing cabinets with different keys, making it difficult to share information.

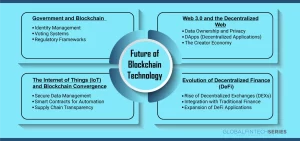

Future of Blockchain Technology

Evolution of Decentralized Finance (DeFi)

DeFi, a blockchain-powered alternative to traditional financial systems, is poised for significant growth. We can expect to see:

- Rise of Decentralized Exchanges (DEXs): DEXs allow peer-to-peer trading of cryptocurrencies and other financial assets without relying on centralized entities. As user adoption grows, DEXs could become mainstream alternatives to traditional stock exchanges.

- Integration with Traditional Finance: Traditional financial institutions are likely to explore integrating blockchain technology for specific services like trade finance or asset management. This could lead to a hybrid system leveraging the strengths of both centralized and decentralized approaches.

- Expansion of DeFi Applications: Expect a wider range of DeFi applications beyond simple trading. Borrowing, lending, and insurance services built on blockchain could offer greater accessibility and efficiency compared to traditional options.

Web 3.0 and the Decentralized Web

The concept of Web 3.0 revolves around a more decentralized and user-centric Internet. Blockchain is a key building block for this vision:

- Data Ownership and Privacy: Users can regain control of their data stored on a blockchain. This would enable them to decide who can access their information and potentially monetize it directly.

- DApps (Decentralized Applications): DApps, applications built on blockchains, could become the norm in Web 3.0. These applications wouldn’t be controlled by any single entity, promoting a more open and censorship-resistant internet.

- The Creator Economy: Blockchain could empower creators (artists, musicians, etc.) by providing secure and transparent platforms for content distribution and monetization, eliminating the need for intermediaries.

The Internet of Things (IoT) and Blockchain Convergence

As more devices become interconnected in the IoT, blockchain can play a crucial role in:

- Secure Data Management: The vast amount of data generated by IoT devices needs secure storage and transmission. Blockchain can provide a tamper-proof and auditable record for this data.

- Smart Contracts for Automation: Imagine self-executing contracts that trigger actions between connected devices based on pre-defined conditions. Blockchain’s smart contracts could automate various tasks and processes in the IoT ecosystem.

- Supply Chain Transparency: For complex IoT-powered supply chains, blockchain can offer real-time tracking and verification of goods and their status, leading to increased efficiency and reduced counterfeiting.

Government and Blockchain:

Governments are exploring the potential of blockchain for various applications:

- Identity Management: Blockchain-based digital identities could streamline government services and reduce fraud.

- Voting Systems: As mentioned earlier, secure and verifiable blockchain-based voting systems could enhance trust and participation in elections.

- Regulatory Frameworks: Regulations around blockchain technology are still evolving. Governments will need to establish frameworks that encourage innovation while mitigating potential risks.

Blockchain is a game-changer for how we handle information. It’s like a super secure filing cabinet everyone can see into, but no one can change what’s inside. This makes it perfect for things that need trust and clear records, like money, medical history, or even voting!

Blockchain isn’t perfect yet, though. It can be slow, and use a lot of energy, and some rules still need to be figured out. But people are working hard to fix these issues. As blockchain gets better, it has the potential to make things faster, cheaper, and more reliable across many industries.

Read More About Fintech Interviews: How Blockchain-Powered Ecosystems Are Poised to Transform the Agricultural Sector

[To share your insights with us, please write to pghosh@itechseries.com ]