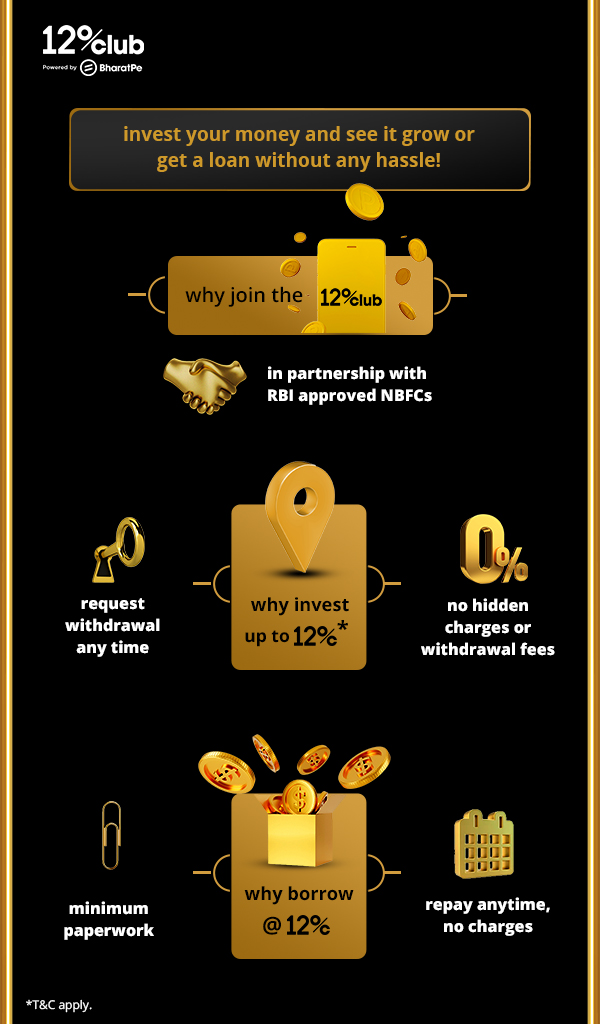

- First-of-its-kind investment and borrowing app for consumers, in partnership with RBI approved NBFCs

- Offers up to 12% interest annually for consumer investments with no lock-in

- Consumers can borrow up to Rs 10 lacs at an interest rate of 12%

- Targets investment of US$ 100mn and loan book of US$ 50mn from the product in the first year

BharatPe, one of India’s fastest growing fintech companies, announced its foray into the consumer space with the launch of its first-of-its-kind consumer product- 12% Club. Available on Google Play Store and Apple App Store, this product is set to redefine the rules of consumer lending and investments. With 12% Club, consumers will have an option to invest and earn upto 12% annual interest or borrow at a competitive interest rate of 12%. BharatPe has partnered with RBI approved NBFCs to offer this investment-cum-borrowing product for consumers. The company aims to achieve an investment AUM of US$ 100 mn and a lending AUM of US$ 50 mn from this product, by the end of the current fiscal.

The consumers on the 12% Club app can invest their savings anytime by choosing to lend money through BharatPe’s partner P2P NBFCs. Additionally, consumers can avail collateral-free loans of upto Rs. 10 lacs on the 12% Club app for a tenure of 3 months, as per their convenience. There are no processing charges or pre-payment charges on the consumer loans. The loan eligibility will be defined based on a number of factors including consumer’s credit score, the shopping history using PAYBACK loyalty system or the payments done via BharatPe QR.

Read More: Blockchain Safety: Why You Should Create a New Bitcoin Address Every Time?

The consumers investing via the 12% Club app can put in a request to withdraw their investment anytime, partially or completely, without any withdrawal charges. They can start their investment journey by investing as low as Rs. 1000 and enjoy daily credit of interest. The upper limit for investment by an individual is currently set at Rs. 10 lacs and would be increased to Rs 50 lac over the next few months.

Commenting on the launch, Suhail Sameer, Chief Executive Officer, BharatPe said, “As we begin our journey on the consumer side, our focus will be to launch products that are industry shaping, 100% digital and easy to use. This one-of-its-kind product for consumers has been designed to ensure industry-best benefits both for lenders, as well as borrowers. We believe that 12% Club will strike the right chord with a diverse set of new-age digitally savvy customers- from young salaried individuals, to professionals with disposable incomes, as well as the investors who park their funds in various financial instruments. The initial response has been phenomenal. In the pilot phase, we have seen great traction with US$ 5mn of monthly investment run rate and US$ 1mn of monthly borrowing run rate. We are confident that this product will be well received in the market and will play a key role in driving financial inclusion in the country. This is just the beginning and we will be adding new customer products during the rest of the financial year.”

Added Suhail, “BharatPe’s P2P lending product for merchants has been one of our industry defining products with Gross Investments of close to US$ 700mn done by over 6.3 lac merchants. Also, we are one of the largest B2B Fintech lenders in the country, having disbursed over US$ 300 mn in business loans to over 2 lac merchant partners”

ü Download the 12% Club app by visiting the link

ü Complete the sign-up process

ü Create the 12% Club account and accept T&Cs

ü Start investments or borrowing journey with 12% Club

Today, BharatPe is a trusted fintech partner for millions of small merchants in India. Over the last 3 years, we have led the way and launched disruptive products to empower merchants- from India’s first interoperable UPI QR, to collateral free business loans and India’s first zero rental POS machines. These products have been well received and have been key contributors for driving financial inclusion for small merchants and kirana store owners.

Recently, BharatPe forayed into the unicorn club with Series E fund raise of US$ 350 mn at a valuation of US$ 2.85 bn. The round, led by Tiger Global, also saw new participation from Dragoneer Investment Group and Steadfast Capital. Five out of the seven existing institutional investors participated in the round – namely Coatue Management, Insight Partners, Sequoia Growth, Ribbit Capital and Amplo. BharatPe is now amongst the Top 5 most valued Fintech startups in India, and has one of the strongest cap tables for any start-up in India.