DNA Of the Modern Stock Market

Although stock market is a term which creates goosebumps but if dealt pragmatically it’s an interesting arena. A stock market is a locus where buyers and sellers both come together to trade into shares of companies and Institutions. Way back the stock market was in the physical trading format which was also known as Ring Trading, but in the digital era, everything related to stock trading can now be accessed through mobile applications powered by advanced stock analytics and Artificial intelligence. Most countries have their own exchange trading platform where the shares are traded and the prices of those are resultant of the market forces of demand and supply.This article shall cover an analysis of the market for equity market data in the United States.This stock exchange is under the regulatory system of SEC-Securities and Exchange Commission which sets all rules and boundaries for all the listed companies.

Majorly there are two types of theories about the analytical of stock market.The first one is Beauty Contest Theory and the other is Efficient Market Hypothesis. The first theory was given by John M. Keynes in 1936. His views were that the investment in any stockex is highly volatile depending upon the expectations of others rather than self expectation.Keynes claims that because people sell their shares to others, they are more interested in other people’s opinions rather than their own thoughts.In technical language, he said that the stock price swings often represented the irrational waves of pessimism and optimism, which he gave the name of “animal spirit of investors.” In a nutshell, the stock market indices are not truly reflecting the economic position of the country.

The latter theory was conceptualized by Samuelson in 1965 which portrayed that the share prices reflect all available market information and the market tends to react to any new information.

Bird’s Eye View On The Major Stock Market In US

This section narrates the two most consequential indicators of the New York Stock Exchange for investment purposes:

- The Dow Jones Industrial Average (created in 1896) which represents the 30 largest companies, known as blue chips, and measures the performance of a portfolio consisting of one share of each company.

- Standard & Poor’s Composite Index (S&P500, created in 1957) which tracks shares of 500 largest companies of the United States. It is the benchamark index of U.S.

U.S. Stock Price Indexes:

- Dow Jones Industrial Average or NewYork Dow consisting of 30 U.S. stocks listed as a representation on the NYSE and Nasdaq.

- S&P 500 Index which is composed of 500 listed stocks. It is the most standardized index. If you want to invest in U.S. stocks as a whole, it would be appropriate to purchase MF and ETF’s that are linked to this.

- NASDAQ Composite Index which consists of 3,739 stocks listed on the NASDAQ market (as of Aug 30, 2022; source: Nasdaq), mostly high-tech and IT companies and startups, and is calculated by weighting the market capitalisation of each stock.

Recommended: Fintech Web Ads Should Comply with Federal Consumer Finance Protections

What Can You Trade In Here While Sipping A Coffee?

It’s not 1950’s. It’s 2022 where all shares are at your newspaper table which you can simply swipe to buy/sell just with a sip of your coffee sitting in your air-conditioned room. To name a few innovative and progressive companies:

- Apple, Google and Amazon, Meta Platforms (formerly Facebook),

- Tesla, the world’s largest manufacturer of electric vehicles

- Netflix, the largest video streaming service

- PayPal which is a payment portal famous worldwide with million users

- Zoom, whose use has rapidly expanded in Japan after the COVID-19 pandemic

- Moderna, a bio-venture industry which helped during coronavirus vaccine development

- YouTube, a Google owned venture which needs no introduction today

- NVIDIA, a graphics boards producer which display the graphics in gaming

- Broadcom, a world leader in semiconductors

- Starbucks ( the coffee that you are sipping into)

- Airbnb, an accommodation services provider

- CloudStrike, a cloud technology provider

- Honeywell International is involved in a wide range of industries, including aircraft, chemicals, and healthcare.

Last 30 Years’ Trend Comparison Chart- An Eye Opener

- S&P 500 PE Ratio Historical Chart which demonstrates the twelve month S&P 500 PE ratio or price-to-earnings ratio from 1990-2022.

2) Dow Jones By Year – Historical Annual Returns Interactive chart exhibiting the annual percentage change of the Dow Jones Industrial Average back from 1990-2022. Performance is calculated as the % change from the last trading day of each year from the last trading day of the previous year. The current price of the Dow Jones Industrial Average as of September 07, 2022 is 31,581.28.

What Would Have Happened If You Would Have Invested $100, 10 Years Back?

What Would Have Happened If You Would Have Invested $100, 10 Years Back?

The stock example taken is Tesla, a well known company listed on S&P 500. If you would have invested $100 in it 10 years ago what would have been your profit.The chart below reveals the price rise so far.

$100 invested 10 years ago would have become today $15386 a whopping amount. It means you would have earned a total increase of $15,285.74% and an annualised increase of 216.28% with profit booking of $15,286.So, it’s clear what massive earning one can make if invested at the right time with some knowledge. In similar circumstances we have many examples which made rags to riches.

An Outlook on 100 Years Investment Pattern on Stock Index

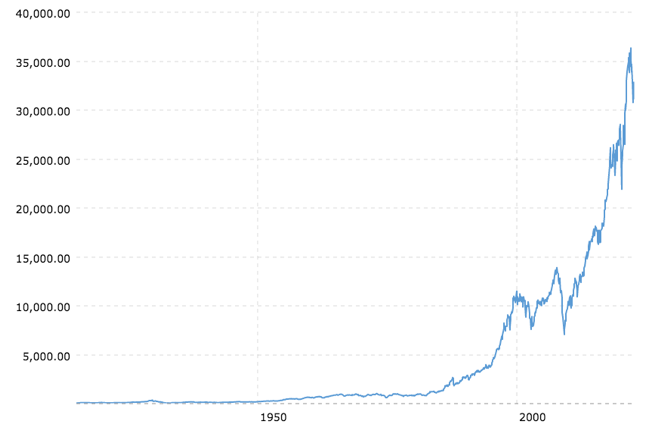

This chart shows Dow Jones – DJIA of 100 years stock market history.The index was at 90.58 in september 1915, while in september 2022 it was at 32151.5 (the figures are on average basis).

So if you would have invested 100 years back $1 it would have inflated to a whopping 350 times. In september 1972 the index was at 953.5 which means if you would have invested $1, suppose 50 years back it would have inflated by 35 times.In september 1992 the index was at 3271.7 which means if you would have invested 30 years back it would have inflated 10 times.In september 2002 the index was 13434.5 which means if you would have invested 10 years back it would have inflated 2.7 times.

Recommended: Analysis of Potential Impact of Global Economic Recession on Financial Frauds

It’s Never Too Late to Invest in Equity Market!

Whenever the thought comes to your mind to enter into the stock market, it’s never too late to dive in because there is no perfect equation or timing.You will always stand to gain if you are a long term investor as we have already seen in the charts above. So, if an investor is ready to invest his money in the stock market no without bothering the current market status then its a yes, as long as you’re planning to invest for the long-term, are starting with small amounts invested through dollar-cost averaging and you’re investing in highly diversified.If you have a long-term investment outlook, the answer is “yes,” it is time to consider investing in the stock market. With the S&P 500 index down approximately 20% from its record highs, this is a good time to consider investing in stocks. In 2030, the patterns reveal that the Dow would reach 50,000. In terms of a price target, Bank of America is targeting S&P 500 4,100 to 4,500 by 2030, between 47% and 61% overall upside over the next 10 years.

Conclusion

In stock market index investing, the price indices related to the U.S. market are now gaining importance.The new highs in the U.S. market indices represent positive earnings at this point in time, regardless of when they were purchased in the past. Since the U.S. population is expected to grow (nearly 79 million people in the next 4 decades and to cross the 400-million mark in 2058), and as many companies that drive the global economy are listed on the U.S. market, there is growing interest in investing in U.S. stocks. Although few strategies can be adapted like not to invest all capital at once and to take advantage of the depression moment of the market; in this scenario any investor can take advantage of the stock market of any country because no matter when you are investing you will get your share of benefit in the long term for sure.

Recommended: Would Mobile Applications Drive the Next-Level of Business Growth in Insurance Industry?

What Would Have Happened If You Would Have Invested $100, 10 Years Back?

What Would Have Happened If You Would Have Invested $100, 10 Years Back?