Banking is necessary, but banks are not and why do banks have branches if money doesn’t grow on trees? Smart banking indeed is the need of today’s lifestyle and work culture. In this piece, we’re going to give you a brief synopsis of the top 10 fintech applications that went viral in 2022-23 specifically built for smart banking. Try out these apps to get a good understanding of why they are so popular. We will be in a better position to evaluate 2024 for the current year once we know what changed and why.

“THE FUTURE OF FINANCE IS NOT TECHNOLOGY; IT IS THE EXTREME OBSESSION TO BE ON THE SIDE OF THE CONSUMER. TECHNOLOGY IS THE ENABLER TO MAKE IT HAPPEN” BY HARIT TALWAR, HEAD OF MARCUS BY GOLDMAN SACHS

Finance has always been a data-rich and innovative sector, so no wonder that now it inspires the creation of the most advanced solutions. You are at the right track, come let’s look at smart banking and its versatility.

Summary

- Smart Banking: What is it?

- A Synopsis of Smart Banking

- What characteristics define a Smart bank?

- Fintech Apps: what are they?

- Technologies Used to Build Fintech Applications

- FinTech mobile app types

- Top 10 Banking Apps

- Fintech statistics

- Snippets from Fintech interview series

- What are the difficulties that arise when creating a FinTech application?

- Final thoughts

Smart Banking: What is it?

In banking or finance, trust is the only thing you have to sell. Smart banking is a modern form of banking that uses technology to make it easier for customers to manage their money. Smart banking is what sounds like a more ingenious method of carrying out transactions. It makes use of technology to remove the system’s previous pain spots and produce an individualized method of engaging customers.

Read the latest article: 10 Best Applications Of AI In Banking

Any business should gain from having both a vendor and a customer, but with the introduction of big data, these advantages are even more apparent. With the use of technology, banks may gain insight into the behavior of their customers and make more strategic, customer-focused decisions. Customers get the service they want in the meantime. Smart banking removes real-world restrictions. Consider 24-hour banking, round-the-clock customer support, and shrewd sales pitches delivered through tailored advertisements. Consider paying bills or checking your savings account without having to physically visit a bank.

A Synopsis of Smart Banking

Mobile banking is the prototype for smart banking. When European banks started interacting with customers who had WAP access in the late 1990’s also the dawn of the smartphone—banking via SMS was first introduced. The features, which included reminders for bill payments as well as the ability to see statements and transaction history, were at best minimal. Additionally, SMS supported banking activities by acting as an extra layer of security by alerting users to any suspicious withdrawals or credit card usage. However, as technology advanced, so did mobile banking. To better serve their consumers, banks and other financial organizations were able to develop apps. Contactless payments also started to be made more widely available in the early 2000s.

Modernizing core banking systems and focusing on a seamless digital transformation journey without sacrificing end user experience in the process, comes down to choosing the right technology partners- Michael Hagedorn, Senior Executive Vice President and Chief Financial Officer at Valley National Bank with Global fintech series Interview.

All of these innovations would eventually mesh together and develop into the sophisticated banking system we have today. With the help of one-time pins (OTPs), even SMS is still useful for online banking operations.

However, there is one significant aspect that sets smart banking apart from online banking, and that is data. Essentially a transitive iteration of traditional banking, online banking. You carry out the same actions, but solely on your computer or mobile device. But smart banking is simple and adaptable. Recall all the banks that assured their clients of a customized banking experience. That promise has finally been kept as of late.

In the past, the banking sector has struggled to change with the times. Most banks are constructed using antiquated, seemingly unalterable legacy systems. An overhaul to integrate could appear like a difficult task that isn’t worth the effort because bank departments often operate independently with distinct budgets. Additionally, regulations and compliance are a source of worry.

Read More: How Does Visa Generate Money From International Transactions?

In addition, a 2020 study by the UK Financial Conduct Authority found that the majority of banks use antiquated technology. 43% of programmers still use 1950s-era programming languages. During the COVID-19 pandemic, banking, or possibly their clients, got a significant break. Digital banking suddenly became a necessity. There was no other choice. But the irony is that banks are taking their time transforming to the digital world. People realized that there were other options available. Fintech businesses have rapidly taken up the slack in recent years. To conduct some banking, you didn’t have to be a member of a bank. But it’s never too late to join the smart banking movement as technology develops further. The convenience of technology plus the prestige of conventional banking make an unstoppable pair.

What characteristics define a Smart bank?

Find out some characteristics of a smart bank below.

Flexibility

Anytime, anyplace banking! A smart bank never stops, regardless of whether you’re using your laptop or phone, moving money between accounts, to another bank, or to a completely unrelated service, during the day or at night. Additionally, it never prevents you from using your money or choosing new goods.

Service Simplicity

According to the 2019 research Generation Z: The Touchscreen Generation, the upcoming generation of banking customers is rational. They prefer straightforward, easy experiences where they don’t have to stand in a queue for hours to complete a short form. Since technology now has e-signatures and autofill functionality, they don’t even want to fill out forms anymore. Another study, this one by Deloitte and focused on millennials, states that this group of banking customers considers their requirements more so than banking offerings. They have certain goals when they bank, whether they visit a physical location or use their phones, and they would prefer not to be sold random things just to get a commission. This brings up the value of personalization.

Tailored Service

This is not to imply that you can’t try to pitch your consumers on things. After all, banking is still a business. However, this is where the data come in. You already know what your customer needs as opposed to what you want them to buy because you are familiar with their behavior. The result is twofold: you increase your chances of making a sale and your customer’s life may be made easier by the goods you’re selling. This strategy demonstrates that you put your customers first. A collaborative bank is a smart bank. It pays attention to consumer needs and wants.

Security

Security has advanced dramatically thanks to technology, which removes one of the major obstacles keeping some people or businesses from going digital. We provide a wide range of services that can assist in the development of a smart banking system, including digital postboxes (an encrypted, closed-network online post platform that is significantly more secure than email), which are ideal for sending billing or transaction statements, e-signatures, which are perfect in fields requiring contracts and agreements, online payments, as well as business intelligence to help make sense of all the data you’re gathering on your users’ habits. While each of these services is offered separately, e-Boks also provides an integrated system, which makes that significant conversion much simpler.

Adaptability

Moving online is only one aspect of the digital transformation process. It superficially changes the way you think about company and customer contact by transforming operations across all divisions with technology. On a deeper level, though, it is not even about technology.

The Harvard Business Review claims that a mindset is key to successful digital transformation: the willingness and determination to continuously adapt, challenge, alter, and find answers. This is the technological world. Even if it’s constantly changing, you now have the advantage of understanding when and how. As a result, the conviction to constantly improve based on current technology and software as well as take into account shifting consumer needs. Not all businesses are designed for it because it’s a marathon, not a sprint. Statistics show that 75% of attempts at digital transformation fail. Here’s another statistic, though. Millennials are less hesitant to switch banks than earlier generations due to the convenience of banking nowadays if they believe their present institution no longer meets their demands.

Citi, which earned multiple honours at the 21st Annual World’s Best Digital Bank Awards program in 2020, including the top honour of World’s Best Digital Bank, is one example of a bank that has adapted to this system. In 2021, Citi made one of its initial strides in smart banking. The banking franchise provided an ATM-like environment where consumers could do transactions that they often completed through a customer representative. It was the ATM’s first brand-new feature since 1970.

In 2019, the personal banking division of Starling Bank (UK) received both the Best Current Account and Best British Bank awards. Small company owners can use their smartphones to open an account in less than ten minutes. On the other side, N26 (Germany) encourages clients to develop financial objectives in order to promote financial literacy. The standout feature of N26, named the World’s Best Bank by Forbes in 2021, is Spaces, which are sub-accounts you may open inside your main account to help you split your money more effectively. Belgium’s Hello Bank was created with busy consumers in mind. It was named the World’s Best Bank in 2016 and approaches banking in a fun, even friendly, way. As the first entirely mobile bank, it made history when it debuted in 2013.

Environment-friendly

An environmentally friendly bank is a smart bank. Now is a crucial time for this. A “code red” has been issued by the UN 2021 Climate Change report, indicating that the globe would likely experience certain climate disruptions for decades to come. According to the study from the experts of the Intergovernmental Panel on Climate Change, humans, particularly companies, are “unequivocally” at fault. It is up to powerful enterprises, especially big businesses like banks, to make environmentally conscious decisions and reduce waste in their operations. One method to achieve this is by reducing paper-based processes and choosing to use digital postboxes as a substitute.

As a provider of digital postboxes, “e-Boks” also want to source all of its data from climate-neutral sources by the year 2030. Long term, this is better for the environment, for both businesses and customers. Being marketed as an environmentally friendly bank has another advantage in that it appeals to younger generations, particularly Gen Z. The “sustainability generation”—Generation Z—is emerging, according to a Forbes study from 2021. Studies cited in the article indicate that Gen Z likes to conduct business with enterprises that have a reputation for caring about the environment.

In fact, if it takes spending up to 10% extra to work with certain companies, they’ll do it. Automated payments: With this function, consumers may keep track of their bills and make sure they are paid on time. At the same time, it does away with the necessity for manual payments and simplifies financial management.

Read Latest: Generate AI Images From Text Using DALL-E : A Revolutionary Tool By OpenAI

Tools for setting up budgets: With the help of this function, consumers may keep tabs on their spending and create budgets to manage their money. Personalized guidance: Smart banking technology enables banks to provide consumers with specialized guidance and services, such as low-interest credit cards and investment opportunities.

Mobile banking

Smart banking enables customers to manage their money more easily by allowing them to access their accounts using mobile phones or other devices from anywhere. Customers may view balances, transfer money, and more via mobile banking.

Fraud prevention

Smart banking gives clients additional fraud defense. Banks employ technology to spot suspicious behavior and notify clients so they can take appropriate action. Customers’ money is kept secure thanks to this crucial layer of defense.

Better customer service is made possible by smart banking technology, which makes it simpler for banks to deliver it. For instance, banks can use smart financial data to provide prompt and accurate client service.

Fintech apps: what are they?

Financial technology is referred to as “FinTech” and is a competitive market of businesses that employ software or other technologies to provide financial services. The majority of FinTech solutions integrate the consumer’s finances with cutting-edge technology to make them simple to use. FinTech can come in a variety of forms, among them FinTech applications. FinTech Apps are pieces of software that link customers to the resources made available by technology for accessing, managing, and facilitating their finances. These apps differ considerably between projects. Some of them make use of cutting-edge techniques like blockchain, data science, and machine learning algorithms.

Technologies Used to Build Fintech Applications

- Artificial Intelligence (AI)

- Cloud computing

- Blockchain and cryptocurrency

- Internet of Things (IoT)

- Big data

Why are Fintech apps so common today?

The popularity of the best FinTech apps is rising in part due to:

- Mobile payments, which account for 25% of all digital payments, are the most important FinTech product.

- Chatbot engagements involving mobile banking are anticipated to rise by 3150% between 2019 and 2023.

- Apps in the fintech space are less expensive for both consumers and enterprises. Since traditional businesses are not involved, many costs can be avoided.

- Apps for fintech are quite practical. They have improved the speed and ease of transactions.

- Apps for fintech enable customization. Businesses can readily identify and respond to changing client needs by utilizing smart data analytics.

- Apps for fintech are safe. The most secure mobile technologies are used by fintech companies to create their offerings.

- Fintech industry expansion and the top FinTech applications

-

The United States of America has 105 Fintech unicorns, making it the global leader on that front.

- Last year, 157 new FinTech unicorns (companies valued at over $1 billion) were created globally.

FinTech mobile app types

FinTech apps come in a variety of varieties. Both consumers and corporations can use them. FinTech apps that are most often downloaded are:

App for mobile banking

One of the earliest applications in the FinTech market is for mobile banking. All smartphones and tablets can access them, and the majority of them make it simple to access money wherever you are. Additionally, they make the opening and funding of accounts quick, easy, and completely safe. There are several mobile banking applications available for carrying out common operations, checking account balances, and sending money.

App for personal finance

Customers can combine their financial data from numerous bank accounts with the use of personal finance tools to create a single dashboard. Customers now find it much simpler to remain on top of their finances thanks to this. Making sense of your finances and maintaining your budget are made much easier with the aid of a personal finance app. Of course, they are customer-targeted for personal use, but there are also wealth-tech apps for all levels of investors, from amateur traders to seasoned pros.

App for investing

With just a few touches, trades may be easily placed on these digital marketplaces. They can be utilized by both inexperienced private investors and affluent big fish with plenty of cash. The fact that investment apps do away with middlemen and provide reduced commissions is a huge advantage. Additionally, they have minimum balance specifications.

Bitcoin and blockchain app

You can find platforms for peer-to-peer transactions, smart contracts, and decentralized ledgers in the broad range of blockchain and cryptocurrency FinTech apps. A trading platform powered by blockchain is a fantastic illustration of such an app.

RegTech application

This industry for FinTech applications is still developing. Financial service providers utilize RegTech apps (Regulatory applications) to assist their clients with regulatory compliance. These apps are part of the FinTech sector, and their main focus is on developing technology that facilitates the better delivery of regulatory obligations. To improve compliance and deliver secure, simple-to-integrate laws, they deploy cutting-edge technology.

Read: Let’s Dive Deep Into Fintech Vs The Conventional Banking

The Top 10 Banking Apps

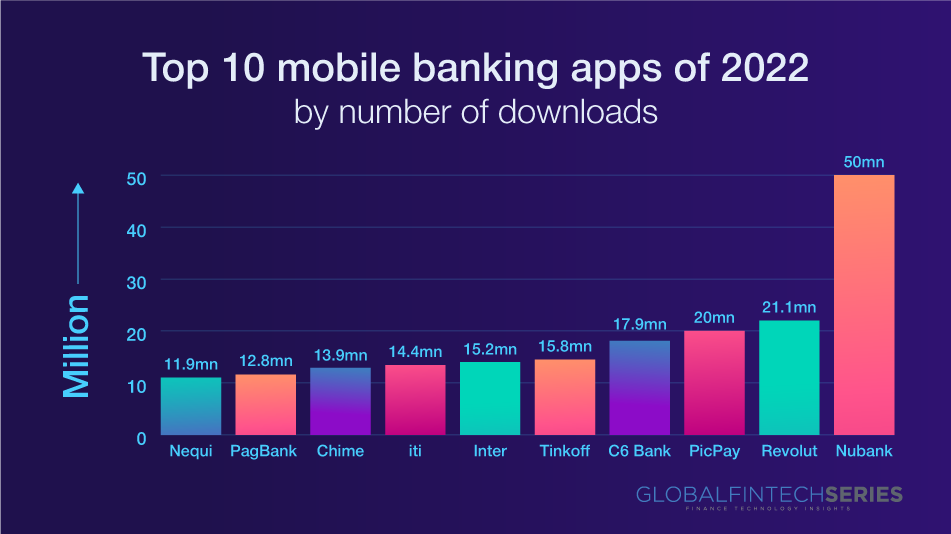

What are the most motivating top FinTech applications to research in 2022-23? The top FinTech apps are presented here!

1. Nubank (Brazil)

Nubank, which competes with PayPal and Alipay, has become the undisputed monarch in less than ten years after its founding in 2013. It is currently the seventh most downloaded banking app worldwide. Its best features are personal loans, credit cards, and a free digital account. The most downloaded banking-related app in 2022 will likely be Nubank, with more than fifty million downloads. It has received twice as many downloads as Revolut, the second-placed banking app.

Check out the most recent article: 10 AI Applications for Banking.

2. Revolut (UK)

With more than 21 million downloads in the last year, the financial behemoth of European fintechs that was formed in 2015 is justified of its place on our list. Some of the services include instant payments, cryptocurrency trading, international transfers, virtual cards, and cashback on some of their preferred brands.

3. PicPay (Brazil)

Despite being one of only three applications on the list to exceed 20 million downloads in a year, PicPay is an underrated and well-regarded app. An entirely digital banking app is PicPay. Customers may quickly send and receive money using their free digital account, pay bills, earn cashback on purchases, top off their phone or transport card, and buy credits for online services like Uber.

4. Bank C6 in Brazil

The C6 Bank app was created in 2018, and by 2022, approximately 18 million people had downloaded it. In addition to personalized credit and debit cards, it also provides money transfers, investments, multi-currency accounts, insurance, and even dental plans.

5. Russian Tinkoff

A Russian digital bank called Tinkoff was established in 2006 and integrates common banking services such as savings accounts, transfers, utility bills, traffic tickets, and toll road payments. Additionally, users can use their smartphones to scan receipts and withdraw money from ATMs using QR codes. This app has been downloaded 15 million times in the last year.

6. Brazil’s Inter

Although Inter poses an existential dilemma for this list because it describes itself as “substantially more than a digital bank,” we still chose to include it. The popular super-application combines a variety of no-cost technological features. It offers simulated credit and debit cards, personal advances and financing, a startup stage, fee-free transfers, insurance, and a free kids’ account that lets parents to teach their kids valuable life lessons like saving and budgeting.

7. iti (Brazil)

The current financial conglomerate Ita Unibanco, which was established in 2008 by the merging of the nation’s two largest banks, is the one responsible for the creation of the Brazilian digital bank iti. Its moderately low age limit, which allows teenagers as young as 14 to pursue it, is one of its strongest qualities. This allows them to begin receiving financial education at an early age. The application also provides free currency exchanges, savings objectives, credit, and visas.

8. Chime (US)

The only American startup on our list, Chime was started in 2013 by Chris Britt and Ryan. It took Chime five years to attract its first million clients, but just another year to reach four million. This is comparable to other applications in that it first struggled to grow a user base. Today, it offers clients alluring features like peer-to-peer transfers, a $200 overdraft cap, and access to coordinated stores two days earlier.

9. PagBank (Brazil)

The payment company PagSeguro’s PagBank has grown to be one of the most well-liked banking applications in Brazil. It offers free digital accounts and bills itself as “the complete bank”. In fact, PagBank was downloaded by around 13 million people in the last year, which is a significant accomplishment in the banking sector. All the functions you would anticipate from a bank, including money transfers, credit and debit cards, mobile top-ups, insurance, and investments, are offered by PagBank, one of six Brazilian apps in our top 10.

10. Nequi (Colombia)

Only 50,000 downloads separated Colombian digital bank Nequi from its nearest rival in the race for tenth place. Nequi is a prime example of a pattern seen frequently in the South American financial sector: established financial institutions introducing fresh, digitized branding. Bancolombia’s contribution was started in 2016, but it gained popularity swiftly, racking up over 12 million downloads just in the last few months.

Read More links for Fintech – FinTech RADAR: 105 U.S. Fintech Unicorns And Their Core Offerings

Fintech statistics:

- The global financial sector will be worth $26.5 trillion in 2022, growing at a CAGR of 6%.

- The market share of the 48 most prominent fintech unicorns is worth more than $187 billion, as of the first half of 2019. This represents slightly over 1% of the global financial industry.

- 60% of credit unions and 49% of traditional banks in the United States believe that partnering with fintech companies will be important for the future.

- What is the most significant fintech product? Digital payments, without a hint of doubt. It amounts to 25% of the fintech market.

- By 2022, mobile transactions will grow by 121%. As a result, they will make up 88% of all of the banking transactions.

- Consumer spending in app stores will increase by 92% to reach a smashing $157 billion globally in 2022.

- By 2022, more than 78% of millennials in the United States will become users of digital banking solutions.

- Banking-related chatbot interactions will increase by 3150% between 2019 and 2023.

- Thanks to chatbots, the operational cost savings in banking will reach $7.3 billion globally by 2023.

Snippets from Fintech interview series

There was a one to one interview conducted with Timothy Rooney, President at Marygold & Co., where he highlighted few key areas of fintech role and banking services. Below are a few:

- Most of the fintech apps I’ve looked at do excellent work. The fundamental business model of fintech allows for more cutting-edge products and services — at lower price points — ensuring the fintech pie will continue to grow. The old-school bank and brokerage firm business model does not allow traditional players to compete in the same manner, so fintechs will continue to take market share from these companies.

- As I stated earlier, the fintech pie is growing, and for a good reason: The value provided by fintech companies is clear. One of the trends I’m excited about is to see people in their 40s, 50s and 60s discover the value of digital banking and working with fintech firms. This transition will take time since inertia is a powerful force in finance, but people will discover that they are getting more value, with much more client-friendly pricing, in the fintech space. We are in the early innings of that evolution, so it is exhilarating to see!

What stands out about fintech applications?

Regardless of their target market, most fintech apps have the following fundamental features in common:

- Face recognition, biometrics, and two-factor authentication are used to securely sign up.

- Basic activities in a particular specialty

- Scanning a QR code

- Integrated third-parties

- AI assistants and bots

- Specific notifications

What are the difficulties that arise when creating a FinTech application, and how can they be overcome?

- The first difficulty is complying with regulations. Government agencies from many branches control financial technology companies, and navigating the dense web of rules can be challenging.

- Making an interface that is user-friendly is another difficulty. Making your FinTech app simple to use is crucial because payment apps can be complicated.

- Thirdly, you’ll need to figure out how to set your app out from the competition. You must find a strategy to differentiate your FinTech firm from the competition because there are so many of them.

- Finally, you’ll need to raise money to launch your firm. You’ll need a sound strategy for raising money for mobile technologies or more features inside your digital FinTech solution because it can be challenging for new businesses to obtain funding from investors or banks.

Best FinTech Apps: Final Thoughts

Open banking emphatically does not play fast and loose with anyone’s money. Its online payment mechanisms are almost certainly more secure than credit card transactions, for example, and the scope for fraud is tiny. However, perception doesn’t always match reality.

FinTech and FinTech apps are undoubtedly a rapidly expanding industry. It is quickly growing in importance to our economy and revolutionizing banking services, immediate money transfers, and ultimately outpacing conventional bank accounts and financial transactions. Top FinTech apps incorporate a variety of innovative techniques that reimagine conventional financial services. The emergence of cutting-edge technology together with consumers’ demand for a safe and more user-friendly banking experience have driven banks and financial institutions to adopt FinTech and its services. It is certain that they will continue to evolve so that their presence is marked everywhere, worldwide. Due to the inclusion of everything we discussed in this article, fintech is now bigger and more prosperous than before. With its retail banking software, financial core banking software, and many more elements coming under it, it is all set to become even greater in the upcoming years. How much of an impact FinTech will have on the financial industry will only become clear with time.

It would appear that changing banking to be “smart” as opposed to “open” would likely reduce some of the perceptual obstacles to people using open banking services and being content with it. It won’t, however, alter the perception of some customers that giving strangers access to their bank accounts is inherently foolish. That will only happen with time and evidence of the security and obvious advantages of open/smart banking.

[To share your insights with us, please write to sghosh@martechseries.com]